Extensive Guide to Australian Construction Industry Peculiarities 2024!

The Australian construction industry is a vital contributor to the country’s economy, generating billions of dollars in revenue and employing hundreds of thousands of workers. However, the industry also faces its unique challenges and peculiarities that require careful consideration for businesses and individuals operating within it.

In this extensive guide to the Australian construction industry, we will provide valuable insights and information on key topics such as the state of the industry in 2024, industry statistics, regulatory framework, construction practices and techniques, and more. As we dig deeper into the differences between the Australian construction industry and its counterpart in the United States, this guide is an essential resource for anyone looking to navigate the Australian construction landscape effectively.

Let’s equip you with valuable insights and knowledge about the industry’s unique peculiarities and learn how the locals can leverage advanced tech solutions to their benefit.

Facts and Figures about the Australian Construction Industry

With strong demand for new infrastructure, housing, and commercial properties, the industry has shown resilience in the face of economic shocks and natural disasters, with government investment in infrastructure and housing construction providing stability. In fact, the industry reported a gross value added (GVA) of around 161 billion Australian dollars as of December 2023. The numbers speak to the significant contribution that the construction industry makes to the Australian economy.

The GDP Share

Back in 2022, the industry generated over 380 AUD million through the Q4, composing 9% of the country’s Gross Domestic Product. Researchers predict an over 2.4% annual growth rate if the current tendencies continue to prevail.

The residential construction sector is a key driver of the industry’s growth. However, the non-residential and commercial property sectors have also been buoyant, with a surge in demand for office spaces and commercial buildings in recent years. As a result, construction companies are working around the clock to meet the needs of these sectors, with innovative designs, sustainable materials, and cutting-edge technologies being used to ensure that these structures meet the needs of modern businesses and consumers.

With the continued growth of these sectors, the construction industry is poised for sustained expansion in the years to come.

Australian Construction Laws and Regulations Breakdown

To ensure the safety of workers and the general public, as well as to maintain high construction standards, various laws, and regulations governing the industry. We will furtherly cover some of the core fundamentals, including the Building Code of Australia (BCA), Occupational Health Services Australia (OHSA), Work Health and Safety Act (WHS), and the National Construction Code (NCC) to give you a better understanding of your rights and obligations.

The Building Code of Australia (BCA)

As one of the key pieces of legislation, the BCA sets out minimum requirements for the design and construction of new buildings, renovations, and alterations. Covering areas such as fire safety, energy efficiency, and accessibility, the BCA ensures safe and sustainable building and plumbing systems for everyone involved in construction.

Due to regular updates, the BCA reflects changes in building technology and safety standards. However, it best works in collaboration with local laws, resulting in deeper enhancement and protection of the building environment.

Thus, in addition to the BCA, state and territory governments have their building and construction laws, which may vary slightly from one jurisdiction to another. For example, some states may require builders to hold a specific license or registration, while others may have different rules around contracts, warranties, and dispute resolution.

Occupational Health Services Australia (OHSA)

OHSA is another critical area of regulation in the construction industry. It protects the workers’ health, safety, and welfare, as well as those who may be affected by work activities, such as visitors to a worksite or members of the public. The main purpose of the OHS Act is to prevent work-related injuries, illnesses, and fatalities by setting out specific obligations for everyone in the sphere.

That said, all Victorian workers have the right to get protection under this Act, including employees, contractors, sub-contractors, and outworkers in State Government departments. The 2004 Act is free to download on the Victorian government legislation repository website. For those working under the Commonwealth Government, the legislation has its unique peculiarities.

In Australia, the OHS Act is governed by the Work Health and Safety Act (WHS), which is a national law that applies in all states and territories. The WHS Act sets out the general duties and provides a framework for managing health and safety risks in the workplace.

It is also supported by a range of regulations, codes of practice, and guidelines, which provide more detailed guidance on specific OHSA issues.

Some of the key areas that OHSA law regulates in Australia include the following:

- Workplace hazards

- Consultation and participation

- Training and instruction

- Incident reporting and investigation

- Rehabilitation and return-to-work programs

The National Construction Code (NCC)

Falling under the responsibility of the Australian Building Codes Board (ABCB), the NCC combines regulations for the design, construction, and performance of buildings, plumbing, and drainage systems across Australia. It’s a set of technical standards that intend to ensure the safety, health, and amenity of buildings for their occupants and the wider community. There are strict minimum requirements for those willing to comply with NCC. This includes fire safety, health, sustainability, accessibility compliance, and more.

The NCC aims to harmonize building regulations across Australia, reduce red tape and compliance costs, and promote innovation and best practices in the industry. It also responds to emerging trends and issues, such as sustainability, climate change, and digital technologies.

Compliance with NCC is mandatory under state and territory legislation. Failure to comply can result in fines, legal liabilities, and reputational damage. Therefore, builders, designers, engineers, and other building professionals need to understand and follow the requirements of their projects.

Australian Construction Taxes and Accounting: How Does the System Differ from the World?

Construction taxes in Australia differ from those in other parts of the world, resulting in misunderstanding and confusion for independent contractors, small construction companies, and those unfamiliar with the system.

As an authoritative federal regulator, the Australian Taxation Office (ATO) defines the compulsory tax requirements of the country’s construction industry. Businesses involved in the construction sector must register for tax and comply with the Goods and Services Tax (GST). The list includes the Pay As You Go (PAYG) withholding and the Taxable Payments Annual Report (TPAR).

Before we go through each of these requirements, let’s discuss a few practical tips to help you manage your construction taxes more effectively.

Dealing with Construction Taxes Is No Longer a Challenge!

As an Australian construction company owner, you know that managing construction taxes can be a daunting task. With the constant changes in tax laws and regulations, it’s easy to become overwhelmed and fall behind on your tax obligations. Not speaking of the paperwork it takes to file your taxes accurately.

The silver lining here: you no longer have to struggle to stay up-to-date and compliant with construction regulations alone. Instead, advanced software like Buildern will help you take control of your tax management and accounting processes. From accounting integrations to streamlined financial tools and on-time reporting, Buildern has it all to help contractors become reliable and exemplary taxpayers.

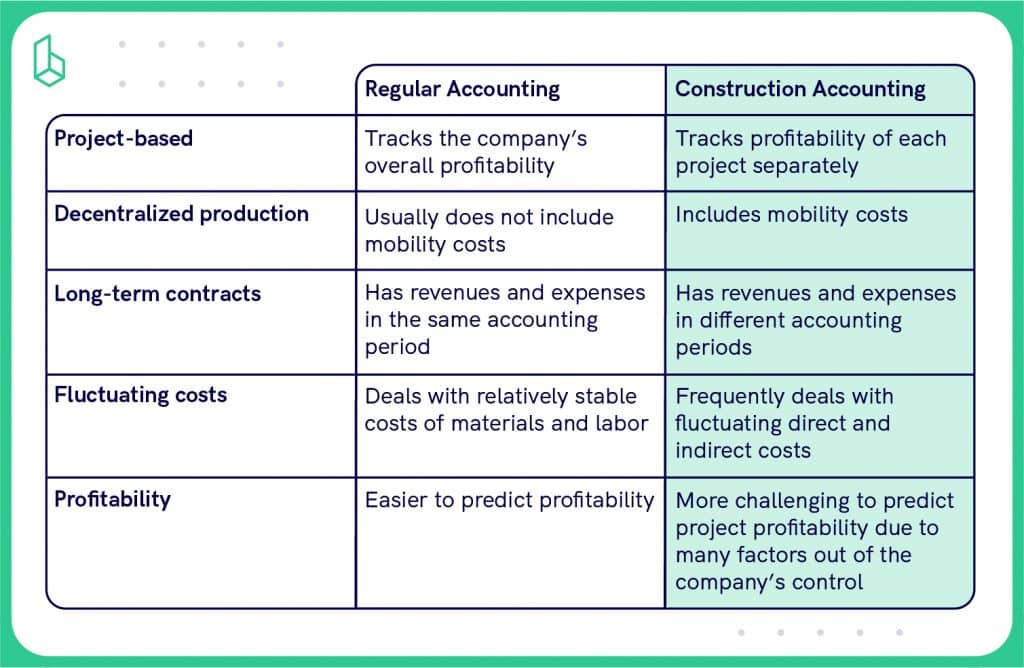

Although construction accounting adheres to traditional accounting principles, it has its unique peculiarities of financial tracking. With decent knowledge and understanding of traditional accounting, you will easily catch up on tracking progress payments, retainage, variation orders, purchase orders, and other project-specific financial data.

Learn about other key principles in our Construction Accounting 101 Guide.

How Can Buildern Help?

The platform’s advanced financial tools allow users to track their expenses by category, project, or vendor, ensuring the accuracy and transparency of accounting. Buildern also helps with invoicing, job estimation, labour tracking, reporting, etc. If you register on the platform from Australia, the taxes and insurance configurations, translations, date formats, and other localisations will be automatically set for you.

Moreover, as an Australian contractor, you are probably familiar with Xero’s accounting software. Buildern allows its users to take Xero’s construction accounting software to the next level by integrating it with construction-specific financial tracking tools and fully automating the entire process.

The construction process is non-linear, requiring non-standard and project-specific financial tracking to avoid cost overruns. The two-way accounting integration ensures no single entry or expense is missed, allowing you to manage construction taxes with confidence easily.

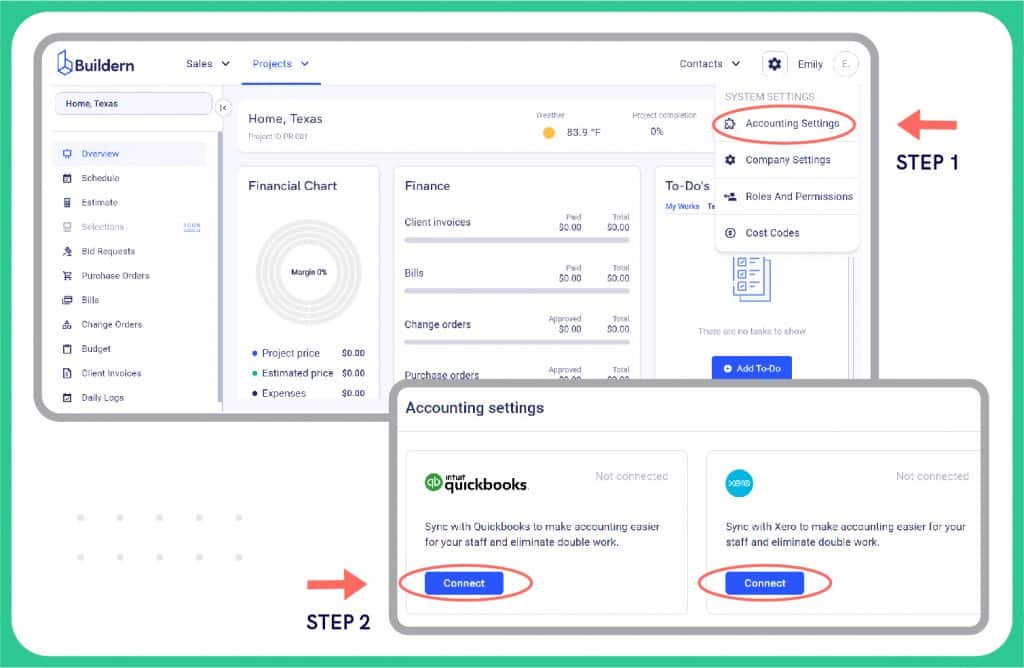

Syncing both platforms may seem complicated at first sight, but the reality is different. Buildern provides intuitive and user-friendly options for Xero users to easily manage their construction taxes and accounting with minimum effort. Here’s a mini step-by-step guide to getting the most out of this integration:

Step #1 Set up both accounts.

From Buildern’s “Account Settings,” select the construction accounting software (Xero or QuickBooks) to sync with.

Step #2 Set up the key settings.

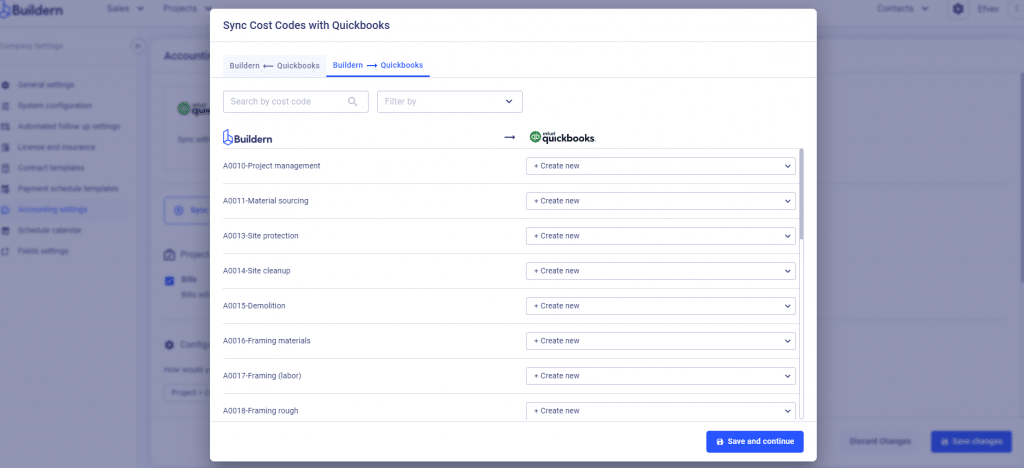

Step #3 Sync cost codes.

This is an essential step in ensuring that all the operational costs, from labour and materials to subcontractors and equipment, are entered accurately. You can either import cost codes from the accounting software or create them directly in your Buildern account. Due to the two-way integration, both accounts will contain up-to-date data.

Step #4 Sync sub-vendors to track your payments.

Regulating construction finances with Buildern’s professional solutions is especially helpful for independent contractors who are often left without a safety cushion during slow periods in their business. Buildern’s integrated system will help you stay organized, accurate, and on top of all the changes in the construction taxation system in Australia.

Now, let’s shift to a more detailed representation of the major tax requirements to help you get a better grasp of construction taxes in Australia. Just note that you can easily handle these and every other financial aspect of your next construction project with Buildern’s tech-driven solutions.

What Is GST Reporting?

The Goods and Services Tax (GST) is a value-added tax that applies to most goods and services sold or consumed within the country. GST is applied at a rate of 10% on the sale price of goods and services, and it is the seller’s responsibility to collect the tax and remit it to the ATO.

For construction companies, GST reporting involves accurately calculating and reporting all goods and services provided or received as part of their business activities. This includes purchasing materials and supplies, subcontractor services, and selling construction services to clients.

Under the GST system, construction companies are required to register for GST if their annual turnover exceeds a certain threshold. Once registered, they must collect GST on all taxable sales, issue tax invoices to customers, and regularly report and pay the collected GST to the ATO.

Thus, new businesses should register for GST if they expect their turnover to be $75,000 in the first year. Registration is optional for businesses with a turnover below the set threshold.

GST Payment Periods

The frequency of GST reporting varies depending on the size of the business and the volume of its transactions.

A set payment schedule depends on the amount of GST collected, i.e., monthly, quarterly, or annual payments can be made to the ATO. Here are examples for better understanding:

- Monthly – entities with an annual GST turnover of $20 million or more

- Quarterly – entities with an annual GST turnover of less than $20 million (ATO hasn’t told the company to report monthly)

- Annually – With a registered GST and an annual GST turnover of less than $75,000 ($150,000 for not-for-profit bodies)

Business Activity Statement (BAS)

BAS is a form that businesses in Australia use to report and pay various taxes to the ATO. The BAS is used to report and pay taxes such as GST, PAYG income tax instalments, PAYG withholding tax, and other taxes and duties.

The statement includes details of the business’s sales and purchases, GST collected and paid, and other relevant financial information. The ATO uses the information provided on the BAS to determine the business’s tax liabilities and issue any refunds or credits owed to the business. Businesses need to ensure that their BAS statements are accurate and submitted on time to avoid penalties or interest charges.

For construction companies, BAS reporting is an important aspect of their tax obligations as it includes reporting on the GST collected and paid on their construction services and supplies. It is recommended that construction companies seek professional advice or use construction accounting software to ensure accurate BAS reporting and compliance with Australian tax laws.

What Is PAYG?

Pay As You Go (PAYG) is a system used in Australia to collect income tax from individuals and businesses throughout the year rather than in a lump sum at the end of the financial year. Under the PAYG system, employers must withhold tax from their employees’ wages and remit it to the Australian Taxation Office (ATO) on their behalf.

Companies practicing PAYG instalments must still lodge an annual income tax report.

The PAYG system helps to ensure that individuals and businesses meet their tax obligations throughout the year, reducing the likelihood of a large tax bill at the end of the financial year. It also helps the ATO manage income tax collection and ensures a steady flow of revenue for the government.

Construction companies can benefit from PAYG instalments in several ways:

- Cash flow management: PAYG instalments allow construction companies to spread their tax payments throughout the year, making it easier to manage their cash flow and avoid any sudden or unexpected tax bill at the end of the financial year.

- Avoiding penalties: By making regular payments, construction companies can ensure they meet their tax obligations and avoid penalties or interest charges for late payments and underpayment of tax.

- Eligibility for discounts: Companies that make their PAYG instalments on time and in full may be eligible for a discount on their overall tax liability. This can reduce the overall tax burden.

The system provides greater flexibility, predictability, and control over the payments, helping to improve their financial management and reduce the risk of non-compliance.

What Is TPAR?

Standing for Taxable Payments Annual Report, TPAR is used to report the total payments made to contractors for building and construction services. Its goal is to improve tax compliance in the construction industry, which has historically been associated with a high level of non-compliance.

TPAR generally applies to B2B transactions. For example, companies that pay subcontractors for building and construction services must report the payments on TPAR.

Contractors should submit the report to the ATO due by 28th August each year. The report should provide detailed information regarding the entire year’s transactions from 1 July to 30 June.

Does your company need to lodge?

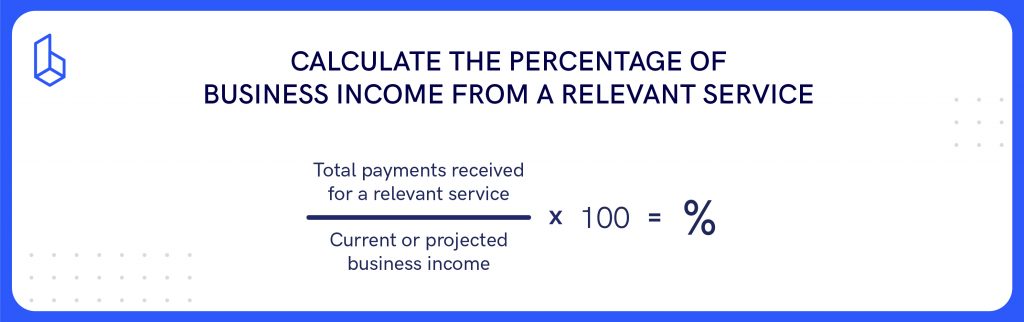

According to the ATO, any construction company with 10% or more of its business income for the financial year from a relevant service should lodge a TPAR. Here are a few simple steps to see if your business falls into this category:

- Estimate the total payments you have received from contractors for each applicable service. Include payments received when your employees, contractors, or subs performed services on your behalf.

- Calculate current income.

- Calculate the percentage of business income from a relevant service for each financial year. Use the formula below.

Your business will lodge a TPAR if:

- 10% or more of the income is from a relevant service

- you paid contractors for a relevant service during the year

While dealing with construction taxes in Australia is a practice for professionals, having a basic understanding of it will help you make a sound decision. Like every sphere, construction is also prone to risks and accidents. That’s why it is crucial to have the right insurance coverage place. Our next subheading will discuss several construction insurance types to ensure you know your rights and obligations regarding this.

Staying Secure: Construction Insurance Types in Australia

Workers’ Compensation Insurance

Workers’ Compensation Insurance is mandatory in Australia and provides financial protection to employees in case of work-related injuries or illnesses. Covering medical expenses, lost wages, and rehabilitation costs for injured workers, it ensures companies are liable for any accidents or injuries that happen in the workplace.

In the construction industry, where accidents are common, having Workers’ Compensation Insurance is essential to protect employees and ensure compliance with Australian construction law.

Australia has 11 workers’ compensation schemes connecting injured workers to services and the support they need. There are schemes for each state plus 3 Commonwealth schemes, each with its laws and specific operations. Safe Work Australia is a national policy body aiming to achieve a healthier, safer, and more productive professional environment for local workers. Collaborating with the Commonwealth, the States, and the Territories’ workers’ compensation authorities, they work hard to support improvements in the field across Australia.

Under the scheme, injured workers are entitled to receive compensation regardless of who was at fault for the injury. The compensation is usually based on a percentage of the worker’s pre-injury earnings and is paid out until the worker has fully recovered or is able to return to work. If the worker is unable to return to work due to the injury, they may be entitled to ongoing compensation or a lump sum payment.

It’s an important safety net for workers in Australia, providing financial protection and support.

QLeave Australia

QLeave is a type of long-service leave scheme available to eligible workers in the construction industry in Queensland, Australia. The scheme provides a safety net for workers who have worked in the industry for an extended period and may not have accumulated sufficient long-service leave entitlements through their employer.

Under the QLeave scheme, eligible workers in the construction industry can accrue long service leave entitlements based on their service in the industry. This service can be with multiple employers and can include periods of self-employment. The rates of pay for long service payments vary depending on several factors.

Read more about this at QLeave.

Construction employers should register with QLeave and pay the levy on behalf of their workers. They also need to provide sufficient information about their workers’ service to QLeave to ensure the entitlement calculations are accurate and timely.

Public Liability Insurance

Public Liability Insurance covers businesses and individuals in Australia from third-party financial loss and damage claims. It provides coverage for legal fees and compensation costs associated with injuries, property damage, or other losses suffered by members of the public that occur on the insured’s premises or as a result of their business activities.

It is most advantageous for businesses interacting with the public, such as retail stores, restaurants, service providers, and individuals owning property or hosting events. As construction companies often encounter liability risks, they can also opt for Public Liability Insurance to safeguard themselves and their workers from potential liabilities.

Practically, it covers a range of situations like damages to the property of others or accidental death and injury caused to third parties.

Still, there is a strict list of cases that this insurance does not cover. Some of these include the following:

- Damage to self-owned property. This may refer to your corporate or personal car, tools, equipment, and other business assets your company owns. You can take the Business Insurance Pack in addition to the Public liability insurance to cover such risks.

- Faulty workmanship. The point refers to any damage or injury caused by defective designs, plans, and specifications due to your or your team’s unprofessional approach.

- Fines and penalties. The insurance covers nothing regarding financial penalties, punitive, exemplary, or other damages imposed through the court of law.

Decennial Liability Insurance

Decennial Liability Insurance covers construction companies for damages caused by structural defects or failures within ten years after closing the construction project. In Australia, this type of insurance is the same as Construction Defects Liability Insurance or Latent Defects Insurance (LDI).

Decennial Liability Insurance aims to protect construction companies from potential financial losses due to claims arising from defects in their construction work. This insurance covers the cost of repairing or replacing any defective work that may cause harm to third parties or damage to property.

The coverage provided by Decennial Liability Insurance typically includes structural defects that may occur due to design or construction issues, such as foundation failures, building collapse, or cracking of load-bearing walls. The insurance also covers damages resulting from defects in materials or workmanship that may cause property damage or injury to third parties.

Although it’s was relatively new type of insurance in Australia, expected to come into force in early 2023, it has been projected to revolutionize how construction companies handle and manage risks. It may be mandatory for all construction projects exceeding a certain value, which varies by state or territory. Contractors, builders, or developers responsible for the construction project can obtain it to ensure the safety and quality of their work.

The Key Findings from Australian Construction Insurance Types

In summary, construction insurance policies play a vital role in managing risks and protecting against potential liabilities in the construction industry in Australia.

Workers’ compensation insurance provides coverage for employees who are injured or become ill due to work-related activities, while QLeave Australia provides long-service leave benefits for eligible workers. Public liability insurance protects construction companies against claims for property damage or injury caused to third parties. Decennial liability insurance covers damages caused by structural defects or failures within ten years after a project is completed.

Understanding these insurance policies is crucial for construction companies to ensure adequate protection.

Now, it’s important to delve deeper into the specific terminology used in the construction industry in Australia. The building jargon professionals use in the industry can be overwhelming, especially for those new to the field or willing to move their business to Australia. Thus, in the next section, we will explore some of the most commonly used terms in Australian construction and provide a clear understanding of their meanings.

Understanding Aussie Building Jargon

The construction industry in Australia, like any other industry, has its own unique jargon and construction terminology that can be too complicated for those unfamiliar with it. While most terms may be similar to those used in other parts of the world, there are some Australian-specific terms and acronyms to learn.

Thus, our comprehensive guide will also briefly cover the most common Aussie construction jargon to help you better navigate the industry.

- Chippie – Australian term for a carpenter; a skilled tradesperson specializing in working with wood and constructing, installing, and repairing various wooden structures and components used in construction.

- Laminate – a type of finishing for cabinets or benchtops with a layer of plastic at the base from particle board.

- Request for a quote – (same as the bid request) a formal request to potential subcontractors or suppliers for a detailed cost estimate or proposal to perform specific work on a construction project.

- Site diary – Australian version for a daily log; a record of important information about a construction project on a daily basis (detailed representation of on-site events, weather conditions, and any issues that arise during the day).

- Sparkie – Australian version for an electrician; a person specialized in installing, maintaining, and repairing electrical systems and components in residential, commercial, and industrial buildings.

- Variance order – (same as the change order) a formal written document that details any changes or modifications to the original scope of work, contract, or plans agreed upon by the project owner and the contractor.

Australian Construction Acronyms

- BCA – The Building Code of Australia (BCA) is a national code that sets the standards for the design and construction of buildings in Australia.

- BASIX – The Building Sustainability Index (BASIX) is a sustainability assessment tool that aims to reduce the environmental impact of residential buildings in New South Wales.

- BOQ – a Bill of Quantities (BOQ); a detailed list of materials and labor required for a construction project used to estimate costs and facilitate procurement.

- DA – A Development Application (DA) is a formal request to the local council for permission to carry out a development or construction project on a particular site.

- EOT – an Extension of Time (EOT); a formal request from a contractor to the project manager seeking an extension of the project deadline.

- NCC – The National Construction Code (NCC) is a comprehensive set of building and plumbing regulations that sets out the minimum requirements for the design and construction of buildings in Australia.

Buildern offers a range of flexible features as a construction project management tool, including the ability to adapt to language-specific communities. When a company changes its location, the dashboard terminology automatically changes to the appropriate language. So, whether you are a US-based or an Australian company, the software has adaptive flexibility to guarantee smooth language variance for your internal and external business communications.

If you want to change your US configuration to Australian, here’s how the transfer will look inside your professional dashboard.

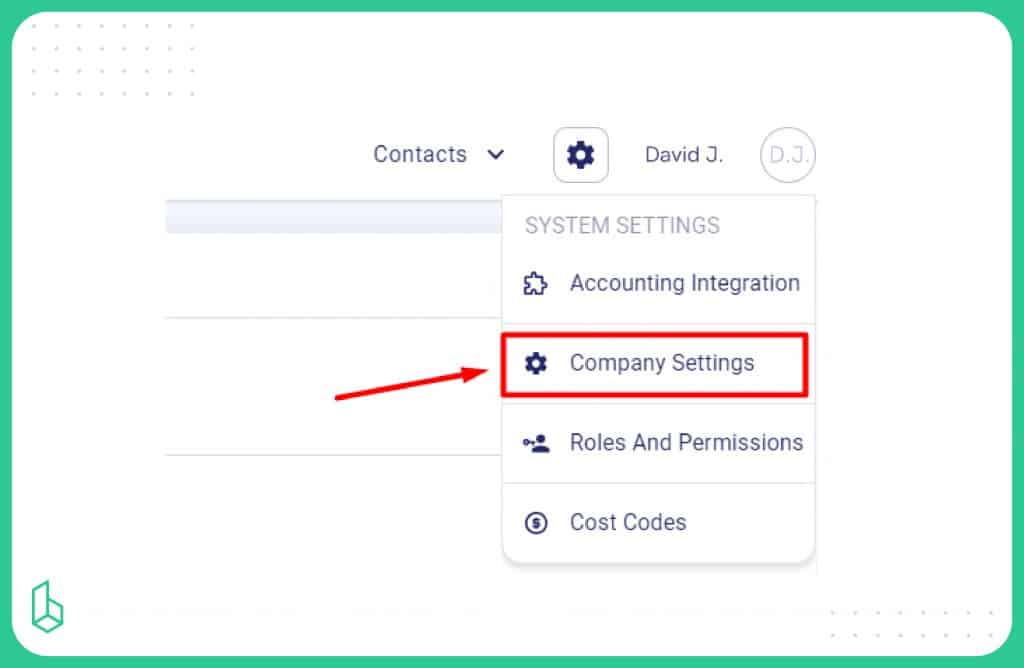

Step 1. Go to your Company Settings

Find a small cog symbol in the upper right corner of your professional dashboard. That’s where you’ll see the “Company Settings” section.

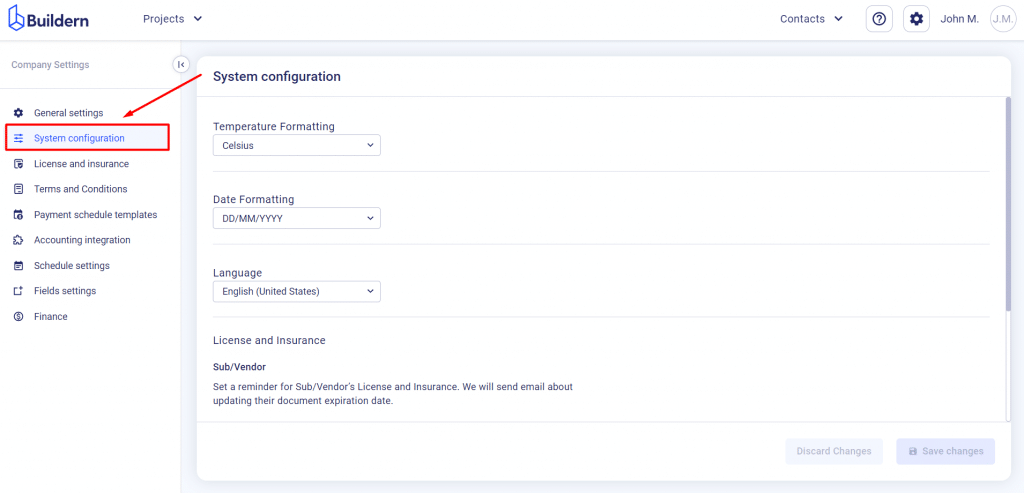

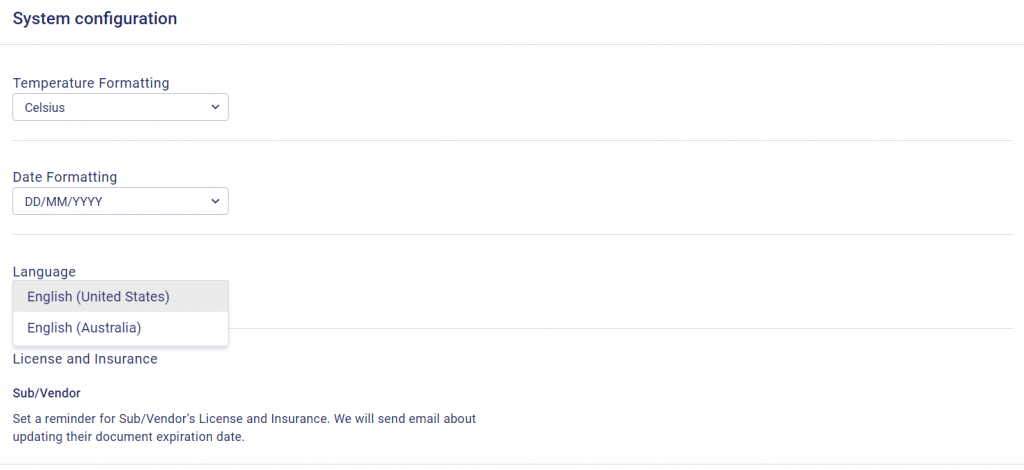

Step 2. Go to System Configuration

Choose the “System Configuration” settings from the left-hand menu.

This is where you’ll need to change your system language from US English to Australian English.

And that’s pretty much everything you need to do to adjust the language variance according to your company’s specifications. Once you save the language preferences, Buildern will automatically replace all US-specific construction terminology with Australian. The final result will give you a localized work environment that uses the industry lingo from down under!

The Bottom Line

The Australian construction industry in 2023 was facing challenges and opportunities. But with so many changes and perspectives in 2024, construction companies must be ready to continue their operations with up-to-date skills, knowledge, and tech support. Construction businesses need to adopt innovative solutions and strategies to succeed in this complex and dynamic environment. One such solution is Buildern serving both as construction project management and construction accounting software.

Use it to enjoy the benefits hundreds of Australian construction companies use daily, including but not limited to real-time data management, better resource allocation, and enhanced taxation and construction law compliance. It can also reduce manual errors, minimize delays and rework, and improve overall project quality and customer satisfaction.

Streamline Buildern’s flexibility in adapting to language-specific communities. Whether using it as construction accounting software integrated with Xero or a standalone construction project management tool, Buildern will help you stay competitive.