Construction WIP (Work-in-Progress) Report: How to Track Finances?

Managing the financial part of a construction project is a complex task. As the project grows, keeping track of figures at all phases becomes crucial.

The risk of “missing the point” during a long construction project is high if you don’t do it on time. For this reason, general contractors usually use a construction work-in-progress or WIP report to keep an eye on their finances. With WIP reports, companies can see whether they are overbilled or underbilled, helping prevent costly surprises.

So, how does this accounting schedule work, and what is the easiest way to create a WIP report? In this blog, we will figure out how the reports fit into effective financial management and how to make them work for your construction business.

Table of Contents

- Understanding the WIP Report in Construction

- Creating a Construction WIP Report

- Project Manager’s Role in Construction WIP Reports

- Risks of Not Tracking Finances

- Common Mistakes to Avoid

Understanding the WIP Report in Construction

WIP reports are documents created by construction accountants during each phase of the project.

This financial document helps construction companies track their costs and revenues. This is a must for any project that uses the Percent Complete accounting method. The core idea behind POC is that revenue and expenses are calculated according to the percentage of completed work during a set period.

WIP reports may vary in format between companies. However, one thing uniting them is the current period and project-to-date columns. Construction accountants use this to track the progress and costs accrued during a specific period.

Accountants implement WIP reporting to track the progress and costs of a project and the exact amount left for further construction. This gives them a clear picture of their financial situation at any given point throughout the project’s completion.

Creating a Construction WIP Report

Creating a report requires extensive knowledge of construction accounting principles. Before you begin the calculations, it’s essential to have accurate data to ensure the report reflects your project’s true financial status.

Necessary Data

The key indicators one needs for a WIP report are as follows:

- Total Contract Value: the full amount the client agreed to pay

- Total Estimated Costs: the total cost of completing the project

- Actual Costs to Date: the amount that has been spent so far

- Total Billed to Date: how much the client has been invoiced

- Payment Status: what has been paid vs. what’s outstanding

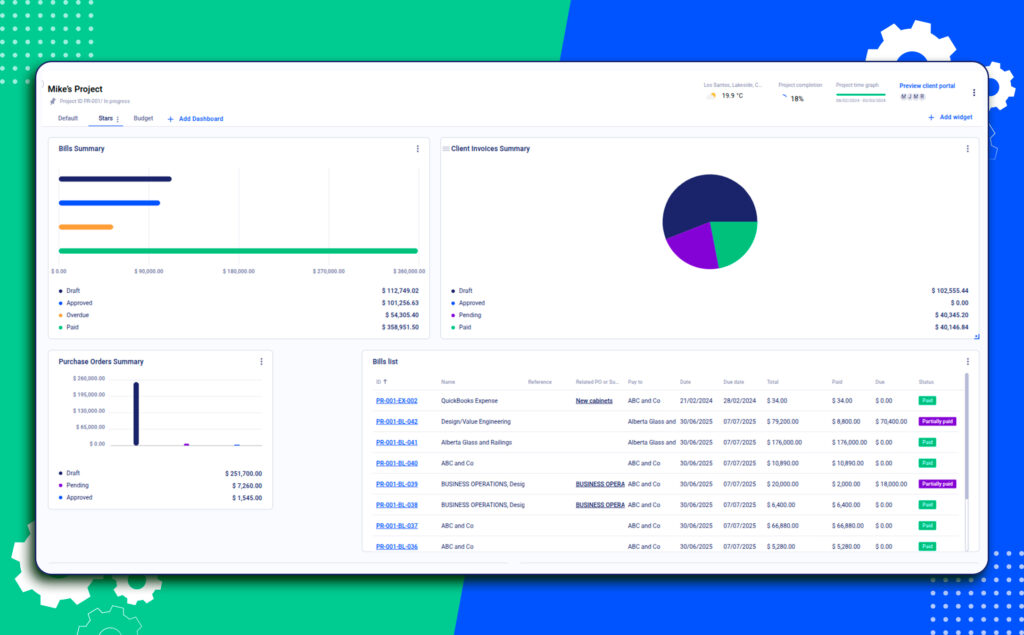

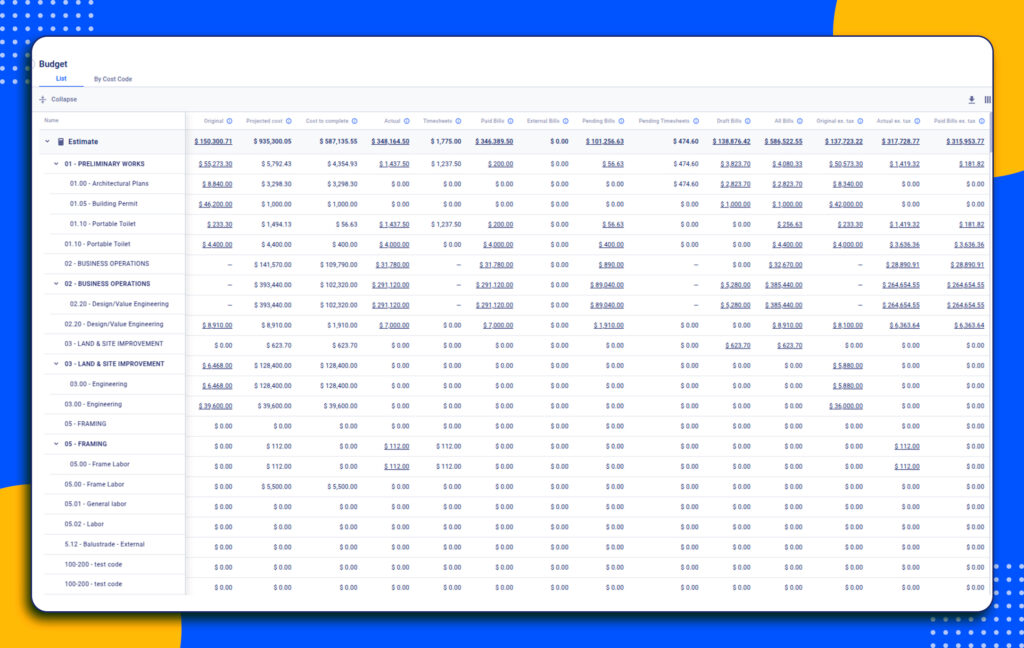

Having this data means the calculations are accurate and reflect the financial performance of your construction project. Construction financial management tools can be used to track the figures at different phases of the project.

How to Calculate?

One of the most important calculations is the Percent Complete. This shows construction companies whether they are over- or underbilled and allows them to apply the necessary changes.

Percent Complete = Actual Costs to Date / Total Estimated Costs

Example:

$260,850 / $347,800 = 0.75 (or 75%)

Percent Complete = 0.75 (or 75%)

Next, use this percentage to calculate Earned Revenue to Date. This is the amount of revenue your company should have earned based on the work completed.

Earned Revenue = Percent Complete X Total Contract Value

Example:

0.75 * $7,800 = $5,850

Earned Revenue to Date = $5,850

Once you’ve calculated earned revenue, compare it with how much you’ve billed the client so far. The difference between the total billings and earned revenue to date will show how much is underbilled.

Over/Underbilled = Total Billed to Date−Earned Revenue

Example:

$5,000 – $5,850 = – $850

Underbilled by $850

Understanding these numbers helps you assess your project’s financial status and adjust billing on time.

How to Read a WIP Report?

Once you have calculated the key financial metrics of the project, you have a clear WIP report that shows:

- Percentage Complete: 75%

- Earned Revenue: $5,850

- Underbilled: $850

This was a simple case with small numbers. Imagine the construction WIP report for a project that lasts two months and costs over $2 million. The longer and more complex the project, the more detailed and accurate your analysis needs to be.

Thus, regular construction expense tracking is key to preventing misunderstandings between companies and their clients. But achieving this level of precision requires time, coordination, and a high level of detail. Relying solely on manual tracking methods is no longer sustainable for modern construction teams, and they choose automated tools to follow the cash flow.

Project Manager’s Role in Construction WIP Reports

WIP reports are typically prepared by accountants. They understand the financial framework and apply accounting formulas. However, it’s a team effort. Project managers play a critical role as they are responsible for managing the data included in the report.

Project managers are the ones on the ground, closely monitoring day-to-day operations. They also handle and approve the material usage, coordinate subcontractors, and keep track of labor and equipment costs. Their input ensures the numbers on paper reflect the actual work happening on-site.

For example, missed change orders, delayed deliveries can affect project costs and schedules. These details may not be visible to accountants working strictly from spreadsheets or budget software.

This is the reason that collaboration between project managers and accounting teams is essential. PMs should regularly update progress, point out potential budget risks, and provide context for any financial gaps.

Risks of Not Tracking Finances

A typical construction project involves several departments, lenders, investors, and subcontractors. While each side has particular interests and goals, project reporting can be challenging.

However, it’s not just a “nice to have” feature. Construction companies risk running out of money without precise reporting before the project is over.

Since construction projects can last from several months to years, it is highly recommended to generate work-in-progress reports regularly and use the information to adjust construction costs if needed.

Let’s take a closer look at what can go wrong when construction reporting is poorly organized.

Underbilling in Construction

This occurs when a construction company charges less than the actual cost of labor, materials, and services provided. This can disrupt the cash flow and negatively affect upcoming phases or future projects. Without enough funds, the company may suffer financial losses or struggle to complete work on time.

For instance, during the first phase, the construction company bills $50,000, while the actual construction costs turn out to be $80,000. It means it will face a shortfall of $30,000 for the next construction phase.

To cover the gap, they may secure an additional construction loan or increase the next phase’s invoice, raising the total project cost.

To ensure construction companies have proper construction billing, WIP reports should become an integral part of construction management.

Consequences of Overbilling

This happens when a company charges more than the actual cost of labor, materials, or services during a project.

First, the construction companies may suffer legal consequences if caught overbilling their clients. If a WIP report shows overbilling for the first construction phase, the builder should refund the overbilled amount or apply the surplus to the next phase of the project.

In some cases, the contractors may be able to pay back the difference and explain the mistake. However, a single overbilling can also be subtracted from the next-phase invoicing. In any case, returning the surplus amount and making the construction cost records transparent will help avoid serious consequences.

Common Mistakes to Avoid

A construction project usually consists of dozens of different tasks. Each phase requires separate financial management. From takeoff to recording change orders, all is connected to finances.

When creating a report, it’s easy to overlook details that can overrun the budget and cause delays in the entire project. Mistakes in reporting often stem from rushed updates, miscommunication, or relying on outdated processes. Let’s see which are the common mistakes and how to avoid them.

Outdated Reports

Project costs, schedules, and billings change frequently. Outdated reports can quickly lead to inaccurate financial insights. To avoid this, WIP reports should be updated at least monthly, or even weekly in case of particular projects.

Luckily, construction software management tools can simplify this process by centralizing project data and automatically syncing the numbers. Regular updates ensure your WIP report reflects current project conditions.

Mismatched Numbers Across Teams

There can be inconsistencies in the figures reported by the different teams. Let’s admit that subcontractors and accounting departments hardly ever meet in the office.

So, differences in numbers may occur when teams use separate tools or manual spreadsheets to track data like labor hours, material usage, or progress updates.

For instance, a field team reports 75% project completion based on actual site work. Meanwhile, the accountant uses outdated timesheets showing only 60%. In this case, the earned revenue calculation will be wrong.

Using a common platform minimizes the risk as project tracking mechanisms are in one place. This can refer, for example, to both material management and timesheets. There is shared access for everyone to see the necessary information.

Ignored Change Orders or Pending Approvals

Before generating a report, a construction company should make sure that the change orders are also included. For example, if a $20,000 approved change order isn’t added, the percent complete and earned revenue will be calculated based on the original lower amount.

Pending approvals are just as risky. Work may already be in progress, but if it hasn’t been formally approved and recorded, the WIP report will not reflect the real cost or revenue.

To avoid these issues, it’s essential to track change orders in real time.

What is included in a WIP report?

This is a financial snapshot of a construction project. It compares the actual progress and the financial performance of a project so far. Typical elements included in the report are contract value, percent complete, and total estimated costs. In addition, the report features amounts billed to date, which helps identify whether a project is overbilled or underbilled.

How often should one create a WIP report?

The reporting period depends on the company’s financial reporting cycle. For most construction companies, this is a monthly report. This is a good period for tracking the performance and cash flow. Depending on the size of a specific project, the report can be created biweekly or monthly. The main point is to rely on accurate data.

Who is responsible for preparing WIP?

These documents are typically prepared by the accounting or finance team. However, they rely heavily on the data accumulated by other staff, for example, a project manager. Collaboration between both teams means the report reflects the current state of the project.