How to Avoid Payment Delays in Construction: Contractor’s Guide

If you are in a construction business, you know that a single late payment can nearly ruin everything.

Timely payments are the driving force of our industry. It’s not only about the financial management of the project. Delayed payment in construction means a subcontractor may not show up at the site, or a vendor may refuse to release the next batch of materials.

Crews lose trust, cash flow tightens, and work slows down because people simply can’t afford to wait. It’s important in terms of keeping the project on track, and it directly affects your reputation.

In my article, I will discuss the main risks of payment delays in construction and how they affect builders’ workflows.

Table of Contents

- Common Causes of Payment Delays in Construction

- Essential Financial Documents for Construction Payments

- Practices and Tools to Avoid Payment Delays in Construction

- Final Thoughts

Common Causes of Payment Delays in Construction

Unfortunately, payment delays are common in construction. The specifics of the industry are that there are multiple stakeholders. Besides, unexpected conditions such as weather changes, delays in supplies, or pending approvals affect the actual work on the site.

Of course, delays are possible in any construction project, regardless of the scope. During a big project, especially a public one, there is a greater likelihood that documents are approved by several parties and double-checked before the project even starts. However, even in this case, some unpredictable delays may occur.

When it comes to a custom home construction, the homeowner and builder can have a misunderstanding on scope changes or a simple change order when it comes to wall paint color.

The consequences go far beyond a late check. Payment delays strain relationships between contractor and homeowner, subcontractor and vendors. When money doesn’t flow, neither does the work.

Let me show you the most common cases.

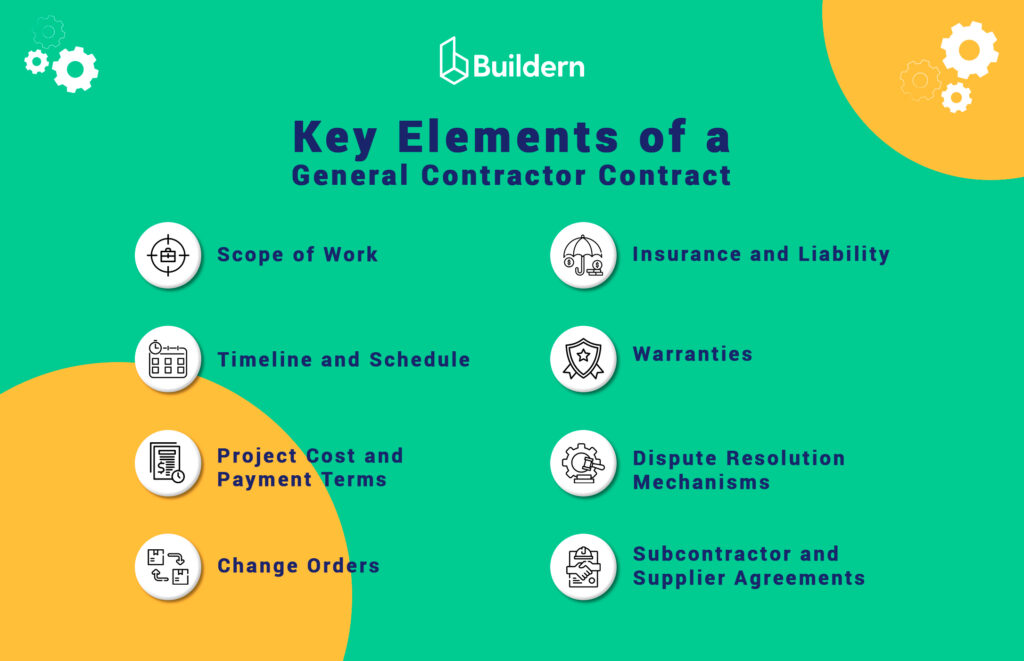

Poorly Defined Contracts

One of the reasons why payments get stuck in construction projects is poorly defined contracts. If there are some uncertainties with interpretation, disputes over payment terms are almost guaranteed.

For example, when drafting a contract, if neither of the parties clearly outlines how retainage will be handled or when progress payments are due, a client and a builder may have different expectations.

This lack of clarity creates miscommunication. It’s similar to uncertainties around change orders and may cause extra work, which is another common trap.

Defining a contract means clearly outlining procedures for approving payments and changes. This may sound like a small thing to track as compared to the material management or getting construction permits. But, believe me, this is the point where everything can be screwed up in a minute. The result is cash flow problems and no new clients.

💡Thus, contracts must be detailed, specific, and reviewed carefully to prevent disputes.

Disputes Over Work Quality or Scope

Disagreements over work quality or project scope are a common problem. For example, disputes can arise when the owner feels the work has not met expectations. It’s not only about the contractor’s poor quality. Sometimes expectations simply are not realistic.

If this happens because of poor communication, there are ways to improve the situation. As a project manager, I’ve seen situations where a subcontractor completed their work on time, yet payment was not made.

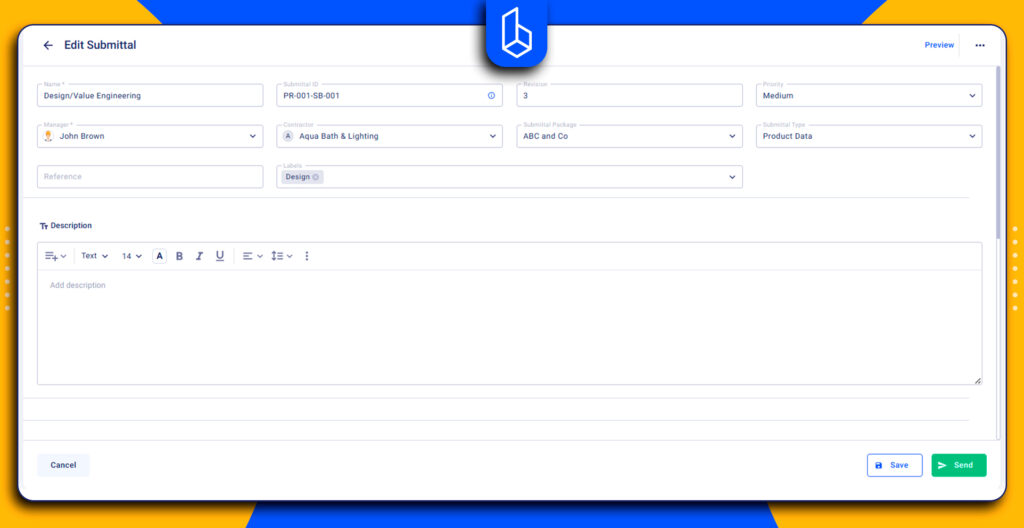

A client or an architect can question the quality, and it’s their right. However, submittals in this regard are essential. By sharing drawings and samples through construction management software, it’s possible to avoid similar problems. You get a clear, documented procedure that speeds up the approval process and ensures payments aren’t unnecessarily delayed.

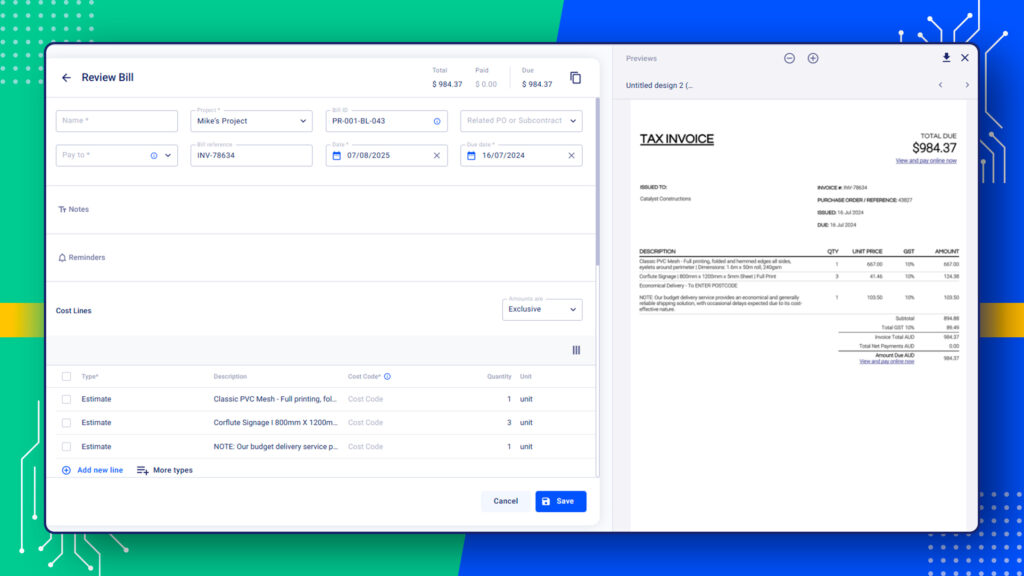

Inaccurate or Incomplete Invoices

It’s clear that missing or incomplete documents, such as client invoices or change orders, create problems in the approval process and subsequently lead to payment delays.

For example, there is a mistake in an invoice submitted without proper backup. A wrong date or account number can cause a payment delay for weeks if it can be returned for clarification, which takes even longer.

From my experience, a problem may occur when different parties use different systems to track finances. For instance, if the accounting software, such as QuickBooks, used by a bookkeeper, does not align with the project management platform that the general contractor uses. An invoice does not match the accounting records, and there is a request for resubmission.

Slow Approval and Review Process

Some processes are out of the general contractor’s control. Even if the field team and office crew do a great job and all the processes are smooth, there is always a homeowner to decide how the project will continue. The builder cannot do much if a homeowner cannot decide which tiles or windows to choose.

The same goes for approval. Although automation through the construction management software simplifies the change order and payment flows, final approval still rests with the homeowner.

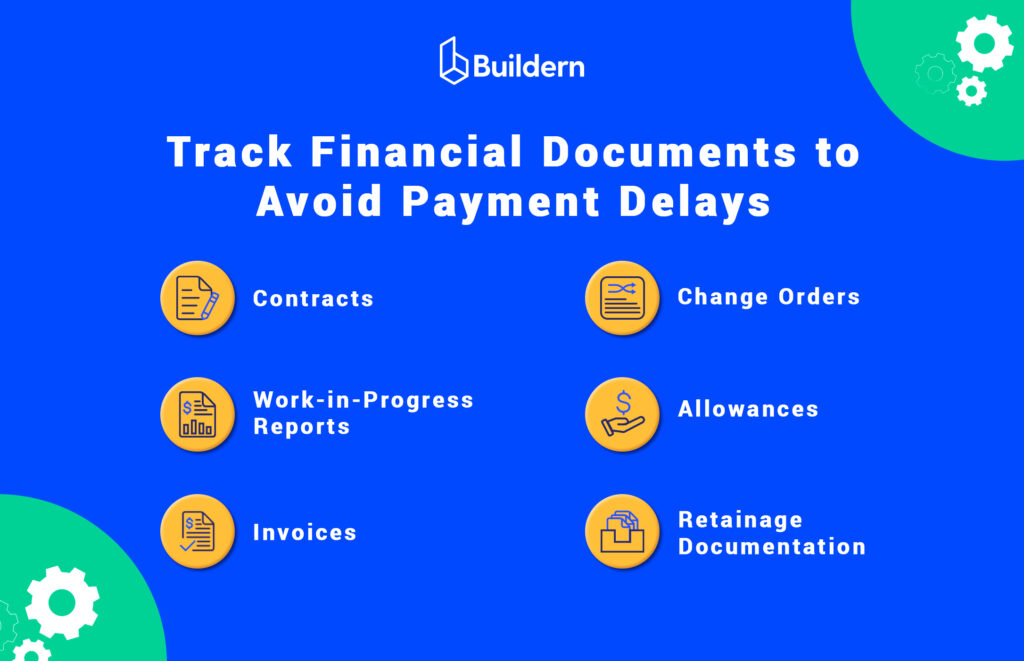

Essential Financial Documents in Construction Payments

A clear record of every financial document is important to avoid delays in payments. Of course, some circumstances do not depend on internal factors, as I’ve already discussed above. However, in other cases, documents keep cash flow steady and prevent disputes between all crews.

Contracts

Agreements between the contractor and homeowner, as well as between the contractor and subs or vendors, are the foundation of payments. They have to be clear and understandable for each party, defining the payment terms and milestones.

For instance, vague wording on how retainage will be released often results in delays. In short, they set the rules, and it’s important to have clear rules from the very start of the project.

When I mention contracts, it does not mean there are paper documents signed by hand. In the construction management software, a digital change order signed electronically is also a legal contract between the parties.

Work-in-Progress Reports

In addition to day-to-day monitoring of the financial flow, it’s important to record the changes in a long-term perspective. For instance, WIP reports give a clear picture of project finances by showing earned revenue, costs, and the percentage of work completed.

Without tracking these indicators, contractors risk overbilling, underbilling, or misreporting progress. When a builder tracks the exact amount left for the next stage of the project and presents all details to the homeowner, it’s more likely that further payments won’t be delayed.

In other words, transparency is needed to keep cash flow consistent, which in turn affects the schedule of payments.

Invoices and AI Billing

I’ve already mentioned the challenges that wrong invoices may bring. Automation is one of the solutions to avoid discrepancies. AI billing can speed up the work as there is no need to check every invoice manually.

For example, if a builder has dozens of invoices sent by different subcontractors, scanning with AI takes only a few clicks. Once the invoices are stored in one place, there is more time to focus on other tasks without fear that a payment may be delayed due to wrong information.

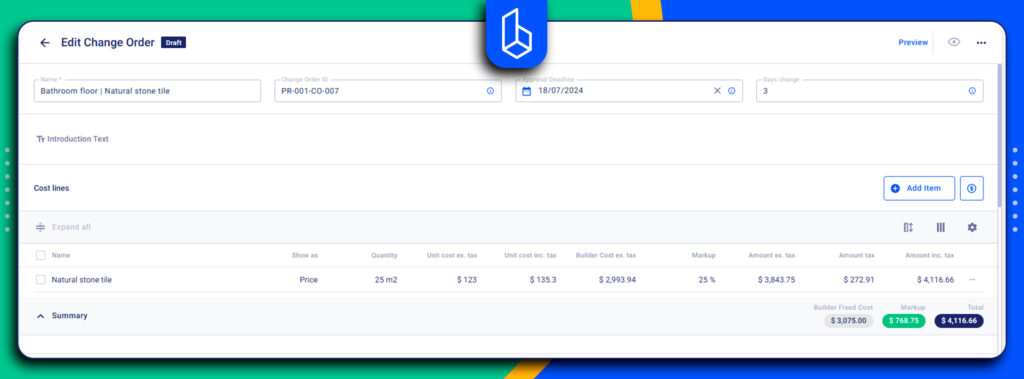

Change Orders

As the construction project progresses, small adjustments, especially in a custom home project, are accumulating. No one will argue that it’s a common practice for a homeowner to make changes. However, one has to deal with the changes as quickly as possible, not to disrupt the scheduled phases of the project.

When working in a construction software management platform, besides providing the right files, I mean images of the changed order, it also contains a deadline for approval or an electronic signature.

Allowances

Having a budget saved for some items not fully defined at the start of a project is a smart way to prevent payment delays in construction.

For example, when a homeowner is not sure which kitchen tiles to choose, we set a $5,000 allowance in the contract. This gave flexibility to decide later without disrupting the budget or causing underpayment issues.

Without construction allowances, costs can grow, and from my experience, it leads to delayed approvals and delayed cash flow.

Retainage Documentation

I can call it a “hidden cause” of delayed payments. Since a part of each invoice is held back until project completion, contractors need a clear record of what has been retained.

Of course, not to have troubles with finances, retainage, just as the type of invoicing and a markup should be defined at the start of a project.

If the retainage is not paid, there are instruments such as a mechanics lien to protect a contractor. It is a legal claim that contractors, subcontractors, or suppliers can file against a property when they haven’t been paid for work or materials.

💡General contractors can file a lien directly against the owner’s property if the owner hasn’t paid for completed work.

Practices and Tools to Avoid Payment Delays in Construction

Once the documents are well-organized and clear, it’s time to minimize the risk of delays. In the past, we used to rely on piles of papers and, later on a manual data entry.

The workflows have changed, bringing more automation to even such traditional industries as construction. Let’s discuss how to apply technology and minimize possible risks.

Automation for Financial Workflow

Automation is not only handful when it comes to complicated processes. Such a small thing, like an automatic notification or reminder that you have an approved change order, can change much. Seeing a notification means there is no need to constantly chase subs or clients. The system notifies the right person when an approval or submission is due.

Much bigger changes come with digital approval workflows. It transforms several processes a the same time. Approving and leaving comments through one channel, attaching files there for more visibility, works perfectly when you need to avoid delays.

Add integration with accounting tools like QuickBooks or Xero to the features that a construction software should have. When invoices or progress payments are updated in the system, the accounting records match automatically.

Technologies for Communication

No matter how big a project is, it involves dozens of subcontractors, vendors, and field workers. Building communication with all of them is an important skill. When performed correctly, it affects the entire progress of the project, including delayed payments.

Dedicated tools for stakeholder communication change the speed of approvals. Everyone, including owners, subcontractors, architects, and the general contractors, must have channels to check updates, share information, and get replies to questions.

For example, when using built-in messaging, being in the office or checking replies on a smartphone does not make any difference; it’s easy and efficient in both cases. No one has to spend more time on submission and resolution of different issues, including payment postponement and the reasons for it.

Tools for Risk Prevention

We all agree that owners protect themselves from project delays and financial risks through various mechanisms. However, contractors also need to take steps to avoid critical delays in payment.

The worst-case scenario is when work must continue, like installing a sink or laying kitchen tiles, while payment for previous milestones hasn’t been made. These situations create real pressure on everyone.

It’s also a problem for subcontractors. One tool to rely on is payment bonds, which guarantee that subs get paid even if there are issues with the main contractor.

Structuring payments around clearly documented milestones with signed approvals reduces the risk of delayed payments. Of course, it depends on the invoicing type a contractor chooses. There is progressive invoicing, when a builder bills the owner for a part of the cost at specific milestones. Meanwhile, when applying a cost plus billing method, a client pays for the actual price of services or materials and a percentage or a fee for the contractor’s profit.

Lien Laws

These are laws that regulate what to do when an owner refuses to pay even though the contractor fulfilled all obligations under the contract.

Lien laws in construction vary significantly depending on the state or country. Each jurisdiction sets its own rules regarding who can file a mechanics lien. For example, some states require notices within a few weeks of starting work, while others allow more flexibility.

Final Thoughts

Payment delays are one of the most common challenges in construction. However, most of them are preventable if the workflow is consistent.

Set the financial documentation from day one. Start with clear contracts that leave no room for different interpretation. I recommend automating all payment terms, retainage policies, and change order procedures. When everyone understands the rules from the very start, disputes become the exception.

Most importantly, protect yourself and don’t wait until you’re in crisis mode. Prevention is always easier than recovering business after a long dispute and legal consequences. Understand payment bonds and establish clear milestone-based payment structures.

How to Deal With a Delayed Payment in Construction?

It’s important to understand what caused a delay. A number one step is to review the contract and confirm if a milestone tied to that payment has been met. In fact, the payment cannot be delayed due to invoicing inconsistency. If all financial documents are recorded clearly, reach out to a homeowner to resolve misunderstandings.

If the payment is postponed by an owner because he is not satisfied with the quality of work, one thing, it’s a more complicated scenario. In this case, a legal advisor can help to ensure the next steps are in line with the contract.

Should a Contractor Stop Work if a Client Doesn’t Pay on Time?

Stopping work is a serious decision and usually the last step to take. I recommend reviewing the contract terms first to see what rights a contractor has. It’s worth trying to resolve the issue through direct communication and providing all documents and progress reports before halting work.

When all efforts fail and cash flow makes it impossible to continue, while a homeowner is not responding to calls, of course, the contractor has no other option. The next stage is to protect your legal rights.

How Long to Wait Before Taking Action?

A contract determines the right time to take action. Most agreements outline a specific payment schedule. If the delay extends beyond the agreed period and communication brings no results, formal steps are needed. Acting too quickly can damage relationships. On the other hand, waiting too long can put your business at risk.