Construction Financial Management: From Budget to Bottom Line

Running a construction business means navigating constant change. Budgets shift, material prices rise, clients request last-minute revisions, and schedules rarely stay on track. Even with solid estimates and a reliable crew, profits can disappear quickly without effective construction financial management.

Some of the most common financial issues as construction budgeting mistakes or inaccurate labor estimates, tend to surface when teams rely on disconnected tools. Learning how to calculate labor cost in construction is a key step toward building a more accurate and stable financial process.

Suppose you’re a residential builder, remodeler, or contractor juggling multiple jobs. In that case, our guide breaks down the key processes, common drawbacks, and must-have tools to help you stay financially in control.

Table of Contents

- Construction Financial Management Explained

- Why Construction Financial Management Matters

- Core Components of Financial Management

- Common Challenges in Construction Finance

4.1 Cost Overruns and Scope Creep

4.2 Poor Budget Visibility

4.3 Delayed Payments and Cash Flow Gaps

4.4 Manual Errors

4.5 Lack of Real-Time Job Costing - 4 Tools That Improve Financial Oversight

Construction Financial Management Explained

Construction financial management covers every financial decision made throughout a project. It starts with the estimate and continues through budgeting, job costing, billing, forecasting, and reconciliation.

But estimating alone won’t protect your profit margins. You need systems that reflect real-time progress in the field and feed that data directly into your financial workflow.

Similarly, when a subcontractor submits hours or material usage, that information should immediately update your job costs and invoicing. Delays or disconnects here lead to missed charges, inaccurate reports, and cash flow issues.

Why Construction Financial Management Matters

Construction projects operate on tight margins and involve a constant flow of coordination between subcontractors, vendors, clients, and field teams. Without clear financial inconsistencies, small issues quickly escalate:

- A change order goes unbilled

- An invoice is delayed or sent to the wrong contact

- A subcontractor’s rate increase isn’t reflected in the budget

Before you know it, the margin you were counting on disappears.

Here, you understand why real-time financial visibility matters. When project managers and accounting teams have access to current data, they can spot issues early and make corrections before they affect the entire job.

It also means decisions are based on what’s happening, not on outdated spreadsheets or field notes left behind.

Core Components of Construction Financial Management

Every successful project starts with a strong, well-structured budget. That begins with an accurate estimate covering labor, materials, markup, overhead, and built-in risk. But building the budget is only the first step, as it has to stay flexible when the job progresses.

Budgets constantly evolve. Prices change, teams approve new change orders, and allowances get used up. If you manage everything in disconnected spreadsheets, your numbers fall out of sync fast.

Workflow Overview:

Estimate → POs → Change Orders → Job Costing → Invoicing → Accounting→ Budget

Cash Flow Tracking and Forecasting

A job might look profitable on paper, but still fall apart under cash flow pressure.

Contractors often put in weeks of work before seeing a payment. If invoicing is delayed, incomplete, or missing key approvals, payments get pushed back even further. When cash flow management is weak, the problem escalates; subcontractors and vendors remain unpaid, crews begin to slow down, and the entire project starts to feel the strain.

Staying ahead of cash flow issues starts with visibility. You need to know:

- What’s already been invoiced

- What’s overdue

- What’s scheduled for the upcoming billing

- What’s approved but not yet billed

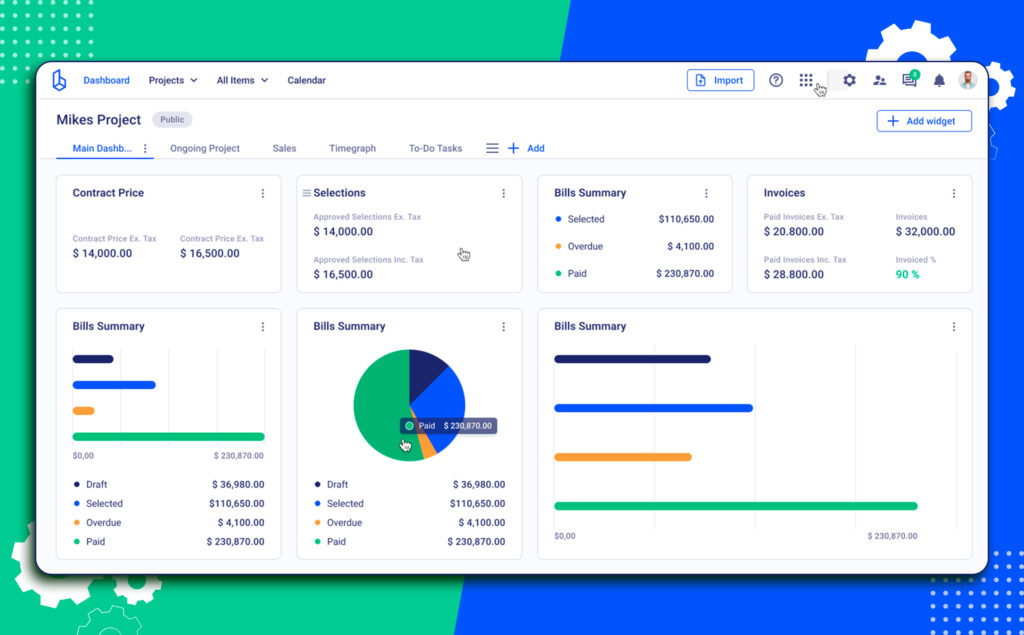

Buildern’s forecasting tools help you spot potential shortfalls early and plan your payouts with confidence.

Job Costing and WIP Reporting

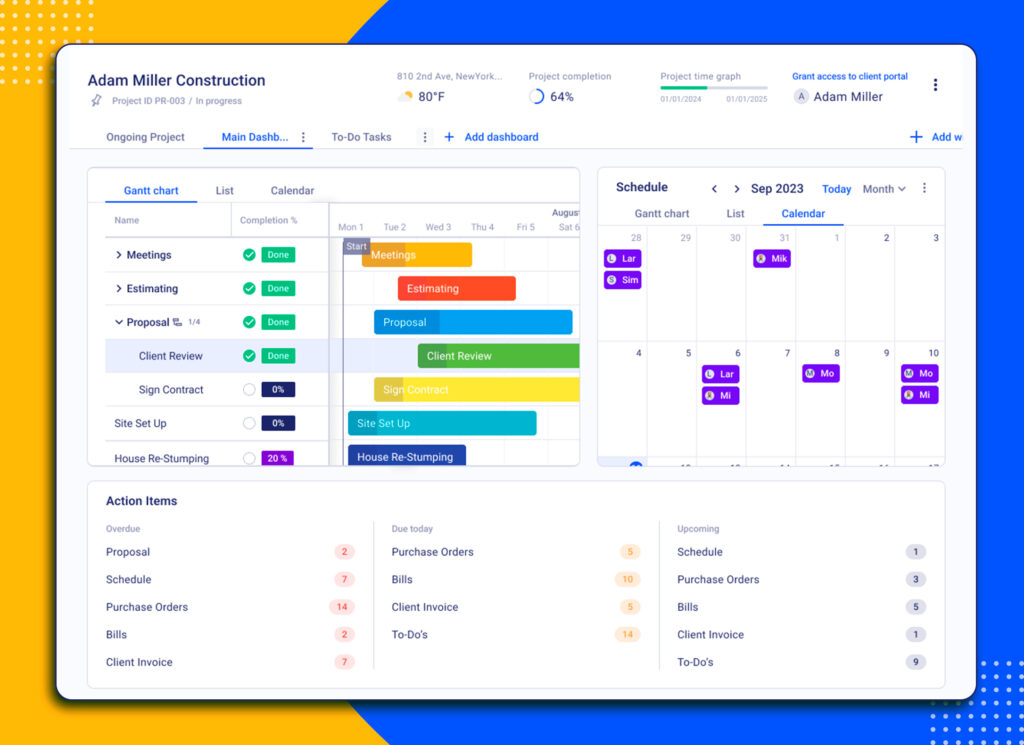

Once the job starts, real costs can slip out of view. Field teams approve purchases on the spot, labor hours add up quickly, and material prices shift. If your job costing doesn’t reflect these changes in real time, your budget loses its value.

Consequently, it acts as a real-time financial health check. When you compare actual costs to the budget daily or weekly, you can see whether you’re over or under and take action before small issues grow.

Work-in-progress (WIP) reports build on that by tracking revenue. They show:

- How much work is complete

- How much revenue you’ve earned

- How much remains to be billed

- Where your cash flow or schedule is at risk

Change Order and Allowance Management

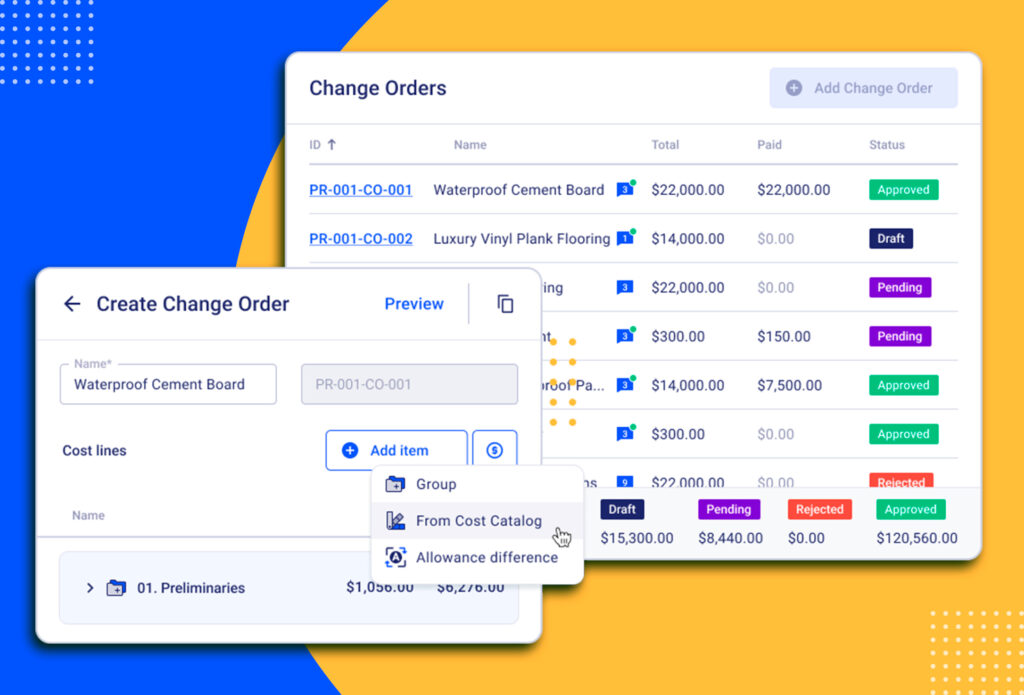

Change orders are a constant in construction. If you do not track them properly, they quickly become one of the easiest ways to lose money.

Construction Change Order software can ensure that every approved change, whether initiated by the client or your team, automatically updates the budget, contract, and invoice. You can also attach documentation such as photos, PDFs, and comments to each change order to keep everything clear and transparent.

💡Recommended Reading: Construction Allowances 101: 4 Effective Practices for Budget Management

Billing Methods and Client Invoicing

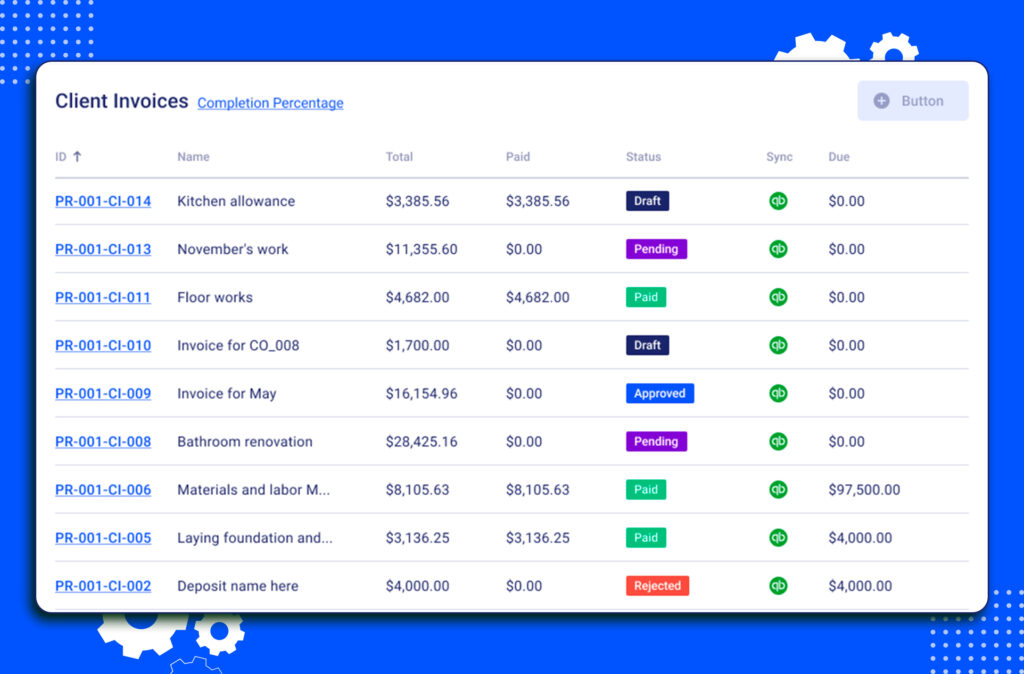

Construction billing isn’t one-size-fits-all. Depending on the job, you might need to bill by milestone, track actual costs, or charge based on time and materials. Each billing method has its challenges, especially when you need to keep everything aligned with project progress.

At length, the key is consistency. Your invoicing should reflect the actual work completed and any approved changes, so that there’s no mismatch between what’s billed and what’s been delivered.

When billing is closely tied to job activity, payments are easier to track, delays are minimized, and your cash flow stays steady.

| Billing Method | Best For | Pros | Cons |

| Fixed price | Defined scope | Predictable costs | Limited flexibility |

| Cost-Plus | Evolving projects | Transparent for clients | Margin uncertainty |

| Time & materials | Reactive or small projects | Simple and adaptable | Requires detailed tracking |

Common Construction Billing Models

Common Challenges in Construction Finance

Most construction companies don’t lose money because of poor workmanship. The real problems usually show up in the numbers. When budgets aren’t tracked carefully, changes go undocumented, or invoices pile up unbilled. Eventually, even a well-run project can become financially unstable.

Below are three common challenges that affect construction businesses and what it takes to stay in control:

#1 Cost Overruns and Scope Creep

Budgets rarely collapse all at once. In a usual scenario, it starts with a few small changes, be it an upgraded material, extra labor, or a scope shift that wasn’t formally tracked. When these adjustments aren’t documented or reflected in the working budget, costs begin to drift away from the original plan.

The best way to handle change orders is with a structured process. When every approved change is tied directly to your budget and contract value, the financial picture stays accurate from start to finish.

#2 Poor Budget Visibility Across Teams

When estimators, project managers, and accounting teams use different tools or separate versions of the budget, it becomes harder to stay aligned. Critical information might get missed, and decisions are often based on outdated or incomplete data.

By bringing everyone onto the same platform, you ensure that your team is always looking at up-to-date numbers, regardless of their role or location.

Buildern’s centralized access helps reduce miscommunication, improve collaboration, and ensures financial decisions are based on real-time data.

#3 Delayed Payments and Cash Flow Issues

In most cases, cash flow disruptions come from billing delays and not because of overspending. Invoices aren’t tied to job progress or approved changes, so they get sent late or end up with errors. These processes slow down payment cycles and create gaps, affecting the entire project.

Connecting your invoicing to the actual work completed works best and closes all the gaps. This way, you know that your team bills accurately and on time, and cash flow stays stable.

#4 Manual Errors from Disconnected Tools

Spreadsheets might feel familiar, but they often do more harm than good when managing construction finances. Manual entry, version control issues, and scattered data across systems create room for costly mistakes. Even small errors in formulas or outdated files can throw off budgets, delay approvals, and disrupt cash flow.

With integrated platforms, financial data is automatically updated and shared across your team. Instead of switching between folders, emails, and spreadsheets, everything from estimates to invoices lives in one connected system. That means less time double-checking numbers and more confidence in your financial reporting.

Here’s how a typical spreadsheet-based workflow compares to a connected financial management system:

| Workflow | Spreadsheets | Buildern |

| Budgeting | Manual data entry | Synced directly |

| Change Orders | Easy to overlook or miscalculate | Tracked and linked automatically |

| Job Costing | Delayed weekly or monthly updates | Updated in real time from field activity |

| Client Invoicing | Pulled from emails or exports | Based on approved data, ready when needed |

| Forecasting | Static and outdated files | Live dashboards with up-to-date insights |

Comparison Table: Spreadsheets vs Connected System

#5 Lack of Real-Time Job Cost Tracking

Waiting until the end of the month to see where your project stands is a risk most teams can’t afford. By then, the budget may already be off, and the opportunity to adjust has passed.

Ultimately, tracking job costing in real time gives you a much clearer understanding of where money is going day by day. Instead of chasing updates or relying on field notes, you see labor, materials, and subcontractor costs as they happen.

4 Tools That Improve Financial Oversight

Improving financial control starts with using tools that eliminate gaps between the field, office, and accounting. When financial data flows smoothly between systems, it becomes easier to make informed decisions, track real costs, and reduce delays.

Here are four key areas where the right tools make a measurable difference:

Tool 1: Integrated Construction Accounting

Accurate financial oversight depends on clean, reliable data. When project-level costs have to be entered manually into accounting systems, errors and delays are inevitable.

So, using software that connects your job cost data directly with platforms such as QuickBooks Online and Xero helps maintain accuracy without doubling your workload. Approved costs, invoices, and payments are synced automatically, reducing the back-and-forth between accounting and project teams.

💡 Recommend Reading: Construction Accounting Explained: Key Terms, Tools, and Techniques

Tool 2: All-in-One Financial Project Management

Many construction tools treat budgeting and cost control as secondary features. But for financial clarity, those functions need to be at the center of the workflow.

Buildern is structured around estimating and cost tracking from the start. This makes it easier to keep financial and operational tasks aligned so your estimates, budgets, and invoices all pull from the same data, not separate spreadsheets or platforms.

Tool 3: Estimating and Budget Control

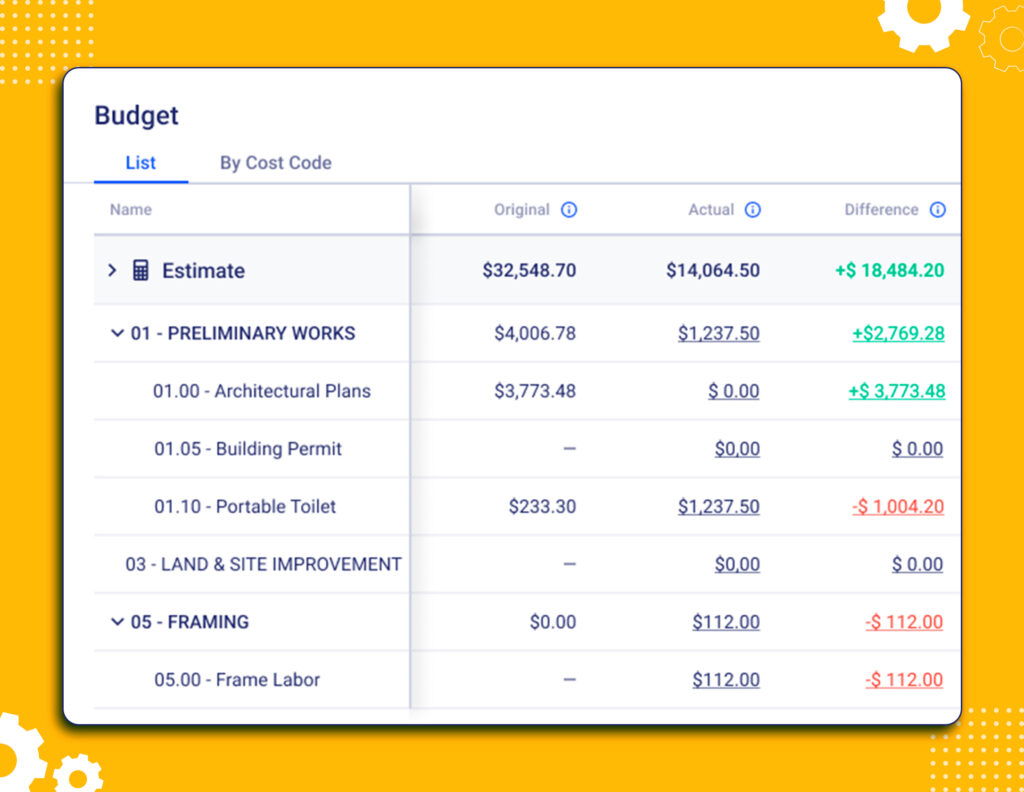

The foundation of good financial oversight is an accurate estimate. Once that estimate is approved, it should feed directly into your budget, purchase orders, and invoices. This reduces manual entry and helps you keep every dollar accounted for.

When each cost item flows from the same source of truth, there’s less risk of a mismatch between what was planned and what’s being spent. It also allows teams to spot discrepancies early, before they impact the bottom line.

Tool 4: ERP, Payroll, and Banking Integrations

When financial data is scattered between field apps, accounting software, and spreadsheets, delays are inevitable.

Connect field operations to your accounting system, and timesheets and job logs flow directly into cost codes and budget categories. This keeps your reporting accurate and your payroll process moving without delays or manual adjustments.

What’s the Role of Budgeting and Job Costing in Construction Financial Management?

Both are essential parts of construction financial management. Budgeting is your forecast since it outlines expected costs for labor, materials, and markup before the project begins. Job costing tracks real spending as the work happens. Budgeting shows where you plan to go; job costing shows where you are. You need both to maintain control over your project’s financial health.

How Do WIP Reports Support Effective Construction Financial Management?

WIP reports are a core tool in construction financial management. They provide a live snapshot of earned revenue, percent complete, and what remains to be billed. With that visibility, you can catch billing delays or cost overruns early, before they damage profitability or cash flow.

How Can Change Orders Be Managed Through Construction Financial Management Software?

Construction financial management relies on accurate, up-to-date data. Managing change orders with software that links them directly to budgets, contracts, and invoices ensures your numbers stay aligned. In Buildern, change orders update automatically and stay connected to all financial records.

Does Buildern support construction financial management through QuickBooks integration?

Yes. As part of Buildern’s construction financial management system, it connects seamlessly with QuickBooks Online and Xero. Approved costs, invoices, and payments sync automatically, helping you avoid manual entry and keep your accounting accurate across platforms.