Construction Accounting 101: Principles and Best Practices

Construction accounting is a unique branch of accounting that reflects the specific financial needs of contractors and construction companies. It’s not a parallel universe, but it’s worth knowing some important differences between construction accounting and other types of business accounting.

The projects are usually larger and more complex than other business ventures. So, the impact of inaccuracies and imprecision is greater in construction accounting.

If you’re in the construction industry and want to keep a closer eye on your company’s financial management to improve your bottom line, this guide is for you. Here’s a quick overview of what you need to know.

TL;DR

- Construction accounting is a more tailored form of accounting that addresses the unique challenges and specific requirements of the construction industry.

- Unlike traditional accounting, it has many moving parts and specific financial management needs.

- Specialized billing methods (e.g., fixed price, time and material, AIA progress billing, and cost-plus) help align invoicing with project progress and contractual terms.

- Construction accounting typically relies on two revenue recognition methods: Percentage of Completion (POC) for ongoing projects and the Completed Contract method for simpler and smaller projects.

- Integrating construction project management tools with accounting software can provide real-time data synchronization and a comprehensive financial overview.

Table of Contents

- What Is Construction Accounting?

- Construction Accounting vs. Traditional Accounting

- Key Principles of Construction Accounting

- Construction Accounting Up Close: Key Steps

- Wrap-Up

What is Construction Accounting?

Construction accounting is a more robust and specialized form of accounting. It’s for the construction industry to track finances, manage subcontractor and vendor payments, and invoice clients correctly.

It incorporates key industry-specific financial elements, such as:

- Billing methods tailored for construction suggest managing payments over the project’s lifecycle rather than a single transaction.

- Retainage implies holding back a percentage of payments until project completion to ensure quality and compliance.

- Change orders allow builders to adjust financial records based on project scope changes.

- Job costing makes tracking expenses for each project more precise and easier.

This data is essential for understanding a construction project’s financial health and making sound business decisions.

At its core, construction accounting adheres to the same principles as traditional accounting. If you have a background in accounting, you will find construction accounting familiar in many ways.

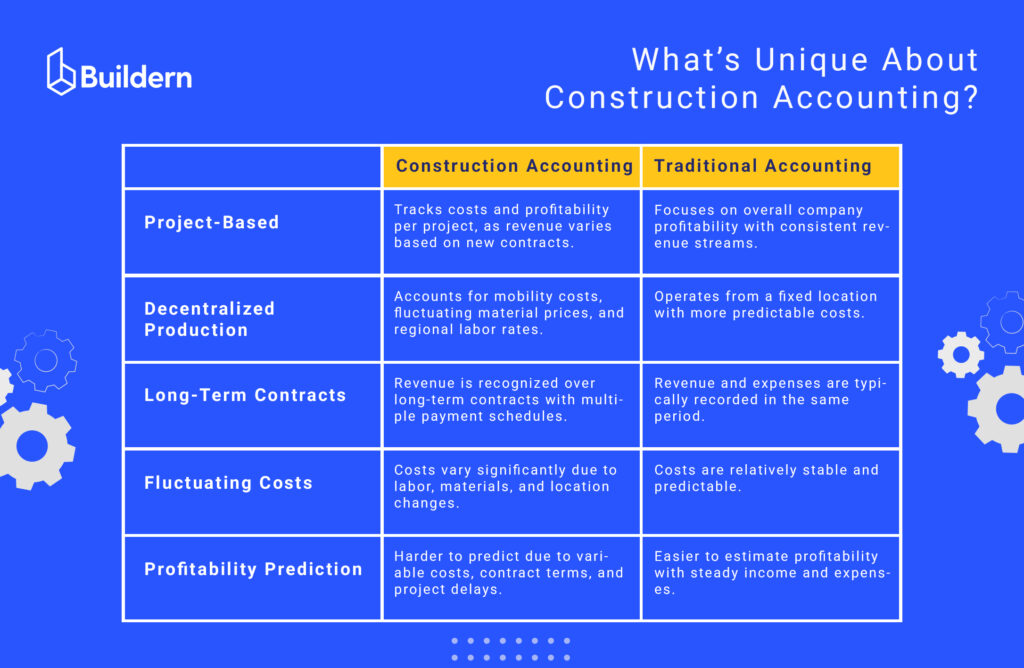

Construction Accounting vs Traditional Accounting

Project-Based

Unlike many industries like manufacturing, where businesses have a consistent stream of revenue from product sales, the construction industry depends on projects. This means it’s impossible in construction to predict how much revenue will be coming in month-to-month or even year-to-year. Everything depends on when the company will have new projects and the size of those projects.

For this reason, construction accounting tracks job costs and job profitability rather than simply overall company profitability. This helps construction businesses better understand which projects are profitable and which ones are losing money, thus making informed decisions about where to allocate their resources.

Even though it seems all construction projects have similar production requirements, the fact is they are very different in terms of site conditions or local variables like labor, cost of materials, and legislation. As a result, construction accountants treat every construction project as a unique, short-term profit center with unique inputs and requirements.

💡Recommended Reading: Complete Guide to Construction Project Management Supremacy

Decentralized Production

Since construction projects happen on different sites each time, construction accounting includes mobility costs in the bid. This is a way of preventing productivity loss due to the movement of resources and personnel.

Decentralized production applies to projects where production does not happen from the same physical location. Consequently, the inventory of equipment and other resources is also in different locations. Builders move them to the new construction location for each new project, resulting in additional mobility costs.

Some construction companies choose to lease local equipment and resources. That’s because it helps to avoid the overhead costs of owning, maintaining, and moving their own fleet.

Decentralized production also means construction accounting reflects the fluctuating costs of labor and materials in a locational context. These costs can vary significantly depending on the region, country, or city where the project is taking place.

In traditional accounting, there is less focus on the variability of costs, as the costs of main materials and labor are often more predictable and stable.

Long-Term Contracts

Construction projects, even small ones, often involve long-term contracts. This is due to the nature of the work, which usually requires a lot of time to complete and has a high risk of delays because of bad weather, material shortages, or other factors beyond the direct control of the construction company.

This means that unlike traditional accounting, where businesses typically book revenue and expenses in the same period, construction accounting businesses often have to wait a long time to receive payments for their work (i.e. progress billings)․ Usually, if a project has delays, accounting companies do not get payments for all the work completed to date.

Many construction contract terms allow for 30, 60, or even 90-day invoice payments. Moreover, retainage withholding or disputes may delay payment even further.

Construction accounting reflects all this in the form of a schedule of multiple payments. This schedule can span multiple accounting periods or even years. This makes construction accounting more complex than traditional accounting and requires businesses to understand their cash flow in more detail to avoid financial difficulties.

That’s why many construction businesses use the accrual basis of accounting. They record revenue when it is earned and expenses when they are incurred, regardless of when the actual cash payment is received.

Fluctuating Costs

Construction accounting also has to deal with the fact that costs can fluctuate greatly during the life cycle of a project. In the modern world, rarely can something have the same price for more than a few months due to the volatile global economy, changing interest rates, natural disasters, and more. All these events can significantly impact the cost of materials and labor, which can in turn affect the profitability of a construction project.

Construction projects are more sensitive to price changes of materials, as these make up a large part of the project expenses. At the same time, it’s too costly to stockpile materials for a project in advance (unlike traditional manufacturing).

Indirect costs like overhead and general and administrative expenses can also fluctuate greatly, depending on the size and complexity of the project.

These factors complicate the construction project estimation and cost control process, making it more difficult to accurately predict a project’s final cost.

Challenges to Predict Profitability

All the factors above make it challenging to predict the profitability of a construction project. There are many variables that can affect the final cost of the project. The construction schedule is one of them.

Not having a clear image of the project’s final profit can put construction businesses at risk. They may not be able to cover their costs if their projects end up costing more than expected.

This is why a good understanding of cash flow is essential for construction businesses, as it can give them a better idea of when they will receive payments and help them manage their finances more effectively.

Key Principles of Construction Accounting

Although construction accounting is more complex than traditional accounting, there are many software platforms and tools, as well as tested approaches, that help businesses manage their finances more effectively.

Scroll down to see the main principles of construction accounting and how Buildern construction management software can make construction accounting a breeze for you!

Job Costing

Traditional accounting relies on the general ledger (G/L) to track all financial transactions. This is the standard method of double-entry bookkeeping, according to which all transactions are in separate accounts (revenues, expenses, etc.).

The ledger accuracy depends on the balance sheet equation: Assets = Liabilities + Equity

Each account contains additional information about transactions, such as date, description, reference number, etc. And this is what a G/L looks like:

Source: Restaurant 365

What Does Job Costing Add to G/L?

To fill this gap, construction businesses use job costing.

The G/L method helps to get a broad overview of the company’s financial performance. This approach, however, does not provide detailed information about specific projects or jobs.

Job costing is a method of accounting that provides detailed information about the costs associated with specific projects or jobs.

In construction accounting, job costing tracks the financial progress of each project separately. This approach is necessary as each construction project has its specific expenses, revenue streams, and other financial transactions.

Unlike G/L, which displays company finances, the Job Costing method tracks project data.

Job costing displays the physical completion of the construction project in units, costs in monetary units, and labor hours.

While there is a G/L account for each category of income and expense that allows the company to track the overall progress of the company, there is a particular job costing account for every job or project to track its individual progress and costs.

This way, contractors can easily track the financial progress of every construction project and make more informed decisions about their business.

They can also compare each project’s estimated and actual costs and make necessary adjustments to their budgets on the go.

Cost Budgeting in Buildern

Buildern allows construction managers to create and manage multiple project budgets simultaneously.

It seamlessly integrates with QuickBooks and Xero accounting software. As a result, every transaction recorded in your preferred software is reflected in your construction management software in real time.

Contract Revenue Recognition

Revenue recognition in construction accounting differs from that of traditional accounting.

Custom home building contracts and billing terms vary for each project, depending on the scope of the project and negotiations between the parties.

Usually, the whole project cost is divided into several parts. The first payment is the down payment from the client to help the contractor start the project. Further, contractors send invoices in parallel with the project’s progress. Usually, contractors send an invoice to the client after the completion of each construction stage. This method is progress billing and is the most popular construction billing approach.

So, construction accounting uses two main types of Revenue Recognition approaches – Percentage of Completion (POC) and Completed Contract.

Let’s take a closer look at each!

POC Revenue Recognition

The Percentage of Completion (POC) method is more suitable for larger construction businesses. It provides a more accurate financial picture of the company.

Under POC, revenue is recognized, and the expenses are reported based on the percentage of work completed on a project. If 20% of the construction project is ready, the company recognizes 20% of the total contract value as revenue. Contractors invoice their clients based on the percentage of work completed.

This approach requires careful tracking of the project’s progress and accurate estimation of costs to succeed. That’s why Buildern’s project management module is perfect for construction businesses using POC revenue recognition.

The module allows managers to easily track the progress of each project and generate accurate reports to make informed decisions about their business. The project Gantt chart allows you to track every task and have a real-time view of your project’s progress. When you need to invoice your client, you can easily do so with just a few clicks from your project dashboard.

Completed Contract Revenue Recognition

This approach is more suitable for small construction businesses as it is simpler to implement and doesn’t require as much project tracking.

Under Completed Contract, revenue and expenses are recognized when the project is completed.

CCM sometimes allows contractors to defer taxable revenue if the project completion happens in the following tax year.

If you operate in the USA

The IRS states that the Completed Contract Method is permissible for home construction and small construction contracts only. Small contracts refer to those completed within two years after the start or with a limited average annual gross revenue.

If you operate in Australia

The recognition of revenues and expenses associated with the construction project depends on whether it’s probable to estimate the outcome of the contract reliably. If the contract outcome can be reliably estimated, contract revenue and contract costs are recognized by reference to the completion stage of the contracting activity at the reporting date. If the contract outcome can’t be reliably estimated, revenue is recognized to the extent of contract costs incurred that it is probable will be recoverable.

💡Read more in Accounting Standard AASB 111 for Construction Contracts.

Contract Retainage

In the construction industry, it is common for contractors to withhold a certain percentage of the contract value until the project’s completion. This is retainage, and it usually ranges from 5% to 10% (varies from state to state).

In other words, retainage is the amount of money the owner withholds from the contractor until the completion and final approval of the project.

The primary purpose of retainage is to provide security to the owners in case the contractor fails to complete the project or if there are defects in the work.

What Does Retainage Mean for Construction Accounting?

Generally, contractors record any unpaid invoice as Accounts Receivable on their balance sheet, in effect assuming that the revenue has already been earned. However, when it comes to retainage, things are a bit different.

When the owner withholds the retainage, the contractor cannot record it as Accounts Receivable. Instead, this amount is a Liability on the balance sheet, representing the amount of money the contractor still owes for the project.

Retainage becomes Accounts Receivable only after the owner’s final approval of the project.

In the meantime, the project owner records the retainage amount as Retainage Payable and the rest of the contract value as Accounts Payable.

What Does Retainage Mean for Contractors?

Though contractors receive the retainage only after the project’s completion, they still need to pay their employees and suppliers for the work.

As construction companies usually operate with small margins, a poorly chosen retainage amount can significantly strain their working capital and cash flow.

Depending on the project, a 5-10% retainage rate can account for 25-50% of the contractor’s revenue. This amount ties up and prevents them from covering project costs.

This can cause serious financial problems for the contractor, especially if the project is large and takes several months or even years to complete. To avoid these issues, it is crucial for contractors to carefully consider the retainage rate before starting a project.

Specialized Construction Billing

Sometimes, contractors choose specialized billing methods such as Fixed Price, Time and Material, AIA Progress Billing, and Cost-Plus. Let’s discuss each in detail.

Lump Sum or Fixed Price Contracts

Lump sum contracts, commonly known as fixed price contracts, require contractors to estimate the total project cost upfront and agree to complete the work for that predetermined amount. Essentially, it’s a mutual understanding that states, “Here’s what I’ll do, and here’s what you’ll pay for it,” with the payment structure designed around the overall scope of work.

Key Features and Advantages of Lump Sum Contracts

- Predictability and Stability: Both contractors and owners benefit from knowing the total cost in advance. Contractors can plan their cash flow and revenue expectations confidently, while owners are assured that project expenses will not exceed the agreed-upon amount.

- Defined Payment Structures: Depending on the project, payment can be structured in various ways:

- Progress Payments: These are partial payments made throughout the project, following a schedule tied to specific work milestones or stages. The builder completes predetermined portions of work and releases payments, ensuring steady cash flow and alignment with the project’s progress.

- Completion Percentage (AIA-Style) Billing: Also known as AIA progress billing, this method invoices based on the percentage of the total project cost completed. Using standardized forms (such as AIA Document G702 and G703), the contractor documents work progress and submits a payment application. This method offers detailed tracking of milestones while reducing paperwork through standardized documentation.

- Suitability for Clearly Defined Projects: Lump sum progress payments work best when the project scope is well-defined with minimal expected changes or unforeseen conditions. For instance, small to medium-sized projects like residential renovations often come with clear parameters, making it easier for both parties to agree on costs and payment schedules from the outset.

Considerations and Risks:

- Risk of Unforeseen Costs: Fixed price contracts increase the risk for contractors if the project becomes more complex than initially anticipated or if unforeseen delays occur. In such cases, the contractor might need to cover additional costs.

- Flexibility Through Negotiation: To mitigate risks, some fixed price contracts include negotiated contingencies. These allow for adjustments if the project scope changes or unexpected issues arise, providing a buffer against financial overruns.

In summary, lump sum or fixed price contracts offer a clear, predictable framework for managing construction projects financially. Whether through progress payments or AIA-style completion percentage billing, these methods ensure that payments are aligned with project milestones while balancing risk and flexibility for both contractors and owners.

Time and Material Contracts

Time and material contracts are for projects with high levels of uncertainty. In this type of billing, the contractor charges the owner for the actual hours worked by its employees and the materials used.

If you opt for this type of construction billing, Buildern can help you track employee hours and project expenses to bill your customer accurately.

To do that, include the material units and labor hours in your construction invoices so that clients can see the resources spent and their owed payment.

Lump Sum Completion Percentage (AIA-Style) Billing

Lump sum completion percentage billing, also known as AIA-style progress billing, is a method that bases invoicing on the specific work completed rather than on a fixed price schedule. Unlike fixed price progress payments, this approach invoices upon the completion of designated project categories or cost codes, ensuring that each phase of work is accurately reflected in the billing process.

At the heart of AIA-style billing are standardized forms developed by the American Institute of Architects. Key documents include:

- AIA Document G702® – 1992

- AIA Document G703® – 1992

- Continuation Sheet

Some of the advantages proposed by the AIA-style billing include:

- Enhanced Profitability Control: By calculating payments based on the exact percentage of the total project cost completed, contractors gain precise insights into project progress. This enables better forecasting of earnings and more effective cash flow management throughout the project lifecycle.

- Streamlined Paperwork: The use of premade standardized forms significantly reduces administrative burdens. Fewer manual entries mean less room for errors and a more efficient billing process.

- Transparency for Clients: With clear documentation and predictable billing tied to actual project progress, clients can easily verify that work is proceeding as planned and that costs remain within the agreed-upon budget. This transparency builds trust and helps ensure financial discipline throughout the project.

Cost-Plus Contracts

A cost-plus contract is a construction contract where the contractor is reimbursed for their actual costs plus an agreed-upon fee. This fee is typically a percentage of the total costs (10-20% of the total contract cost) and helps to cover the contractor’s overhead and profit.

In this type of contract, it is essential to understand what costs will be included in the reimbursement clearly. For example, will the client reimburse for materials, labor, equipment rental, or other indirect costs? There should also be a clear understanding of which factors form the additional fee (e.g., as a percentage of total costs).

Cost-plus is one of the most common construction contracts, particularly for larger projects. It is suitable for both public and private sector projects.

Construction Payroll

Payroll is the combination of all the money an employer pays its employees in exchange for their work. Beyond just wages, payroll also includes benefits paid to construction workers and payroll taxes.

Here are the main payroll components construction accounting should take into account.

Prevailing Wage

Prevailing wage is the hourly wage, usual benefits, and overtime pay required by law to be paid to workers on certain federally funded or assisted construction projects.

The Davis-Bacon Act requires contractors and subcontractors performing work on federal or federally assisted construction contracts to pay their laborers and mechanics not less than the wages prevailing in the locality as determined by the Secretary of Labor.

Therefore, contractors must certify their project compliance using certified payroll reports.

*Payroll reports vary in different states. The same employee can be eligible for different benefits depending on the type of work they are doing.

Prevailing Wage Adjusted to Union Scale

Union payrolls require contractors to consider prevailing wages and employee benefits according to the local union contract.

There is a corresponding union scale for each job that outlines the hourly wages and benefits for each position. To avoid paying penalties, contractors need to make sure they comply with the union contract.

Simply put, employees should get all the benefits that their local union determines for them.

Multi-Union Payrolls

If an employee lives in one state and works in another, the contractor may need to consider different union contracts.

For example, if an employee lives in New York but works on a Pennsylvania project, the contractor must comply with both states’ requirements.

This is where things can get complex for contractors. They need to keep track of all the work hours in each state and make sure they are paying the correct amount to their employees.

Avoiding Double Taxation

Contractors work on different job sites simultaneously, meaning their workers may live in one state but work in another. This can create a problem of double taxation for contractors, as they need to withhold taxes for both states.

Fortunately, there are steps contractors can take to avoid paying double taxes. To do that, they must fill out a non-resident tax return in the other state.

Another way to avoid double taxation is to get a reciprocal agreement between the two states. This type of agreement allows employees who work in one state but live in another to pay taxes only in their state of residence.

Construction Accounting Up Close: Key Steps

Choose an Accounting Method

The two key options construction accountants have are cash accounting and accrual accounting.

Cash accounting is a simpler method where you only record transactions when money changes hands.

Accrual accounting is a more complex method that records transactions when they occur, regardless of when the money changes hands.

Since clients typically take time to pay after the work is completed, accrual accounting provides a more accurate picture of your company’s financial health. This is especially true for large companies with long project timelines.

Cash accounting is preferable for small companies, as it requires less bookkeeping and invoices are paid relatively quickly.

Get a Business Bank Account

One of the mistakes of starting a business is mingling personal and business funds. This makes it difficult to track expenses and can create legal problems down the road. To avoid this, open a business bank account as soon as you start your construction company. Deposit all incoming revenue into the account, and pay all business expenses from it.

Get a credit card for your business, separate from any personal credit card. This will make it easier to track expenses and get business-specific perks like cash back or travel rewards.

Choose Your Software. Try Buildern Now!

If you need a seamless construction accounting experience, you need to integrate your accounting software with specialized construction management software. In this way, all your data related to the construction project will be in one place, and you will not have to juggle multiple pieces of software to see the whole picture.

Which Accounting Software to Choose?

Xero and QuickBooks are the most popular accounting tools. They are both easy to use and have a wide range of features that allow you to track your finances, create invoices, and manage your payroll without deep technical knowledge.

If you already use one of these tools and have your construction accounting data in it, scroll down to see how you can integrate it with construction project management software with just one click.

If you’re still in search of good software, read this Xero vs. QuickBooks comparison from Forbes

to determine which is best for you.

Which Construction Project Management Software to Choose?

Once you have all your project data filled in the accounting software, link it to Buildern – a construction industry-specific tool that covers all project stages from design and pre-construction to closeout and final invoicing.

Why Integrate QuickBooks or Xero with Buildern?

Construction accounting requires a different approach from traditional accounting, as the construction process is non-linear. To avoid cost overruns, you need closer monitoring of job costs, change orders, and subcontractor invoices.

To do this effectively, you need construction project management software to give you complete visibility into your projects.

Buildern does just that by integrating with leading accounting software like Xero and QuickBooks. A bonus – it’s super easy to do!

Step 1: Once you have your accounts set up in either tool, choose Account Settings from Buildern and select which accounting platform you want to sync with.

Step 2: Configure the key settings, such as contract type, payment options, etc.

Step 3: Sync Cost Codes by either importing them from your accounting software or creating them in Buildern.

If you choose an option from Xero to Buildern, all the cost codes predetermined by you in advance will be transferred to Buildern. You can either modify them later or leave them as they are.

If you choose the option of Buildern to Xero, all the cost codes you create in Buildern will be automatically displayed in Xero.

Step 4: Finally, sync sub-vendors to track who you’re paying, how much, and when.

You’re all set! Now, all your construction accounting data will be available in Buildern. Any activity performed in Buildern will be automatically displayed in your accounting software and vice versa. This way, you will always have an up-to-date view of your finances

Start Tracking Business Transactions

Now that you have your software set up, it’s time to start tracking transactions. The first step is to connect your bank account so that all your business transactions are automatically imported and categorized. This will save you a lot of time, as you won’t have to manually enter them into the software.

To have an accurate picture of your business finances, you need to track Accounts Receivable (invoices you have sent to clients but haven’t received payment for yet) and Accounts Payable (bills you have received from vendors but haven’t paid yet).

You can issue invoices from Buildern or your accounting software. In both cases, the system automatically syncs the invoices, giving a complete overview of your receivables at all times. Similarly, you can track bills in both tools

Have Adjusting Journal Entries

Adjusting journal entries are entries made at the end of the accounting period to correct errors or omissions in the original journal entries. Simply put, adjusting entries are used to bring the books up-to-date so that the financial statements accurately reflect the current state of affairs.

For example, if you forgot to record a supplier invoice in your Accounts Payable, you would make an adjusting entry to add it to the software. This way, all your transactions will be accounted for, and you can be confident that your financial reports are accurate.

Generate Financial Statements

The summary of your business activities is a financial statement. The most important ones for construction companies are the balance sheet, income statement, and cash flow statement.

The balance sheet shows your company’s assets, liabilities, and equity at a specific point in time. It’s a snapshot of your company’s financial health.

The income statement shows your company’s revenue and expenses over some time, typically one year. This is also the profit and loss statement.

The cash flow statement shows the inflows and outflows of cash over time. This is important because it shows whether your company has enough cash to cover its expenses.

Your accounting software can generate these financial statements for you with a single click. You can get a summary of all your previously recorded data or generate a report for a specific period – all without manual entry or calculation.

You should carefully analyze reports to make informed business decisions. For example, if you’re planning to expand your business, the cash flow statement will show you whether you have enough cash on hand to finance the expansion.

Pay Taxes

Exploring the tax legislation of the country of your operations is crucial, because although construction approaches and practices are pretty similar everywhere, taxation and similar procedures may largely vary in different countries.

💡Recommended Reading: Construction Taxes 2024: USA, Australia, New Zealand, and Canada Guide

Construction Taxes in The USA

Construction companies are taxed differently in the United States. Explore the IRS website and contact a tax professional to make sure you’re paying the correct amount of taxes.

Some states tax construction companies when purchasing materials and equipment, while other states tax a company’s gross receipts.

Income tax is usually calculated based on the company’s net income – that is, revenue minus expenses. But there are different tax rates for different types of companies, so make sure you’re using the right one.

Once you’ve determined how much tax you owe, you can pay it online.

Construction Taxes in Australia

Construction taxes in Australia are regulated by GST (Goods and Services Tax) – Australian Taxation Office. Companies that provide building and construction services must lodge a Taxable Payments Annual Report (TPAR) by August 28 each year.

Wrap-Up

Here we are, with the comprehensive guide to construction accounting. This guide will help you set up your own construction accounting system and will make sure you are tracking all the important aspects of your business finances.

Integrating accounting and construction project management software into one solution will save you even more time and effort. Not only will you have a complete overview of your finances, but you’ll also be able to track project progress and profitability.

Try Buildern today and see how easy construction accounting can be!