The Contractor’s Guide to AIA G702: Get Your Payment Application Approved the First Time

Submitting an Application for Payment should be routine. In reality, it is one of the most sensitive financial management checkpoints in a construction project.

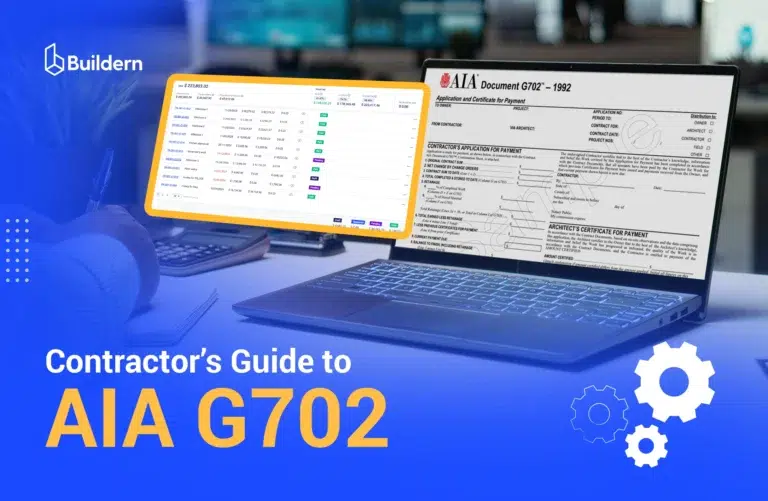

The AIA Document G702 is what triggers architect approval and owner payment under most AIA-based contracts. When you sign it, you are certifying that the work is complete to date, the numbers are accurate, and the request complies with the contract.

Most payment delays are not caused by calculation errors but by signature authority issues, retainage misalignment, missing change orders, or misunderstanding what the architect’s certification actually means. On lender-backed projects, a rejected G702 can stop funding entirely.

For project managers and owners, the objective is straightforward: submit once, get certified, protect cash flow. This guide focuses on the big picture behind the G702, legal signatures, approval mechanics, and how to avoid first-submission rejection.

Table of Contents

- What Is AIA G702 and Why Does It Control Your Cash Flow?

- Where G702 Sits in the AIA Payment Chain

- The Legal Meaning of Signing the G702

- Notary Requirements and When They Apply

- 5 Reasons Payment Applications Get Rejected

- The G702 Review Process From Submission to Funding

- Risk Mitigation Checklist Before You Submit

- Digital vs Manual AIA G702 Workflows in Construction

What Is AIA G702 and Why Does It Control Your Cash Flow?

AIA Document G702 is the standard Application for Payment used on projects governed by AIA contracts. It functions as the official summary of work completed to date and the amount currently due.

At a glance, it looks simple. A few lines. A few totals. A signature block.

In practice, it is the document that converts progress into payable dollars.

The G702 consolidates:

- Original contract sum

- Approved change orders

- Work completed to date

- Stored materials (if applicable)

- Retainage withheld

- Previous payments

- Current amount due

Once submitted, it moves to the architect for certification. Without certification, the owner has no contractual obligation to release funds. Therefore, the G702 controls cash flow more than any internal cost report ever will.

It Is a Legal Certification, Not Just a Summary

When the contractor signs the G702, they certify that:

- The work covered by the application complies with the contract documents

- The amount requested accurately reflects work completed

- Subcontractors and suppliers have been paid from prior disbursements

This language is not decorative. It carries contractual weight and can be referenced in disputes, audits, or lien claims. Treating the form as “administrative” is a common mistake.

It Connects Directly to Contract Enforcement

Under AIA Document A201, payment procedures are governed by Article 9. The architect reviews the G702 and either certifies the amount payable, modifies it, or withholds certification.

If certification is withheld, payment stops. If it is reduced, only the certified amount moves forward.

That means the G702 is not merely reporting past work. It actively determines whether funds are released this cycle.

It Interfaces With Lenders and Sureties

On financed projects, the certified G702 often supports lender draw packages. Banks rely on architect certification before releasing construction funds. In bonded projects, sureties may review payment applications to monitor exposure.

In other words, the document is reviewed beyond the project team. Its accuracy affects funding, risk assessment, and sometimes bonding capacity.

Where G702 Sits in the AIA Payment Chain

The AIA Document G702 operates within a defined contractual payment structure. Instead of functioning as a standalone construction billing form, it is one component of a coordinated process governed by contract terms, architect oversight, and, in many cases, lender controls.

The Three Core Documents in the Chain

At a minimum, the payment process under standard AIA contracts involves:

- AIA Document G702: The summary and certification page

- AIA Document G703: The detailed breakdown supporting the totals

- AIA Document A201: The governing rules for review, certification, and payment timing

The G703 supports the math. The G702 carries the certification. The A201 defines how and when payment must occur.

If any one of these elements is misaligned, approval slows down.

Submission Is Only the First Step

When the contractor submits a G702, it enters a formal review sequence. The architect evaluates whether the work claimed is consistent with site progress and contract documents. Certification may match the requested amount, reduce it, or be withheld altogether.

Certification is the contractual trigger for payment. Until it occurs, the owner is not obligated to release funds.

Owner and Lender Review

Once certified, the G702 becomes the owner’s authorization to pay. On financed projects, it may also move through lender draw review before funds are disbursed. Banks often rely on architect certification as part of their risk control process.

A clean, accurate G702 shortens this chain, while errors or inconsistencies extend it.

Why This Position Matters

The G702 sits at the intersection of contract compliance, architect oversight, owner funding, and lender controls. It is the financial checkpoint between completed work and released cash.

Understanding its position in the payment chain changes how it should be prepared. The goal is not simply to submit an application. The goal is to move it through certification and funding without interruption.

The Legal Meaning of Signing the G702

Signing the AIA Document G702 is a formal certification tied to contractual and financial responsibility in construction management. The signature converts internal project data into a legally binding payment request.

What the Contractor Certifies

By signing the G702, the contractor certifies that the work covered by the application has been performed in accordance with the contract documents and that the amount requested accurately reflects progress to date.

The certification also represents that payments previously received have been properly applied, including payments to subcontractors and suppliers. This language is significant. If disputes arise later, the signed application can be referenced as evidence of representations made at that point in time.

Who Is Authorized to Sign?

The signature must come from an individual with proper authority to bind the company. On many projects, this is an officer, managing member, or designated representative identified in corporate governance documents.

If the signer lacks authority, the certification may be challenged. In some cases, this can delay approval or complicate enforcement.

💡From a risk standpoint, companies should clearly define who is permitted to execute payment applications and ensure consistency across billing cycles.

Architect’s Certification Role

After the contractor’s submission, the architect reviews the application and issues a certification for payment. Under AIA Document A201, this certification represents the architect’s determination of the amount properly due at that stage of the project. It confirms the amount payable based on observed progress and contract compliance. Also, it does not guarantee final acceptance of the work, nor does it eliminate the possibility of future corrections.

Without an architect’s certification, payment does not move forward. That is why the legal meaning of each signature on the G702 directly affects project cash flow.

Notary Requirements and When They Apply

AIA G702 does not automatically require notarization under standard AIA terms. However, many contractors assume this means a notary is never involved. In practice, notarization often enters the process through owner requirements, lender conditions, or public project rules.

Understanding when it applies prevents unnecessary delays.

In private projects governed strictly by AIA contract documents, the G702 itself is typically signed without a notarization. The architect’s certification is also not a notarized act. The contract language controls the requirement.

Notarization most commonly appears in related documentation, such as:

- Sworn statements regarding payments to subcontractors

- Contractor affidavits required by owners

- Lender draw request forms

- Public project payment certifications

On financed projects, lenders frequently require notarized affidavits confirming that funds will be used to pay subcontractors and suppliers. These affidavits may accompany the G702 submission package, even though the G702 form itself remains unnotarized.

The practical risk is timing. If notarization is required and not prepared in advance, the approval cycle slows immediately. Coordinating signature authority and notary availability before submission avoids last-minute administrative friction.

The safest approach is to verify notarization requirements at project kickoff, especially on lender-backed or public work. Payment approval is rarely delayed because the form is too thorough. It is often delayed because a required certification is missing.

5 Reasons Payment Applications Get Rejected

Even when the numbers appear correct, payment applications are frequently returned for revision. In most cases, the issue is not the form itself but how it aligns with the contract and supporting documentation.

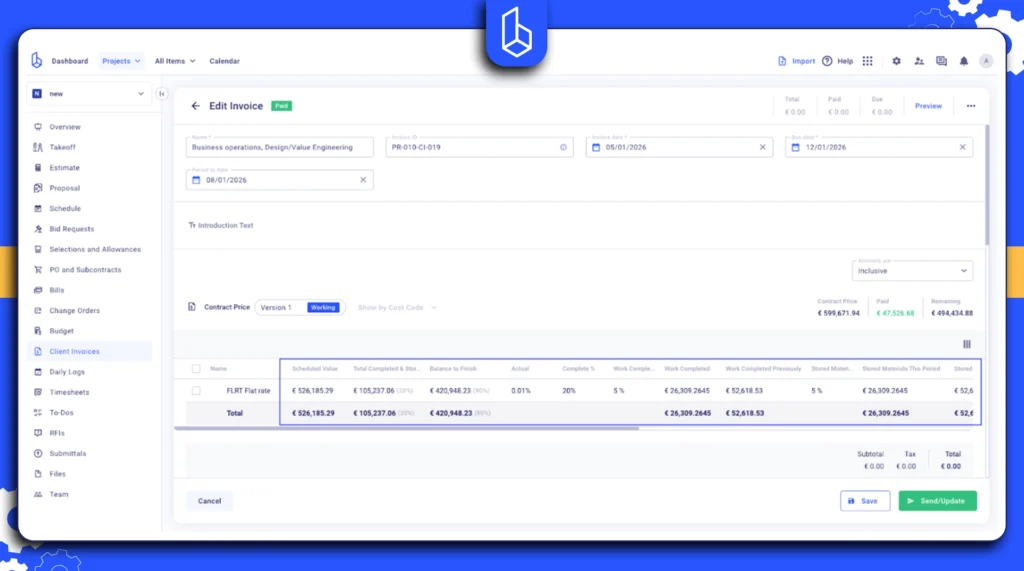

1. Schedule of Values Misalignment

The totals on the AIA Document G702 must reconcile exactly with the supporting AIA Document G703. When line items shift, percentages are adjusted informally, or change orders are not integrated properly, the summary no longer matches the breakdown in the Schedule of Values.

Architects typically verify continuity from the prior billing period. If cumulative totals do not roll forward cleanly, certification is delayed.

Solution: Lock the schedule of values structure early and update it only through executed change orders. Reconcile cumulative totals before submission, not after rejection.

2. Retainage Errors

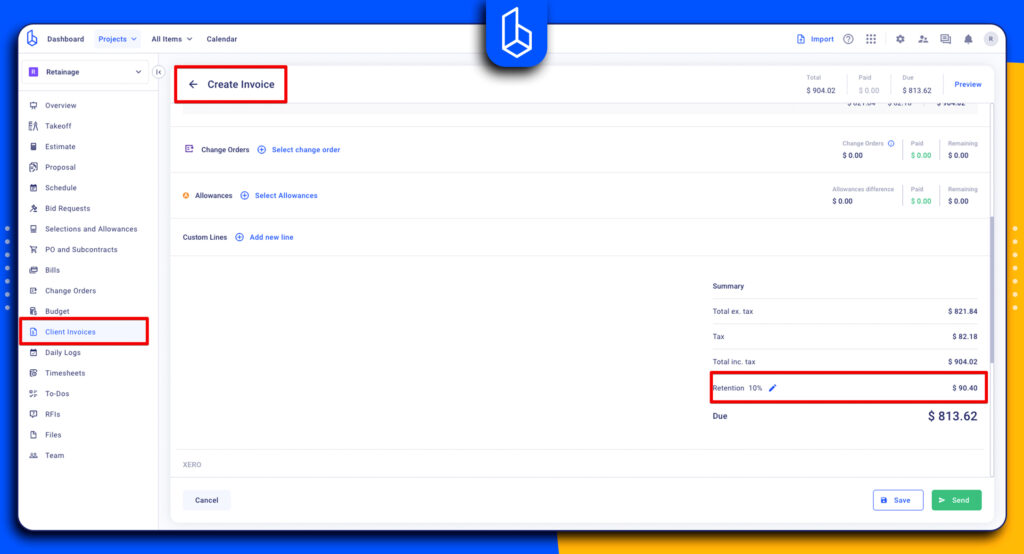

Retainage (Retention) miscalculations are one of the most common rejection triggers. This includes applying the wrong percentage, failing to adjust retainage after substantial completion, or incorrectly releasing partial retainage without contract authorization.

Construction retainage is contract-driven. If the percentage shown on the G702 does not match the agreed terms, certification may be reduced or withheld.

Solution: Cross-check retainage terms in the contract and any amendments before each billing cycle. Adjust only when formally authorized.

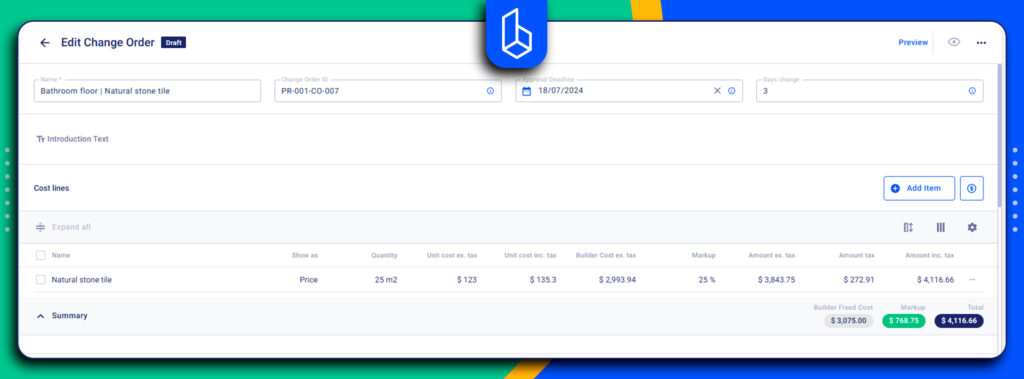

3. Missing or Unexecuted Change Orders

Including pending change order amounts that have not been formally approved creates immediate review friction. Architects and owners typically certify only executed changes.

When pending changes are blended into the contract sum prematurely, the G702 overstates the payable amount.

Solution: Separate approved change orders from pending proposals. Bill only what has been fully executed unless the contract expressly allows otherwise.

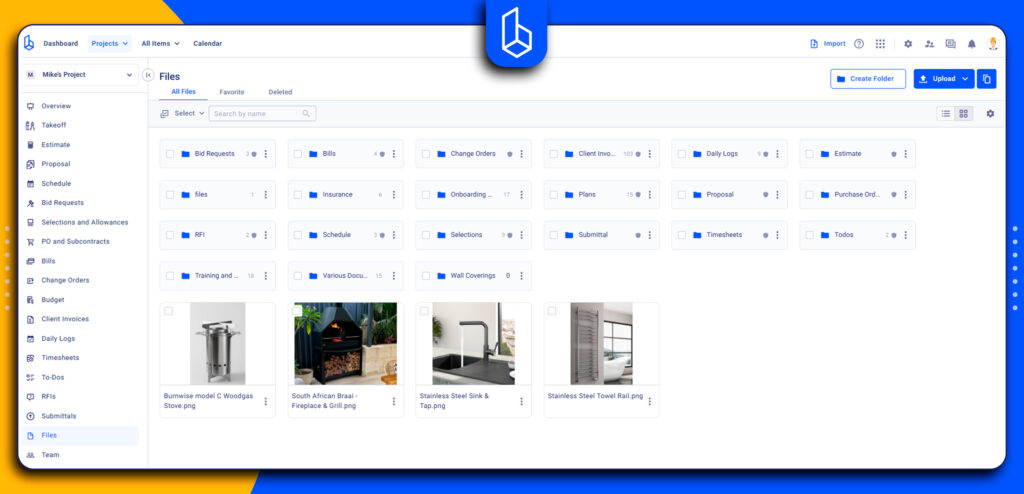

4. Incomplete Supporting Documentation

Even when the G702 itself is accurate, missing documentation can delay approval. Common gaps include unsigned lien waivers, missing stored material invoices, or required affidavits not included in the submission package.

On lender-backed projects, documentation deficiencies can delay bank draw approval even after architect certification.

Solution: Standardize a payment application checklist that includes all required attachments. Treat the submission as a complete package, not just a form.

5. Signature and Authority Issues

The G702 requires a valid contractor signature and architect certification. If the contractor’s signatory lacks authority or if the signature block is incomplete, the form may be rejected outright.

In some cases, inconsistent signers across billing cycles raise compliance concerns.

Solution: Designate authorized signatories at project kickoff and maintain consistency. Verify signature blocks before submission to avoid administrative rejection.

Payment applications are rarely rejected because of one big mistake. They are rejected because small inconsistencies signal risk to the reviewing party. Eliminating these predictable issues improves the odds of first-cycle certification.

The G702 Review Process From Submission to Funding

The AIA Document G702 moves through a defined approval chain. Understanding this sequence clarifies where delays occur and how to prevent them.

The typical progression follows this order:

1️⃣ Contractor submits the completed G702 with supporting documentation.

2️⃣ Architect reviews the application against observed progress, contract requirements, and prior billings.

3️⃣ Architect certifies (or modifies) the amount payable under AIA Document A201.

4️⃣ Owner processes payment based on the certified amount.

5️⃣ Lender reviews (if financed project) before funds are released, particularly when bank draw inspections are required.

Each step represents a control point. An issue at any stage resets the timeline.

What Happens if the Architect Withholds Certification

If the architect withholds certification entirely, payment stops for that cycle. Under A201, withholding must generally be tied to specific concerns, such as defective work, noncompliance, or failure to meet contract conditions.

The general contractor must resolve the identified issues before resubmitting or requesting reconsideration. This often delays the billing cycle by a full month if not addressed quickly.

The practical impact is significant. Without certification, the owner has no obligation to release funds.

Pay-When-Paid vs Pay-If-Paid Implications

Contract payment timing may also affect downstream obligations to subcontractors.

Under a pay-when-paid structure, the contractor must pay subcontractors within a reasonable time after receiving owner payment. Delays at the owner level compress the contractor’s margin but do not eliminate the obligation.

Under a pay-if-paid clause, subcontractor payment is contingent upon the contractor receiving funds from the owner. If certification is withheld, subcontractor payment may be delayed contractually, depending on enforceability in the jurisdiction.

Understanding these distinctions is critical. A rejected or modified G702 does not only affect the prime contract. It influences the entire financial management and payment chain.

Risk Mitigation Checklist Before You Submit

Before submitting the AIA Document G702, a structured internal review reduces the risk of rejection. Most delays are predictable. A short pre-submission control step protects the billing cycle.

Use this checklist as a final gate before transmission:

- Contract sum verified: Original contract amount and all executed change orders are accurately reflected.

- Cumulative totals reconciled: Prior applications, payments received, and current request roll forward without discrepancies.

- Retainage aligned with contract terms: Percentage and release conditions match the governing agreement.

- G703 totals matched exactly: The continuation sheet reconciles to the summary without rounding or percentage errors.

- Supporting documents attached: Lien waivers, affidavits, stored material invoices, and any lender-required forms are complete.

- Signature authority confirmed: The individual signing has documented authority to bind the company.

- Billing timing validated: Submission date complies with contractual billing cycles.

The objective is consistency. A clean, fully reconciled application signals reliability to the architect, owner, and lender. Reducing review friction improves the likelihood of first-cycle certification and protects cash flow predictability.

Digital vs Manual AIA G702 Workflows in Construction

Preparing the AIA Document G702 manually often means exporting data from spreadsheets, reconciling totals by hand, and double-checking cumulative figures against prior applications. Each billing cycle becomes a version-control exercise. One small mismatch between the summary page and the continuation sheet can delay certification and extend the funding timeline.

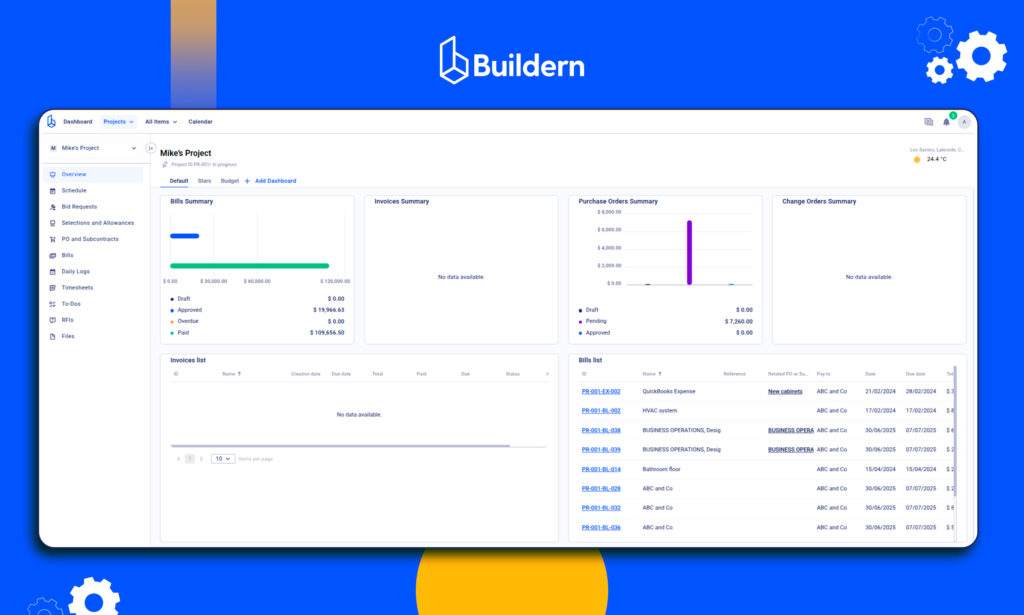

Digital workflows reduce this friction by connecting the schedule of values, approved changes, retainage settings, and cumulative billing history in a single environment. When the system understands AIA and AIA-style billing structures, the G702 summary pulls directly from live project data rather than being recreated each month. This minimizes reconciliation errors and ensures that the totals reflect executed changes and prior payments automatically.

Integrated platforms also improve collaboration. Subcontractor billings can be reviewed against the same schedule of values, vendor invoices can be tied to cost codes, and supporting documentation can be stored alongside the application. Instead of chasing attachments, the payment package is generated from within the project record itself.

The practical advantage is consistency. When AIA billing logic is built into the workflow, each application becomes an extension of ongoing project tracking rather than a separate administrative task. That shift reduces review friction and increases the likelihood of first-cycle certification.

What’s Next?

G702 is the financial control point that determines whether certified progress converts into released cash. When handled strategically, it protects both profit margin and momentum.

At a high level, approval comes down to four principles:

- Certification is legal, not clerical.

- Alignment prevents rejection.

- Process discipline protects cash flow.

- Integrated digital workflows reduce friction.

For project managers and owners, the goal is straightforward: fewer resubmissions, shorter review cycles, and stable cash flow. Moving from manual assembly to an integrated, AIA-aware workflow turns the G702 from a monthly risk point into a controlled financial process.