Construction Budgeting: Complete Blueprint for General Contractors

Published October 5, 2022. Updated August 1, 2025

Construction budgets have always played a critical role in how projects perform. That hasn’t changed. What has changed is the level of precision now required to keep jobs on track.

A budget today is the framework for your project’s financial health. When done right, it tells your team where every dollar goes, how each phase connects to cash flow, and what room you have to adjust when things don’t go as planned. That level of control is what makes the difference between closing out profitably or chasing costs long after the job wraps.

Table of Contents

- Why Construction Budgeting Still Defines Your Project Success

- Construction Budget Structure: What’s Included?

- 4 Main Construction Budgeting Phases

- How to Create a Construction Budget That Works

- Common Budgeting Mistakes (And How to Avoid Them)

Why Construction Budgeting Still Defines Your Project Success

According to 2024 data from Dodge Construction Network, more than two-thirds of U.S. builders reported budget overruns on residential and light commercial projects. In 2025, tighter profit margins, shifting material prices, and financing constraints continue to make budget clarity a non-negotiable.

Good construction work doesn’t protect your profit on its own. Accuracy in the field matters, but without a clear budget structure behind it, even efficient teams lose visibility fast.

Detailed budgeting makes everything measurable. It defines how funds are distributed, how costs are tracked, and where corrective action is possible. Without that visibility, even the smallest overruns turn into financial setbacks, often without warning.

- Labor rates shift mid-project.

- Equipment gets delayed.

- Clients request changes halfway through the build.

When your budget accounts for these moving parts, your financial plan becomes a tool you can actually manage, and a file on a shared drive.

Construction Budget Structure: What’s Included?

A professional construction budget separates cost categories into clear and traceable items. Without a breakdown, financial planning becomes harder to maintain once work begins.

The typical framework includes both direct costs (what you spend to build) and indirect costs (what you spend to operate). Each line item should map to real decisions and tie into how progress is tracked on-site.

Standard Line Items in a Construction Budget

Materials

Material pricing changes weekly in some regions, so up-to-date supplier quotes are essential. Your budget should reflect current market rates for everything from bulk framing packages to specialty finishes.

Labor

This includes all site labor internal crews, subcontractors, and any temporary staff. It’s also where many budgets go off course, especially when production slows or crews get stuck on overlapping phases.

Equipment

Equipment expenses cover rental and owned machinery used on-site, from compactors to cranes. Don’t overlook maintenance and delivery logistics when pricing equipment usage.

Permits and Fees

Permit costs vary by region but can add up quickly on multi-phase or multi-unit projects. Include plan check fees, utility connection charges, and any environmental or zoning costs up front.

Taxes, Insurances, and Overheads

Wrap these together only if they’re tracked under one account. General liability, builder’s risk, and payroll taxes typically sit here. So do overhead allocations like fleet usage, field management software, and office admin tied to the project.

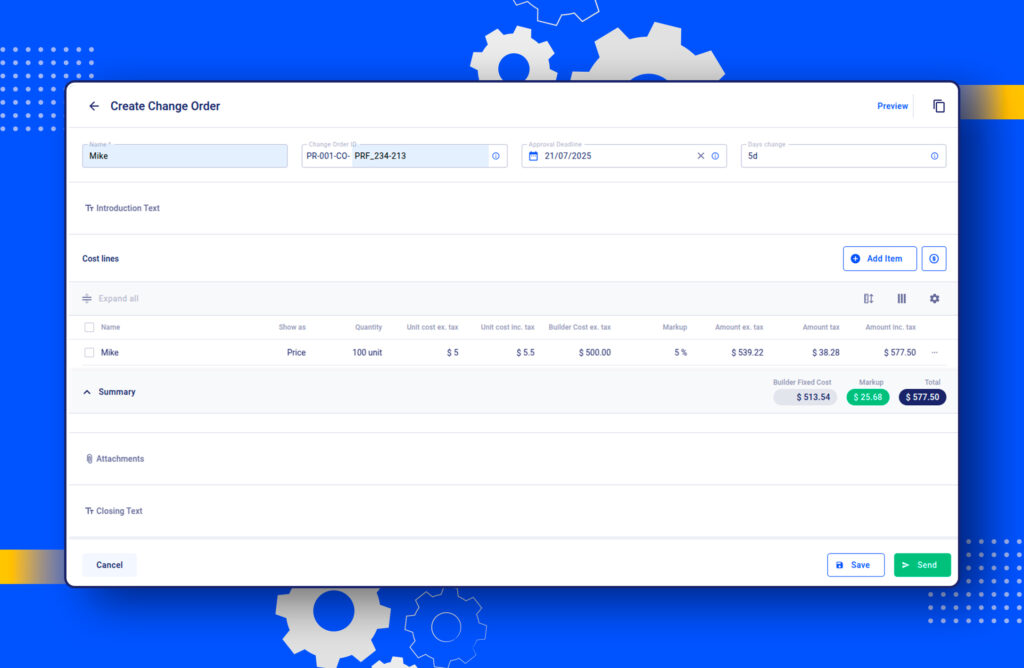

Budgeting for Change Orders and Allowance

No budget stays untouched from start to finish. Change orders and allowances exist to absorb that movement without putting pressure on your original line items.

Change orders apply when the contract scope adjusts after execution. These could stem from site issues, late design decisions, or requests for alternate materials. The key is to separate these from baseline items so you can track actual scope drift.

Allowances are placeholders typically used for selections not finalized at the time of estimate, such as, for example, finishes or appliances. The risk undervalues them. When the actual cost comes in higher than the placeholder, it should be clear who’s responsible for the difference and how the overage will be approved.

When structured correctly, both of these categories act as buffers. They let you move with the project, not around it.

4 Main Construction Budgeting Phases

A construction budget doesn’t appear in one step. It builds gradually, as the project itself comes into focus. Each phase introduces a different level of certainty and a different set of risks to manage.

1. Discovery and Initial Analysis

Construction budgeting starts long before the first brick is laid. Success depends on teamwork as much as on the quality of raw materials. When every team member knows their exact duties and scope of responsibility, the process will run as smoothly as possible.

Use this phase to evaluate the construction site conditions and make forecasts regarding every scenario.

Once you have everyone’s role defined, move on to the next step, designing and developing the project overview.

2. Design and Development

The second phase involves planning, drawing, calculating and outlining the future project. Meet with designers, subs, vendors and local authorities to clarify misunderstandings.

Designers and architects come up with the final versions of the future project at this stage. Clarifying each detail with the client will save you time and effort in the long run and free you from workovers.

3. Preconstruction

In the preconstruction phase, builders secure approval of the final budgeting and architectural drawings. Ensure that the project has secured all the necessary work permits, licenses, and insurance. No one wants to build a two-storey house to find they broke the law while doing it.

Keeping all your paperwork and budgeting neatly organized will position your company as a trustworthy industry representative. So, before introducing the final project overview to your client, ensure it’s well-created.

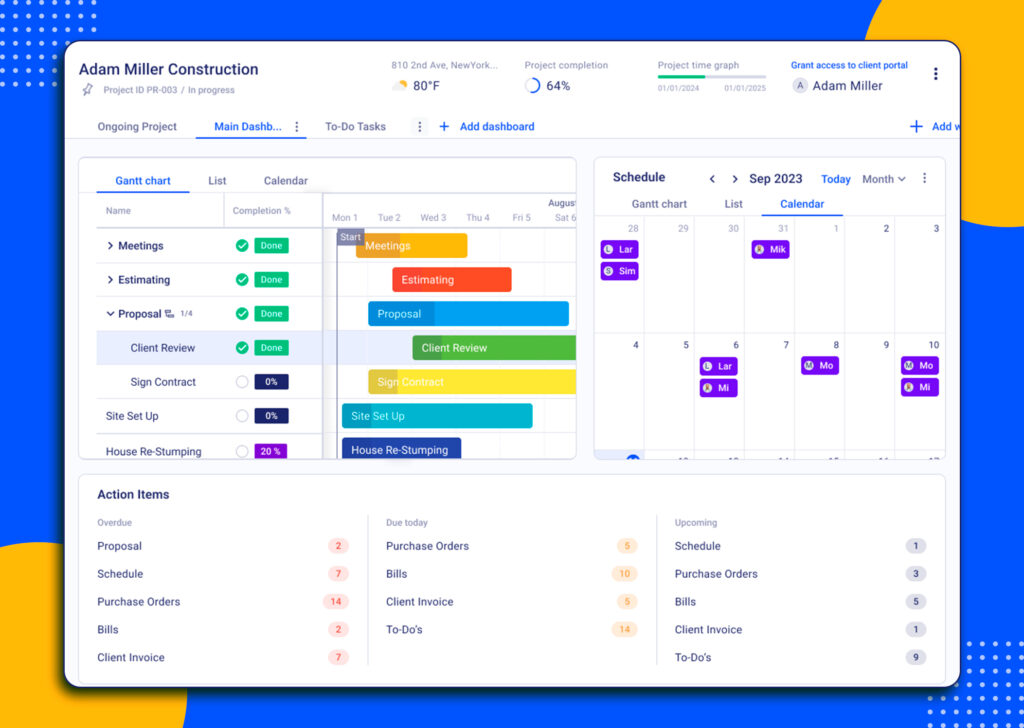

4. Construction and Closeout

Building and closing a project is the longest and probably the most complex phase. Construction managers need to track the whole process to ensure everything is delivered according to schedule. While construction is ongoing, building managers also need to focus on the quality of construction.

It’s important to have regular meetings with all construction managers to review construction budgeting and make necessary changes. To avoid any unpleasant surprises at the end of the project, have a final inspection with the construction crew. Doing so will help identify and solve any potential issues.

How to Create a Construction Budget That Works

The most reliable construction budgets come from the process, not just copied templates. A strong workflow, built on clear project inputs and organized cost tracking, is what turns estimates into tools.

1. Start with a Clear Project Scope

Without a defined scope, even the best budgeting tools fall short. Scope clarity removes ambiguity before the numbers start.

That includes:

- Detailed finish schedules and material specs

- Defined construction phases with clear deliverables

- Written exclusions and boundaries for what the job won’t include

When scopes are missing these details, estimates tend to get padded or worse, underbid. And when adjustments arise mid-project, no one’s sure what’s extra and what’s covered. That leads to unnecessary disputes and budget creep.

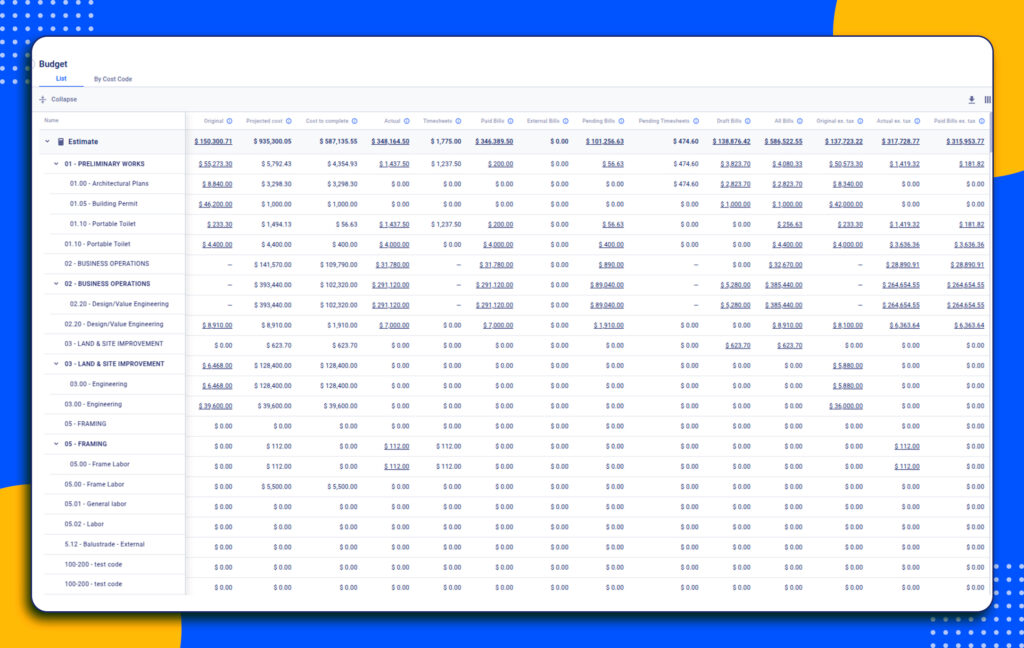

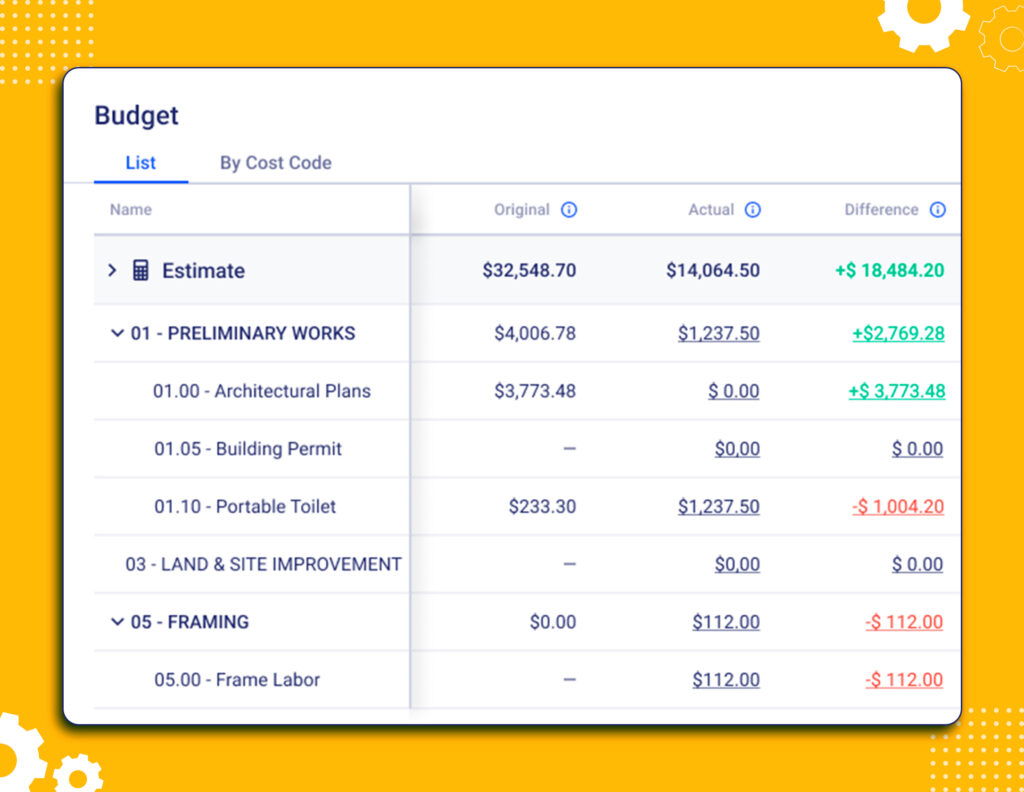

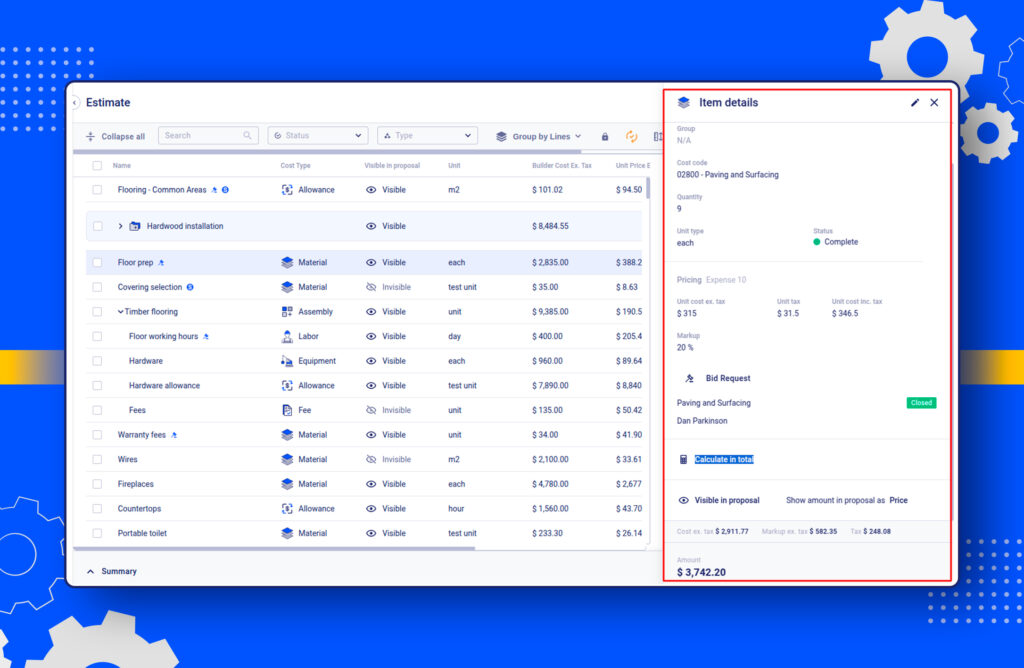

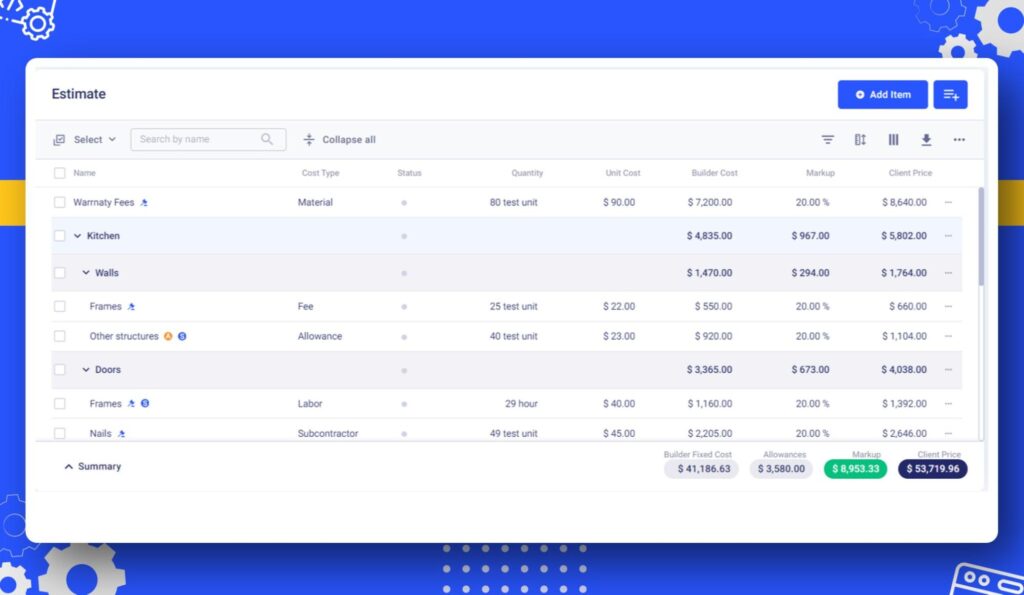

2. Break Down Costs Accurately

Costs must be tracked in a way that reflects how the work actually happens. That means separating direct costs from indirect ones, and assigning every dollar to the right task, crew, or service.

- Direct costs cover physical work materials, equipment, and trade labor

- Indirect costs include jobsite insurance, management overhead, technology tools, and anything that supports operations behind the scenes

To manage these effectively, builders use standardized cost code systems. These codes help sort, label, and compare costs across jobs and phases.

Two of the most common frameworks include:

- CSI MasterFormat: Widely used for commercial projects. Breaks down scopes by trade and system (concrete, finishes, HVAC, etc.)

- NAHB Home Builder Cost Codes: Preferred for residential jobs. Organizes line items by function (framing, drywall, roofing, and so on)

Both frameworks help builders avoid overlap, double entries, and missed costs. They also make it easier to communicate across teams, submit clean invoices, and compare planned vs. actual spending.

3. Add Markup, Profit, and Contingency

Markup and profit reflect what keeps the business viable. Without a structured approach to both, the budget might look complete but still fall short when invoices and payroll arrive.

In residential construction, construction markup often ranges from 20% to 30%, depending on the job size, risk level, and competitive pressures. In commercial projects, markup tends to fall between 10% and 20%, reflecting tighter bid margins and a longer cash cycle.

Markup should be added after calculating base costs, and profit should be separated from overhead recovery. Builders who blend these two risk losing visibility into job performance and margin trends over time.

The budget should also include a construction contingency line to cover risks that aren’t clearly defined at the time of estimating. Unlike allowances, which are placeholder values for client selections, contingency accounts for project-wide unknowns. This might include minor design adjustments, access issues, or price fluctuations during longer builds.

4. Use Historical Data and Real-Time Tools

A reliable budget comes from understanding how past projects performed. Builders who reference historical cost data can better predict where time and money tend to slip. That might mean tracking how long your framing crew typically takes on a two-story build or how much steel pricing moved between quarters.

When this data is collected and categorized properly, it shapes more accurate assumptions for the next job. It also helps validate or challenge vendor quotes, especially in volatile markets.

Just as important is what happens after the job starts. A static budget, created during preconstruction, quickly loses value unless it’s updated to reflect real-time changes. Builders working with integrated construction budgeting tools can tie budgets to live schedules, sync field reports with cost codes, and adjust values as client selections evolve.

💡These tools turn budgeting into an active part of project management. The more current the data, the more confident the decisions become.

Common Construction Budgeting Mistakes (And How to Avoid Them)

Even experienced builders run into budgeting problems. What matters is how quickly you spot them and whether your system gives you a way out. These are five of the most common missteps we see in construction budgeting, and some professional tips on how to overcome each.

Mistake #1: Underestimating Labor Costs

Labor is one of the most unpredictable line items. Weather delays, scope creep, and trade shortages all affect how long tasks actually take.

💡How to Fix It

Base your labor estimates on tracked production data, not hourly rates alone. If jobsite updates and crew activity are consistently logged, labor trends become easier to analyze. This kind of visibility is what makes daily field reporting valuable for financial planning.

Mistake #2: Ignoring Change Orders

When change orders aren’t reflected in the budget structure, unexpected costs result. This often leads to billing errors and unapproved work.

💡How to Fix It

Link every approved change directly to your cost categories. Adjust forecasts as soon as client decisions shift the scope. It’s also important to standardize how change orders are documented and approved so the budget remains trustworthy.

Mistake #3: Relying on Static Spreadsheets

Spreadsheets aren’t built for live project conditions. When multiple versions circulate across teams, you lose a clear picture of where the budget actually stands.

💡How to Fix It

A connected system makes it easier to manage ongoing adjustments without duplication. If your current workflows still rely on local files, consider moving to purpose-built estimating tools that integrate budgets, schedules, and cost tracking in one place.

Mistake #4: No Contingency Planning

Without contingency and allowance funds, projects either exceed budget or sacrifice quality to compensate. Builders are left choosing between absorbing the cost or pushing back on the client.

💡How to Fix It

Include contingency or allowance lines from the beginning. The data should be visible, isolated, and tied to specific triggers. Budgeting for design gaps or price variability up front prevents margin erosion.

Mistake #5: Disconnect Between Estimating and Budgeting

When cost breakdowns from estimating don’t carry into active budgets, field teams start tracking off different baselines. That leads to misalignment and missed overruns.

💡How to Fix It

Use cost coding systems that bridge estimating and budget management. When everyone references the same structure, updates flow cleanly across teams. Systems like CSI or NAHB codes are commonly used for this reason, they reduce confusion and improve financial traceability.

What’s the Difference Between a Construction Estimate and a Budget?

An estimate comes first. It’s used to price the job before any work begins. Most builders base it on plans, materials, and early conversations with subs or suppliers. But the numbers are still in draft mode.

A budget, on the other hand, is what you manage once the job is active. It takes that original estimate and folds in change orders, markup, and actual costs as they come in. Good budgets respond to the job. They track how your plan holds up in the real world.

How Much Contingency Should You Include in a Construction Budget?

There’s no fixed rule, but most builders use 3% to 5% for well-defined new builds. Remodels or designs that are still evolving may need closer to 8% to 10%.

What matters is treating contingency as its own category. It shouldn’t get lumped in with markup or left to cover client upgrades. When it’s visible and separate, it becomes a useful tool instead of a last-minute patch.

What’s the Best Tool for Construction Budgeting?

The best tools are the ones that reflect how you actually build. Some firms rely on spreadsheets, others use software that connects estimating, cost tracking, and field updates.

Look for something that mirrors your process. If you need to link costs to tasks, log progress from the site, or break work down by phases and codes, choose a tool that keeps those pieces connected.

Can You Update the Budget After the Project Starts?

Yes, and it’s common. Budgets aren’t static. When plans shift or clients request changes, the numbers should reflect that. Most builders update their budgets through revised estimates, new selections, or formal change orders.

That said, it’s easier to keep control when the core budget stays close to the original agreement. Frequent edits can make it harder to track progress and harder to communicate costs clearly. If your estimate already includes reasonable buffers, the need for large revisions drops off.