Construction WIP (Work in Progress) Report | The Easiest Way to Create It

At some point, construction project management becomes a complex and expensive task. As the project evolves, keeping track of your finances every step of the way is crucial. An older report provided by McKinsey claims that larger projects typically take over 20% longer to finish than the scheduled timeframe. This leads to cost overruns that make up 80% and negative financial consequences. Although the research is outdated, the overall picture with larger projects remains the same. The risk of “missing the point” is high if you don’t stay on top of things. To prevent this, construction companies use a construction WIP report technique to keep an eye on their finances.

Construction accounting is a separate branch of construction project management. It’s a complex task, as construction costs can pile up quickly. Construction accountants are responsible for tracking progress payments, reviewing construction liabilities and calculating construction costs. With construction WIP reports as the “must-have” financial tool, companies can understand if they are over or underbilled.

So, how does this accounting schedule work, and what is the easiest way to create a WIP report? Read on to learn more!

What Is a Construction WIP Report?

Standing for work-in-progress, construction WIP reports are documents created by construction accountants during each construction phase of the project. The report is a financial document helping construction companies track their costs and revenues during construction. This is a must for any project that uses the Percentage of Completion (POC) accounting method. The core idea behind POC is that revenue and expenses are calculated according to the percentage of completed work during a set period.

WIP reports may vary in format between companies. However, one thing uniting them is the current period and project-to-date columns. Construction accountants use this to track the progress and costs accrued during a specific period.

Accountants implement WIP reporting to track the progress and costs of a project and the exact amount left for further construction. A construction WIP report assists accountants in keeping track of a company’s revenue and expenses, giving them a clear picture of their financial situation at any given point throughout the project’s completion.

What Is the Construction Company Missing If It Doesn’t Track WIP Report?

A typical construction project involves several departments, lenders, investors, and subcontractors. While each side has particular interests and goals, project reporting can be challenging. However, it’s not just a “nice to have” feature. Construction companies risk running out of money without precise reporting before the project is completed.

Since construction projects can last from several months to years, construction accountants need to track everything before the project’s completion to see a clear picture of their revenues and expenses. It is highly recommended for companies generate work-in-progress reports regularly and use the information to adjust construction costs if needed.

Figuring out the financial state before the project ends guarantees construction companies they are not under or overbilled. Let’s furtherly look closer at the consequences of badly-organized reporting.

Underbilling and Its Results

With a WIP report, construction companies can avoid underbilling their clients, which leads to a lack of money to complete the construction phase.

Underbilling describes the practice of charging less for the labor, materials and services provided. It can also impact subsequent construction projects, as construction companies won’t be able to afford them. As a result, the construction company endures financial losses and might be unable to complete the construction phase on time.

For instance, if the first phase construction company bills $50,000 while the actual construction costs turn out to be $80,000, it will lack $30,000 for the next construction phase. This can be compensated by an additional construction loan or up to the second phase invoicing, raising the total project costs.

To ensure construction companies have proper construction billing, work-in-progress reports should become an integral part of construction management.

Overbilling and Its Results

Overbilling is the opposite of underbilling and refers to construction companies charging more than the construction costs. Such practices may seem beneficial for construction companies, as they get extra money at the end of the construction project.

However, construction companies may suffer legal consequences if caught overbilling their clients. If a WIP report shows overbilling for the first construction phase, construction companies should immediately make the necessary corrections.

In some cases, construction companies may be able to pay back the difference and explain the mistake. However, a single overbilling can also be subtracted from the next-phase invoicing. In any case, returning the surplus amount and making the construction cost records transparent will help construction companies avoid serious legal consequences.

How to Create a Construction WIP Report

As we already know, WIP accounting is an integral part of large-scale and long-term construction projects. It’s necessary to track construction costs to avoid getting lost in construction bills and invoices.

Creating a construction WIP report requires extensive knowledge of construction accounting principles.

The accountant should have the general industry knowledge to understand the construction accounting basics and construction process.

An average WIP report has several estimations composing the construction budget. One of the constituent parts is the calculation of the Percent or Unit of Complete. This shows construction companies whether they are over- or underbilled and allows them to apply the necessary changes. Long-term contracts have estimates for costs and revenues.

Percent Complete = Actual Costs to Date / Total Estimated Costs

Example:

$260,850 / $347,800 = 0.75

Percent Complete = 0.75 (or 75%)

Accountants must apply the final number to the Total Estimated Revenue and find Earned Revenue to Date. Use the following formula for calculations:

Earned Revenue to Date = Percent Complete * Total Estimated Revenue

Example:

0.75 * $7,800 = $5,850

Earned Revenue to Date = $5,850

As a construction accountant, you’ll need these numbers for construction WIP reports. The difference between the company’s Total Billings on Contract and the Earned Revenue to Date will show whether the project has Over/Under Billed Revenue.

Total Billings on Contract – Earned Revenue to Date = Over/Under Billed Revenue

Example:

$5,000 – $5,850 = $850

Underbilled = $850

Summing up the Calculations

Once you have all these numbers and estimates, your WIP report will have the following image:

- Percentage Complete = 75%

- Earned Revenue = $5,850

- Under Billings = $850

This was a simple example with small numbers. Image the construction WIP report for a construction project that lasts two months and costs over $2 million. Construction companies should run financial audits of construction expenses after every phase to avoid potential losses. Moreover, longer projects require more detailed analysis with estimates and other essential statistics to ensure construction companies keep track of the construction costs and make intelligent decisions.

Taking responsibility for accurate construction expense tracking risks no misunderstandings between construction companies and their clients. Still, it requires the utmost focus and attention to detail. Thus, let us introduce you to an advanced and more professional solution for constructing a WIP report.

The Easiest Way: How to Create a Construction WIP Report in Buildern?

Accurate data without overstatement and bias is the key to construction cost tracking. If, by chance, there is a miscalculation or omission, companies may face significant financial issues. False amounts and wrong cost tracking may also result in a lack of communication between project stakeholders and construction companies. This, in its turn, is a severe challenge. The inability to see a clear picture of the project’s progress creates tension and leads to construction disputes and claims.

A platform like Buildern has been developed to help construction companies avoid these and other project management issues. Ideal for small to medium-sized companies, Buildern has all the advanced features and robust integrations with third-party platforms to create the most detailed and accurate construction WIP report. Here’s how construction companies can benefit from using Buildern:

- Automated construction cost tracking with real-time construction reports

- Professionally crafted estimates with construction cost calculation for any new project

- Status and time tracking tools for precise scheduling

- Transparency of construction project costs and expenses

- Integrations with Xero and QuickBooks for invoicing, budgeting, and bookkeeping

- Overall construction cost analysis to ensure you never overbill or underbill your construction projects again

And much more!

Unlike other construction management software covering only a single area of project management, Buildern is a comprehensive platform that allows construction companies to stay ahead of their projects and never miss out on financial opportunities.

WIP reporting is even easier with Buildern as the software has all the necessary data at hand. Companies can track construction costs and expenses, create cost analysis reports, and use construction-specific tools to optimize their construction process.

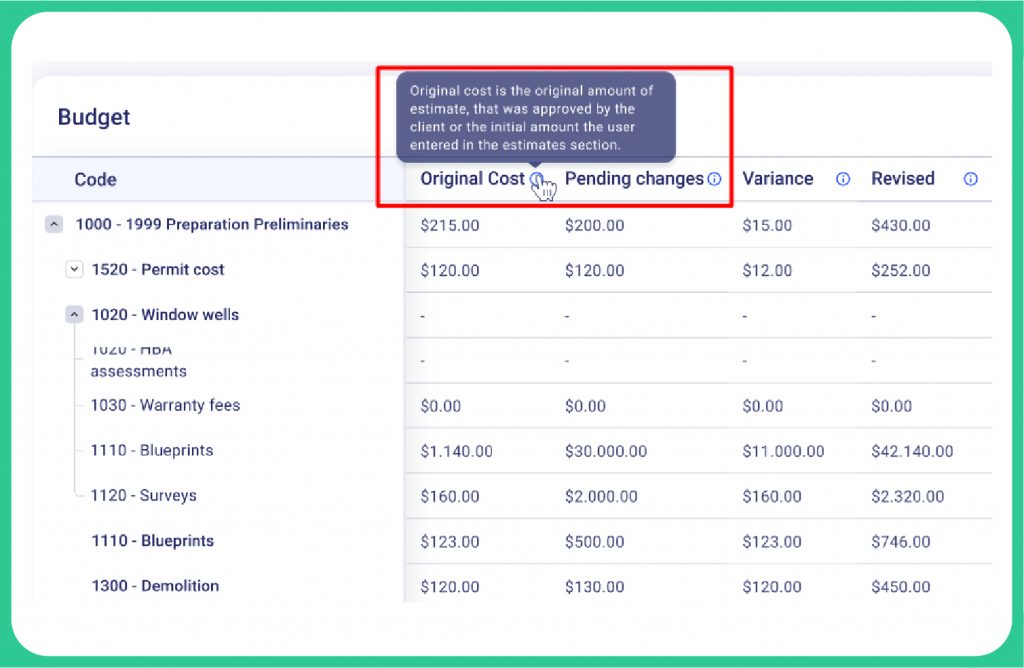

Here’s a quick overview of how to view a project’s WIP report through your Buildern dashboard.

View Your Construction WIP Report in Buildern

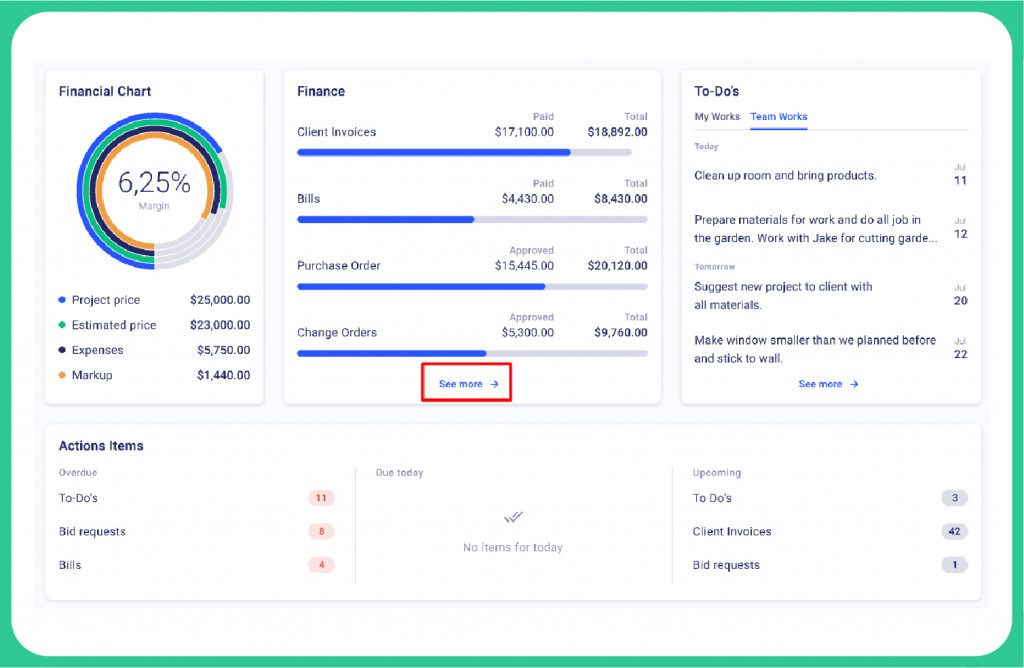

Step 1. Log in to your project’s professional dashboard

The professional dashboard is where everything project-related happens. From to-do lists to cost tracking, time graph, invoices, important files, and more – all the data can be seen in one place.

Click on the “See more” button below the “Finances” dashboard to view everything related to the current project’s financial status.

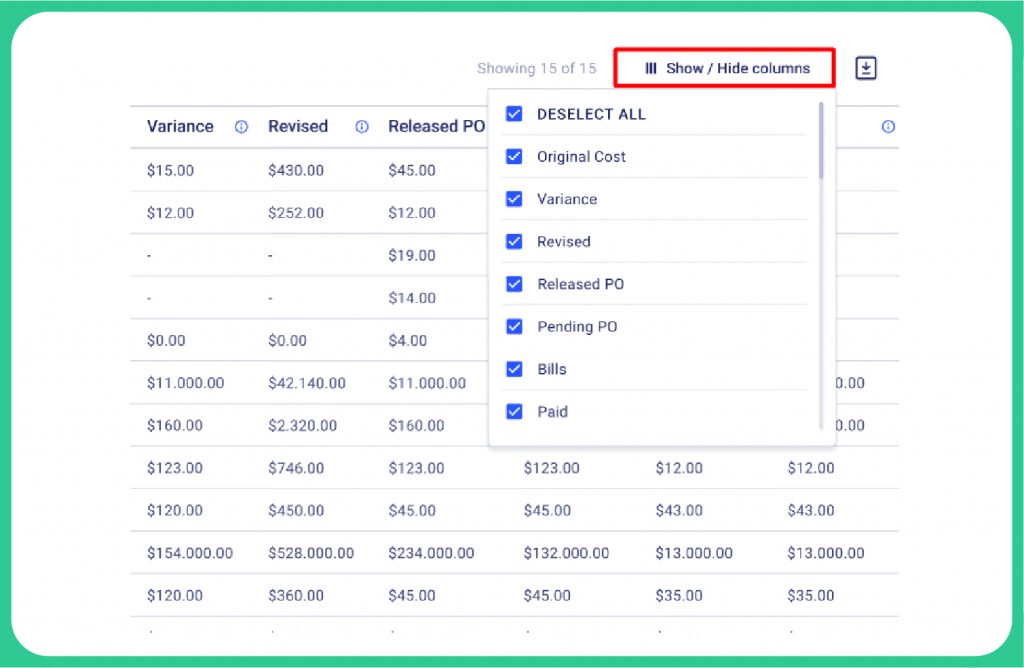

Step 2. Filter data for your convenience

Once you’re in, everything regarding your project’s financial status and construction costs can be seen in a quick view. Filter the columns with relevant information by clicking on the “Show/Hide Columns” button to get the required information. The list includes all the relevant data with a detailed representation of each construction cost. You can quickly learn about each construction cost with a click of a button.

Thus, for instance:

- Original cost is the amount logged in estimates, i.e., your initial construction cost calculation

- Pending changes indicate the number of approved change orders

- Outstanding are the bills not marked as paid yet

- Expected changes shot the amount of not yet accepted changes sent to the client’s approval

Step 3. Generate construction WIP report

The Budget dashboard is the extended version of your future WIP report. It includes construction cost breakdowns, materials and resources categorized according to your cost codes, as well as actual margins and profits contrasted to the expected amounts.

Click the “Download” button to get the report in a .xlsx format.

The document will include only those columns you initially preferred to show in your report.

Working with Buildern is several times easier and faster than manually tracking construction costs. Not only does it save your time, but it also eliminates costly human errors offering accurate construction cost tracking. All the analysis comes in real time, without additional input or manual calculations.

Project Manager’s Role in Construction WIP Reports

Now that you know how easy it is to generate construction WIP reports in Buildern, let’s touch on another no less sensitive topic – the construction project manager’s role in report generation.

WIP reports tend to be tools for accountants. They understand construction financials on a deeper and more professional level. They use WIP reports to ensure construction companies stay within a pre-set budget.

Nevertheless, neglecting the differences between information written on the sheet and things happening on the construction site is not an option. In other words, construction project managers and financiers should work together to make construction WIP reports as informative and accurate as possible.

So, while an accountant turns all numbers into a harmonic status report, construction project managers should provide accurate cost-tracking data and estimate the possibility of completing everything within the set timelines.

Conclusion

Team collaboration seasoned with advanced software solutions is the key to a project’s success. When construction project managers, financiers, architects, engineers and other professionals working on the construction site join their efforts with the help of Buildern, reporting and the final results come out exactly as needed!

Therefore, it’s time to forget about manual data input and bring construction WIP reports to a new level.

![Detailed Construction Project Cost Breakdown [Examples Included]](https://buildern.com/resources/wp-content/uploads/2024/09/BLOG_Cover_Construction-project-cost-breakdown-2-copy-150x150.webp)

![Detailed Construction Project Cost Breakdown [Examples Included]](https://buildern.com/resources/wp-content/uploads/2024/09/BLOG_Cover_Construction-project-cost-breakdown-2-copy-768x501.webp)