2026 Construction Industry Outlook: Costs, Growth, and Regional Trends

Buildern’s 2026 Construction Industry Outlook highlights key costs, growth forecasts, and regional trends shaping the sector this year. After years of supply chain issues, labor shortages, rising material prices, and shifting economic conditions, construction firms now face both challenges and new opportunities.

Public infrastructure investments are growing, sustainability regulations are redefining project priorities, and financing conditions continue to evolve.

Our analysis combines market data, regional performance, and investment trends to help contractors, investors, and policymakers understand the current landscape and plan. Tracking construction business KPIs supports better performance and smarter decisions.

Buildern aims to deliver clear, data-backed insights that help industry leaders plan with confidence. Explore our full outlook below for insights on costs, growth, and regional trends driving construction in 2026.

Table of Contents

- Global Construction Market Size & Growth Forecasts

- Sector-by-Sector Growth Analysis

2.1. Residential Construction

2.2. Infrastructure Construction

2.3. Commercial Construction - Inflation and Rising Material Costs

- Supply Chain Vulnerabilities

- Tight Financing Conditions and Project Viability

- Regional Construction Outlooks

6.1. United States: Public Spending and Nonresidential Growth

6.2. Europe: Green Regulations and Economic Headwinds

6.3. Asia-Pacific: Urbanization and Megaprojects

6.4. Middle East: Energy Transition and Government Funding - Public Investment and Megaproject Funding

- Financing Shifts and Project Feasibility

- Key Takeaways from Buildern’s 2026 Outlook

Global Construction Market Size & Growth Forecasts

Buildern’s analysis of global construction activity shows steady expansion through 2026, driven by public infrastructure programs, housing demand in emerging markets, and investment in energy and industrial projects.

Altogether, economic uncertainty and tighter financing conditions are shaping the way and where growth occurs. The following data highlights the current market size, projected growth through 2030, and the main factors influencing performance across sectors and regions.

Market size in 2024 vs 2025, CAGR to 2030

The global construction market was valued at about $11.4 trillion in 2024 and is projected to reach $12.1 trillion in 2025. Growth is expected to continue throughout the decade, with total market value forecast to reach $16–17 trillion by 2030. It represents a compound annual growth rate of around 5–6% over the next five years.

Much of this growth is driven by public infrastructure programs in transport, energy, and digital networks, as well as urbanization in emerging economies where housing and commercial demand remain high. In mature markets, residential construction faces pressure from high interest rates and affordability issues, while commercial activity varies by region.

To sustain growth and protect profit margins, companies must strengthen cost forecasting, improve project efficiency, and manage risks across different market conditions.

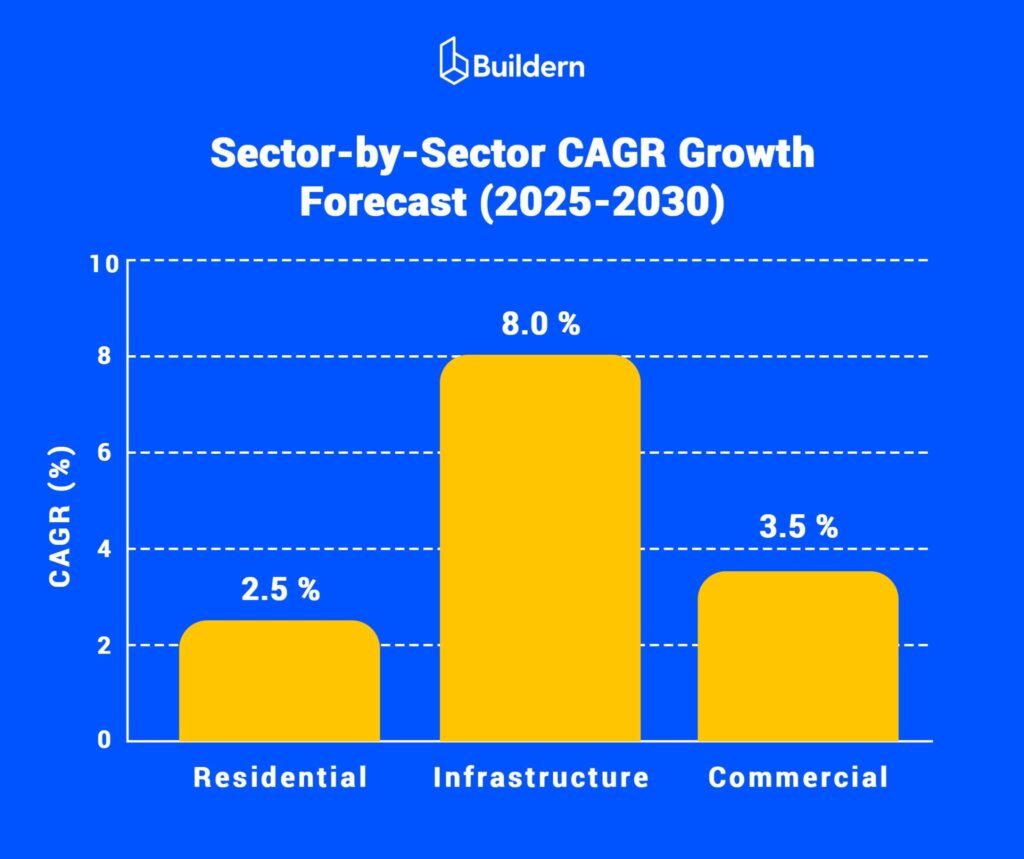

Sector-by-sector growth

Construction activity is expanding, but growth rates differ across sectors. In 2026, demand in residential, infrastructure, and commercial markets is driven by distinct factors.

For all that, economic conditions, interest rates, public funding, and demographic trends all play a major role in how each sector performs this year and in the years ahead.

These differences can be valuable for contractors, investors, and policymakers planning projects or allocating resources effectively. Labor shortages and workforce pressures remain among the top HR challenges in the construction industry, influencing project delivery and costs across all sectors.

Residential construction

Residential construction accounted for more than half of the total construction value in North America in 2024, with housing demand remaining strong in developing economies driven by urbanization and population growth.

In contrast, high mortgage rates and affordability concerns in regions such as North America and Western Europe have slowed the pace of new housing starts. Forecasts indicate only moderate growth for the residential sector, particularly as financing costs continue to rise.

Additionally, tools as the construction client portal can help residential contractors improve communication and client management even in challenging market conditions.

Infrastructure construction

Infrastructure remains the fastest-growing segment of the construction industry. Global forecasts show infrastructure projects expanding at nearly 8% CAGR through 2030, supported by major government spending programs in transportation, clean energy, and utility networks.

Many countries are prioritizing resilient and sustainable infrastructure, ensuring this sector maintains long-term growth momentum even as material costs and labor shortages create near-term pressures.

Commercial construction

Commercial development presents a mixed outlook. Demand for logistics hubs, healthcare facilities, and data centers continues to rise steadily as e-commerce, healthcare needs, and digitalization accelerate.

Simultaneously, traditional office construction is slowing in many regions as hybrid work models reduce the need for new office space. Financing constraints and broader economic uncertainty are also delaying some large private developments, especially in markets with tighter lending conditions.

Inflation and Rising Material Costs

While global construction output is expected to grow in 2026, three persistent challenges continue to weigh on project costs, schedules, and overall feasibility. Understanding the impact of inflation, supply chain risks, and financing conditions is critical for construction budgeting and investments this year.

Inflation remains a concern despite some recent moderation. Between 2021 and 2023, prices for core materials such as steel and cement jumped by more than 20% in several regions. As our construction project cost breakdown guide explains, understanding how these increases affect total budgets is essential for accurate forecasting and cost control.

While the pace of increases has slowed, costs are still sitting well above pre-2020 levels. Labor expenses add to the problem, with wages for skilled trades climbing 5-7% annually in many markets as worker shortages persist.

Supply Chain Vulnerabilities

Supply chain reliability has improved since the worst disruptions of the pandemic years, but vulnerabilities remain. Global shipping delays still affect delivery times, and energy price swings continue to push up transport costs, as discussed in our construction supply chain management.

Additionally, large projects, even a two to three-week delay on critical materials, can trigger cascading schedule and budget impacts.

Tight Financing Conditions

Financing conditions present another hurdle. In the United States, benchmark interest rates are now above 5% for the first time in more than a decade, raising borrowing costs for residential and commercial developments.

Private projects face stricter lending criteria, while public infrastructure programs benefit from government funding that shields them from some of these constraints.

Keeping Projects Viable

Taken together, these factors underscore the importance of early cost forecasting, flexible procurement strategies, and diversified funding models to keep projects viable in a tougher economic climate.

Regional Construction Outlooks

Concerning growth patterns, they vary significantly across regions. Economic conditions, public investment levels, and sector priorities all play a role in shaping demand.

Some markets are benefiting from major infrastructure programs and strong housing needs, while others face slower growth due to financing constraints, higher interest rates, or cost inflation. Here is how the industry is performing across key regions in 2026.

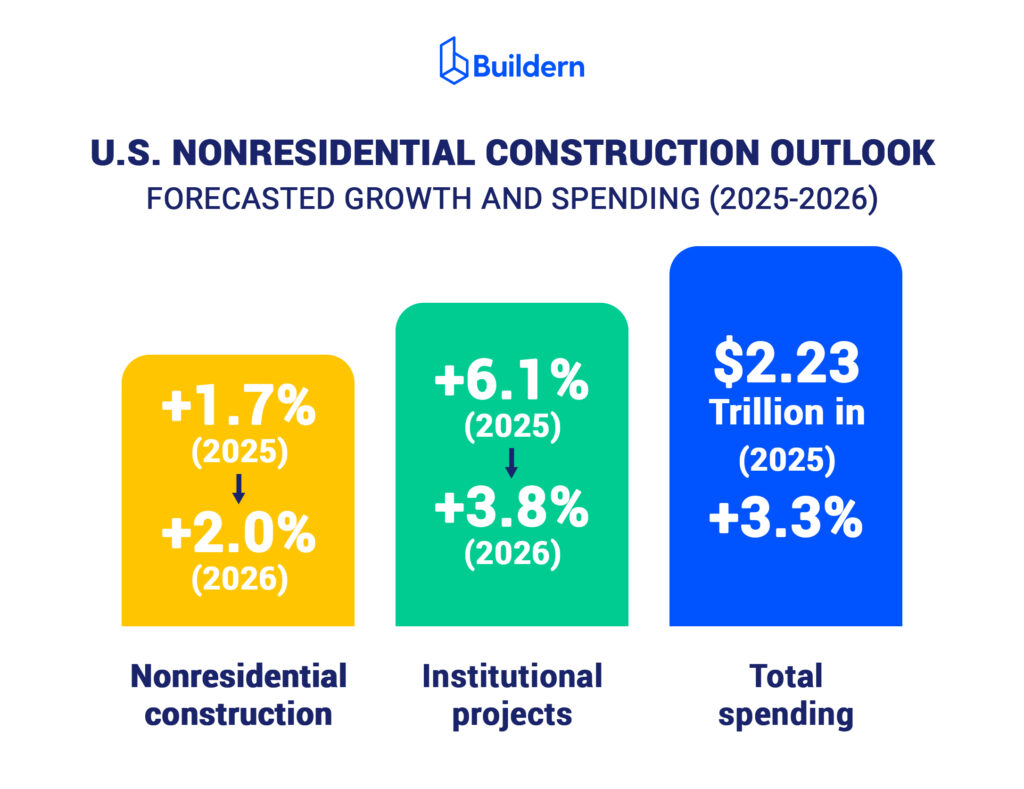

United States: Nonresidential growth, public spending priorities

Our report projects nonresidential construction in the United States to grow by 1.7% in 2025 and 2% in 2026. Institutional sectors such as healthcare, education, and public facilities will drive this growth, with spending expected to rise 3.8% in 2026.

Overall, total construction put-in-place spending is forecast to reach $2.23 trillion in 2026, up 3.3% from 2025.

Moreover, public investment is centered on infrastructure, with federal and state programs funding transportation, renewable energy, broadband expansion, and water systems. Sustainability requirements and energy efficiency standards are shaping project designs as governments tie funding to environmental performance goals.

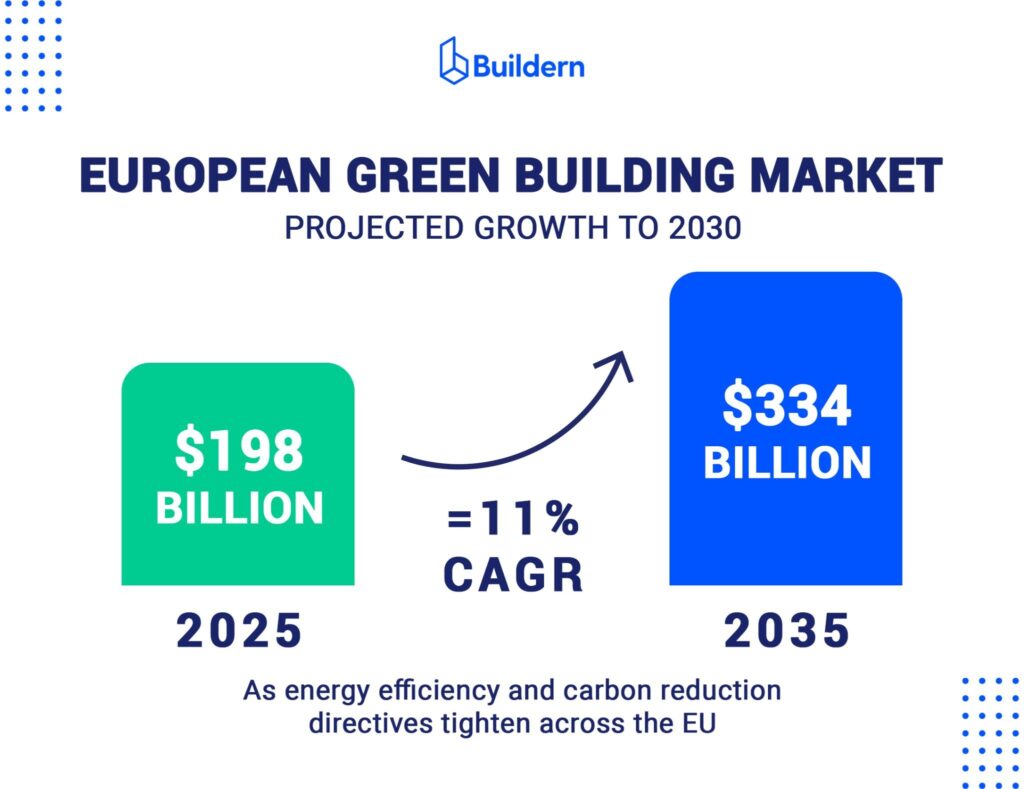

Europe: Economic headwinds, green regulations, infrastructure trends

According to our analysis, Europe’s construction market was valued at roughly $3.2 trillion in 2024 and is projected to grow at a 3.2% compound annual growth rate through 2033. Green building initiatives are driving a significant share of this growth.

The European green building market is expected to reach $198 billion in 2026 and $334 billion by 2030, representing an estimated 11% CAGR as energy efficiency and carbon reduction directives tighten across the EU.

At the same time, inflation, labor shortages, and slowdowns in private-sector investment continue to create uneven growth patterns across the region, particularly in markets with higher borrowing costs and weaker economic outlooks.

Asia-Pacific: Urbanization, megaprojects, private sector investment

The Asia-Pacific region remains one of the fastest-growing construction markets, driven by rapid urbanization and large-scale government infrastructure projects.

Countries such as India, Indonesia, Vietnam, and China are funding major projects in transportation, energy, and housing, while private developers are expanding residential and commercial capacity in fast-growing metropolitan areas.

Modular and off-site construction methods are gaining adoption as contractors look for ways to control costs and accelerate timelines in high-density urban areas. The region’s outlook remains strong as both public and private investment continue to drive demand.

Middle East: Energy transition, megacities, government funding

In the Middle East, our report highlights rapid expansion supported by government investment and energy transition projects. Countries such as Saudi Arabia and the United Arab Emirates are prioritizing renewable energy, green hydrogen, and large-scale infrastructure initiatives.

Megacity projects such as Saudi Arabia’s NEOM are transforming the region’s urban landscape, and construction messaging software helps keep contractors, architects, and agencies aligned throughout the process.

Ultimately, these projects are central to national diversification strategies aimed at reducing reliance on oil revenues and fostering long-term economic growth.

Public Investment & Megaproject Funding

Several high-profile projects are set to move forward in 2026 with budgets exceeding one billion dollars. These projects often require managing complex contracts, permits, and regulatory files across multiple stages.

Yet, construction document management can help project teams centralize and control all documentation for better collaboration and compliance.

Infrastructure budgets and priorities

Governments are increasing infrastructure spending to support economic growth, improve resilience, and modernize essential systems. Transportation projects such as highways, rail networks, and airports continue to receive the largest share of funding.

Additionally, utilities and energy infrastructure, including water systems, power grids, and renewable energy projects, are also high on the agenda as countries work to meet energy transition and sustainability goals.

In many developing economies, public investment is the main source of funding for new infrastructure. In more mature markets, budgets are often tied to specific policy objectives: carbon reduction targets, efficiency upgrades, and resilience against climate risks.

Overall, this very combination of traditional infrastructure needs and new sustainability requirements is shaping the project pipeline for 2026 and beyond.

PPP and alternative financing models

Public-private partnerships remain a central tool for delivering complex, high-value projects. By combining public funding with private investment, PPPs spread financial risk, bring in specialized expertise, and often improve project delivery timelines.

Other financing models are also gaining attention. These include performance-based contracts, availability payments where governments pay for access rather than ownership, and blended funding structures that combine public grants with private capital.

Ultimately, these approaches allow governments to expand infrastructure programs even when budgets are under pressure.

Financing Shifts & Project Feasibility

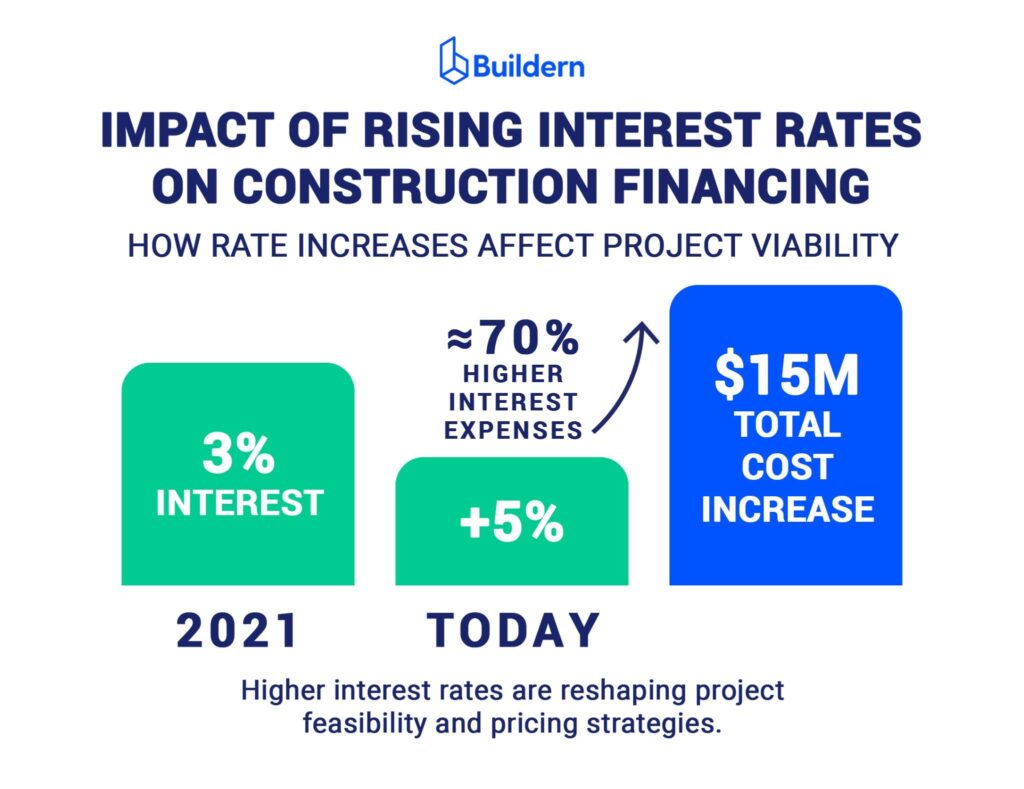

Rising interest rates are putting pressure on construction projects in 2026. With U.S. benchmark rates above 5%, borrowing costs have increased sharply compared to near-zero in 2021.

Similarly, A $100 million project financed over 10 years could now cost over $15 million more in interest, reducing profit margins and forcing higher rents or sale prices to remain viable.

Lenders are also tightening requirements. Many banks now expect debt service coverage ratios above 1.25 and higher equity contributions from sponsors, pushing some marginal projects out of the pipeline altogether.

In markets such as commercial real estate, where office vacancy rates remain elevated, rising rates combined with weak demand have slowed or canceled several major developments.

To offset these pressures, developers are exploring alternative financing structures, including public-private partnerships, blended funding from infrastructure funds and institutional investors, and phased project delivery to spread risk over longer timelines.

In our view, financial discipline and early construction project forecasting are essential for keeping projects viable as capital costs remain high.

Key Takeaways from Buildern’s 2026 Outlook

Our 2026 Construction Industry Outlook brings together the main factors influencing construction and the areas that will need the closest attention in the years ahead.

Key Themes in 2026

- Rising interest rates and higher material and labor costs are challenging project feasibility.

- Public infrastructure investment and sustainability regulations are opening growth opportunities in multiple sectors.

- Urbanization in fast-growing regions continues to drive demand for housing, commercial, and infrastructure projects.

Factors to Monitor Through 2030

- The pace of interest rate adjustments and their impact on financing conditions.

- The balance between private capital flows, public funding, and new sustainability mandates is shaping project pipelines.