2026 Residential Construction Marketing Report: Budgets, ROI, and Lead Generation Insights

Buildern’s 2026 Residential Construction Marketing Report provides an in-depth look at how home builders are spending, measuring, and optimizing their marketing budgets in a changing economic climate. After several years of rising costs and volatile housing demand, marketing strategies have shifted from aggressive growth to efficiency and measurable returns.

This year’s data shows that builders are allocating budgets more strategically, favoring high-performing channels and technology-driven visibility. Marketing ROI has become the primary benchmark for decision-making, replacing traditional metrics like lead volume or ad reach.

Consequently, our report explores spending patterns, cost-per-lead data, ROI comparisons, and technology adoption trends across major markets, including the U.S., Canada, Australia, and the U.K. It also highlights the growing influence of automation, analytics, and integrated construction software in shaping campaign efficiency.

Each section includes insights from real performance data to help construction companies assess their marketing effectiveness and identify where to invest next.

Keep reading for Buildern’s full analysis of 2026 residential construction marketing budgets, ROI trends, and the key strategies shaping the industry’s most competitive year yet.

Table of Contents

- Marketing Spend Benchmarks for Residential Builders

- Marketing ROI and Channel Performance

- Lead Generation in 2026

- Technology Adoption and Digital Maturity

- Key Marketing Challenges for Residential Construction Marketing

- Regional Breakdown of Marketing Spend and ROI

- Residential Construction Marketing Outlook for 2026 and Beyond

- Buildern’s Recommendations for Smarter Marketing Investment

Marketing Spend Benchmarks for Residential Builders

Marketing budgets in 2026 reflect a more disciplined and performance-oriented construction sector. Following two years of high ad inflation and slower housing starts, builders are prioritizing stable lead generation channels over experimental campaigns. Across most regions, marketing spend remains between 1.8% and 3.2% of annual revenue, depending on company size and project volume.

Overall, construction companies that maintain structured tracking systems and ROI benchmarks report higher budget efficiency and lower acquisition costs. Digital marketing continues to dominate allocation, though many companies are rediscovering the value of referrals and long-term client retention efforts.

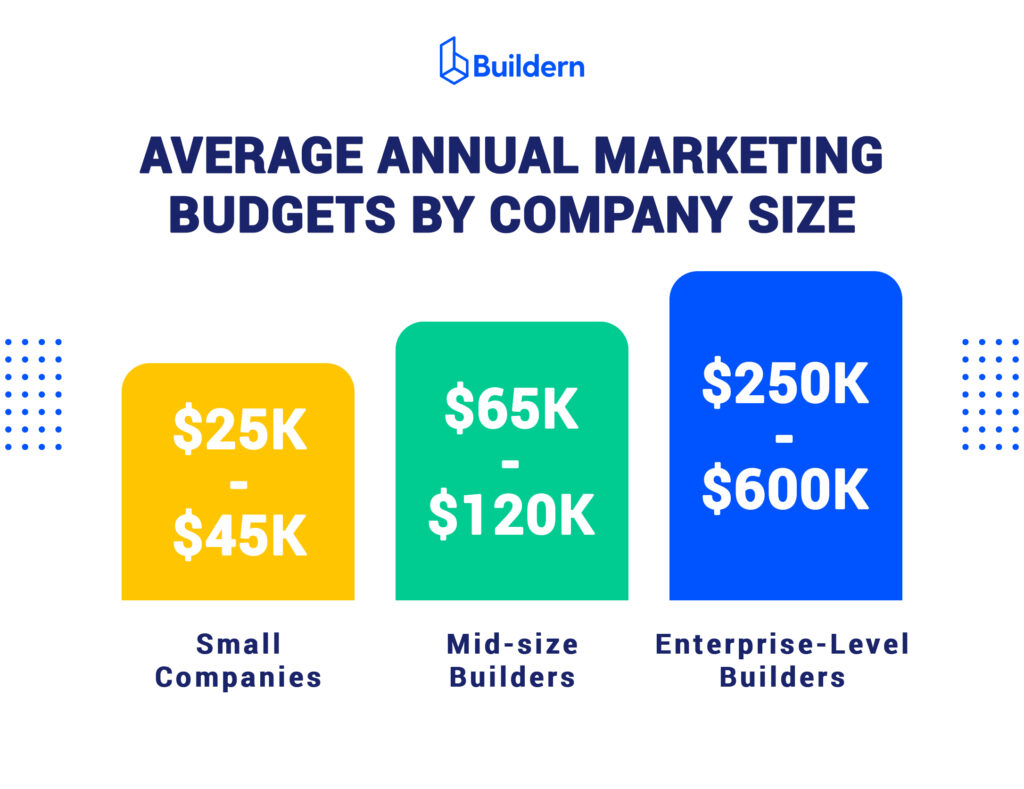

Average Annual Marketing Budgets by Company Size

What we’d like to highlight is that company size remains one of the most reliable predictors of residential construction marketing spend.

Smaller firms, often managing fewer than five projects annually, allocate between $25,000 and $45,000 per year, focusing on high-conversion local channels like Google Ads, listings, and word-of-mouth campaigns.

Mid-size builders, managing 6-20 projects, invest around $65,000 to $120,000 annually. Their budgets include multi-channel campaigns, SEO, paid search, CRM automation, and client referral programs, often managed internally or through hybrid agency partnerships.

Similarly, enterprise-level builders spend between $250,000 and $600,000 per year, prioritizing digital analytics, video content, and brand positioning to maintain visibility across regions. Many now operate in-house marketing teams dedicated to lead tracking, data attribution, and campaign analysis.

Across all tiers, the most profitable builders report that consistent spend tied to tracked ROI yields better returns than reactive budget adjustments tied to sales fluctuations.

Channel Allocation: Digital, Referrals, and Offline

Digital marketing remains the largest expense category, accounting for roughly 55-65% of total budgets. Within that share, search advertising (PPC) and organic SEO dominate, followed by social media and retargeting campaigns.

Referrals and repeat clients now contribute around 20-25% of total leads, with strong ROI due to low acquisition cost. Builders investing in structured referral programs, particularly with real estate agents, architects, or previous clients, report up to 35% higher conversion rates than firms without such systems.

Offline marketing, including local sponsorships, signage, and print, continues to decline in direct lead impact but remains valuable for reputation building in smaller markets. Most companies now treat these efforts as complementary to digital campaigns rather than standalone strategies.

Additionally, hybrid approaches, such as pairing offline open house events with digital remarketing, are gaining traction as builders look to maximize visibility without inflating budgets.

How Inflation and Interest Rates Shaped 2026 Budgets

Economic pressures continued to influence how builders planned their 2026 marketing spend.

Borrowing costs above 5% and material prices still 15-20% higher than pre-2020 levels have made builders more selective about how they allocate marketing funds. Many companies have paused year-over-year budget increases or shifted investment toward channels that provide clear and measurable ROI.

Builders in the United States and Australia reported the strongest spending stability, while companies in Canada and the U.K. implemented budget reductions of 5-10% on average.

Despite these adjustments, the industry trend leans toward smarter, not smaller marketing: fewer channels, tighter measurement, and better attribution.

In short, 2026 marks a transition from volume-based marketing to data-backed allocation. Builders who integrate financial visibility into marketing planning now outperform competitors relying on intuition or static annual budgets.

Marketing ROI and Channel Performance

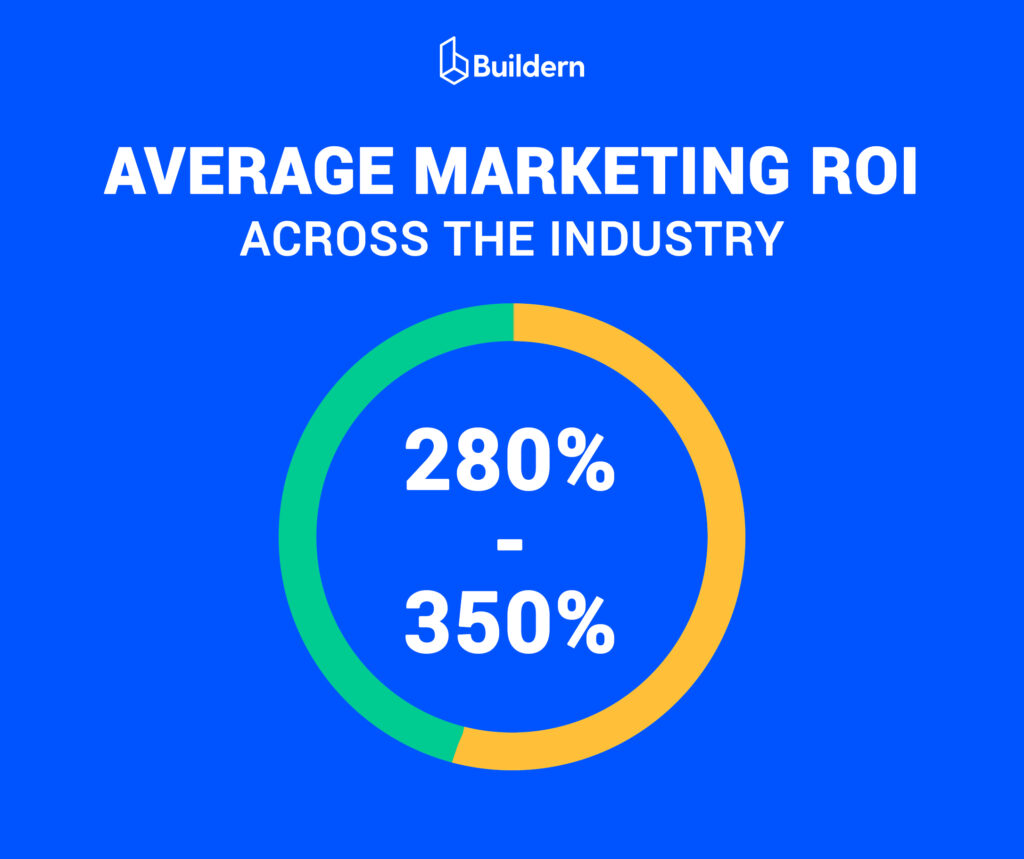

Return on marketing investment became the primary performance metric for residential builders in 2026. Rather than increasing total spend, most companies focused on optimizing the channels that delivered measurable financial results.

Across the industry, the average marketing ROI ranged between 280% and 350%, depending on company size, regional demand, and campaign maturity. Builders that consistently tracked lead attribution across all channels reported significantly higher efficiency and lower acquisition costs per project.

ROI by Channel: SEO, PPC, Social Media, Referrals

Search-based marketing remains the most cost-effective long-term investment for residential builders.

SEO campaigns achieved the highest ROI in 2026, averaging 400-450%, driven by improved local visibility and long-tail keyword targeting. Firms combining organic optimization with structured content and consistent link acquisition outperformed those relying solely on paid channels.

PPC advertising maintained strong performance, with ROI averaging 250-300%, though rising cost-per-click rates limited profitability in competitive metro areas.

Social media delivered mixed results, averaging 180-220% ROI, performing best for mid-size builders targeting design-focused clients on Instagram and Facebook.

Referral marketing stood out for its efficiency, despite generating fewer total leads; referrals achieved ROI levels exceeding 500%, thanks to minimal acquisition costs and higher close rates.

Builders combining organic search visibility with structured referral programs reported the strongest lead quality and lowest marketing waste across all company sizes.

| Marketing Channel | Average ROI (%) | Primary Strength | Key Limitation | Typical Use Case |

| SEO (Organic Search) | 400-450% | Sustainable long-term lead generation | Slow initial results | Local and service-based keyword targeting |

| PPC (Paid Search) | 250-300% | Immediate visibility and measurable conversions | Rising cost per click | High-intent local ad campaigns |

| Social Media Advertising | 180-220% | Strong visual engagement and brand awareness | Lower direct conversion rate | Design-focused and custom home projects |

| Referral Marketing | 480-520% | High trust and minimal acquisition cost | Limited scalability | Client and trade partner referrals |

Campaign Types with the Strongest Returns

Among all marketing initiatives, three campaign types produced the most consistent financial outcomes in 2026:

- Local SEO and Google Business optimization continue to drive qualified, location-based leads at low cost.

- Automated email and CRM remarketing flows, improving client retention and converting previous inquiries into new projects.

- High-quality content campaigns, particularly those featuring project showcases, construction pricing guides, or financing insights, generated high trust and long-term traffic value.

Paid search and social campaigns still play a crucial role in brand awareness, but the highest ROI is achieved when they’re combined with long-term inbound strategies.

Ultimately, builders who track post-lead engagement and pipeline conversion rates achieve more predictable returns and stronger overall profitability.

Average ROI Benchmarks by Company Size

Accordingly, residential construction marketing performance correlates closely with company scale and resource allocation.

- Small builders (1-5 employees) reported an average ROI of 260-280%, with the highest returns from organic search and referral programs.

- Mid-size companies (6-25 employees) achieved 320-350% ROI, benefiting from CRM automation, targeted PPC, and optimized lead follow-up systems.

- Enterprise-level builders saw an average ROI of 370-400%, driven by data analytics, attribution modeling, and integrated marketing-financial dashboards.

Across all tiers, the most profitable companies in 2026 were those that treated marketing as a financial system, not an expense, linking every campaign to revenue tracking, client lifetime value, and job profitability.

Lead Generation in 2026

The residential construction market in 2026 has shifted toward quality-focused lead generation. Builders are investing less in broad awareness campaigns and more in measurable, high-intent channels.

While overall lead volume declined by about 7% compared to 2025, conversion efficiency improved by nearly 11%, showing that fewer but better-qualified leads now drive more predictable revenue.

Organic search and client referrals remain the most reliable sources. SEO-generated inquiries account for roughly 38% of total qualified leads, while referrals contribute 26%, offering the highest conversion rate at around 40%. Paid campaigns deliver approximately 22% of new opportunities, primarily in the custom home and remodeling segments, with social media contributing the remaining 14%.

Builders who integrate marketing and sales data through CRM platforms see significantly higher performance. On average, firms using CRM-linked attribution models report 10-15% lower acquisition costs and faster follow-up cycles, resulting in stronger client relationships and recurring work.

The average cost per lead increased slightly to $95-$125, reflecting tighter competition across digital channels and persistent ad cost inflation. However, companies maintaining active referral networks and local SEO visibility continue to achieve sustainable acquisition costs.

Technology Adoption and Digital Maturity

In 2026, digital maturity has become a defining factor in residential construction marketing performance. Companies that operate with connected, data-driven systems consistently report higher ROI, stronger lead conversion, and lower operational costs.

Now, Technology adoption extends beyond websites and CRMs into integrated marketing, estimating, and client communication platforms.

More than 70% of residential builders now use at least one construction management or CRM system to centralize project and client data, while about 45% rely on automated email and SMS workflows for lead nurturing.

Ultimately, the adoption of analytics dashboards and AI-driven reporting tools rose to 52%, allowing firms to track campaign efficiency in real time and adjust spending based on verified results.

Despite progress, the industry still shows wide variation in digital maturity. Small firms often depend on manual tracking and third-party spreadsheets, which limit visibility into cost-per-lead and ROI data.

In contrast, mid-size and enterprise builders have embraced cloud-based software ecosystems that connect marketing insights with project profitability metrics.

The firms achieving the highest marketing efficiency are those combining construction-specific CRMs, client portals, and project tracking tools under one platform. Such an alignment between sales and operations not only improves response time but also helps attribute marketing outcomes directly to project wins and long-term client retention.

Key Marketing Challenges in 2026 for Residential Construction Marketing

Despite stronger digital adoption and improved ROI tracking, residential builders in 2026 continue to face a number of persistent marketing challenges. Market saturation, rising costs, and skill gaps in data-driven marketing have limited how effectively many firms can scale visibility and lead generation.

The following issues define the year’s most common pressure points across small and mid-size construction businesses.

Budget Limitations and Rising Acquisition Costs

Marketing budgets have remained flat for most companies, while the cost of acquiring new leads continues to rise. The average cost per lead increased by 6% in 2026 due to higher ad competition, material inflation, and overall financing strain. Smaller builders are the most affected, often unable to match the paid ad spending levels of regional competitors.

Companies that rely solely on paid channels are reporting thinner margins, pushing many toward lower-cost strategies such as local SEO, referral programs, and CRM-based retention marketing.

Difficulty Tracking ROI and Channel Performance

Roughly 40% of residential builders still lack a unified system for tracking ROI across campaigns. Without integrated analytics, it becomes difficult to link marketing expenses to signed contracts or ongoing client relationships.

As a result, many firms continue to misallocate spend toward channels with weak conversion rates or low visibility into final revenue impact. The shift to centralized platforms, such as Buildern or integrated CRMs, is helping close this gap, but progress remains uneven.

Declining Lead Quality in Competitive Markets

Competition for homeowner attention has intensified. While total inquiries have remained stable, lead quality has declined, with many firms reporting up to 20% fewer qualified opportunities than in 2025.

Builders attribute this drop to overexposure in digital ads and broader targeting parameters that attract price-sensitive clients rather than serious buyers. Those refining lead scoring models and using project-based qualification questions within contact forms are seeing higher conversion consistency.

Overreliance on Paid Advertising Without Conversion Insight

Paid channels remain essential for visibility, but overdependence has become a significant risk. Many construction companies invest heavily in PPC or Meta ads without structured conversion tracking or attribution systems.

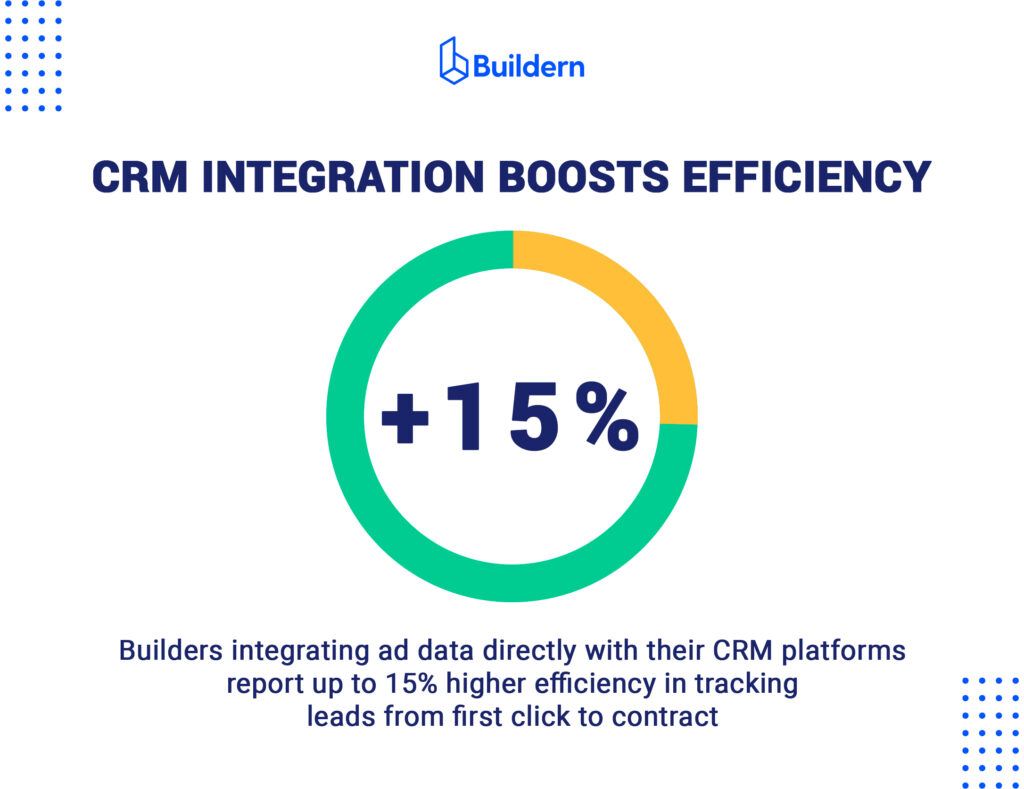

Obviously, such a lack of insight often leads to inflated budgets with uncertain returns. Builders integrating ad data directly with their CRM platforms report up to 15% higher efficiency in tracking leads from first click to contract, providing a clearer view of real ROI.

Skills Gap in Digital and Data Analytics

The transition toward analytics-driven marketing has revealed a talent gap across the construction industry. Many small and mid-size builders lack in-house expertise in digital marketing, automation, or data interpretation.

Many builders still struggle to interpret the data their marketing tools provide, leaving valuable insights untapped. Companies seeing the best results are the ones addressing this gap directly, by training internal teams, partnering with digital specialists, or adopting intuitive analytics platforms that simplify reporting and turn data into clear, actionable direction.

Regional Breakdown of Marketing Spend and ROI

Marketing performance in residential construction continues to vary widely by region. Economic stability, housing demand, and digital adoption levels all influence how much builders invest and what returns they achieve.

While the U.S. leads in both spending and ROI, other markets such as Australia and Canada show more measured but efficient performance patterns.

United States

In 2026, U.S. residential builders allocated an average of 2.8-3.2% of annual revenue to marketing, up slightly from 2.5% in 2025.

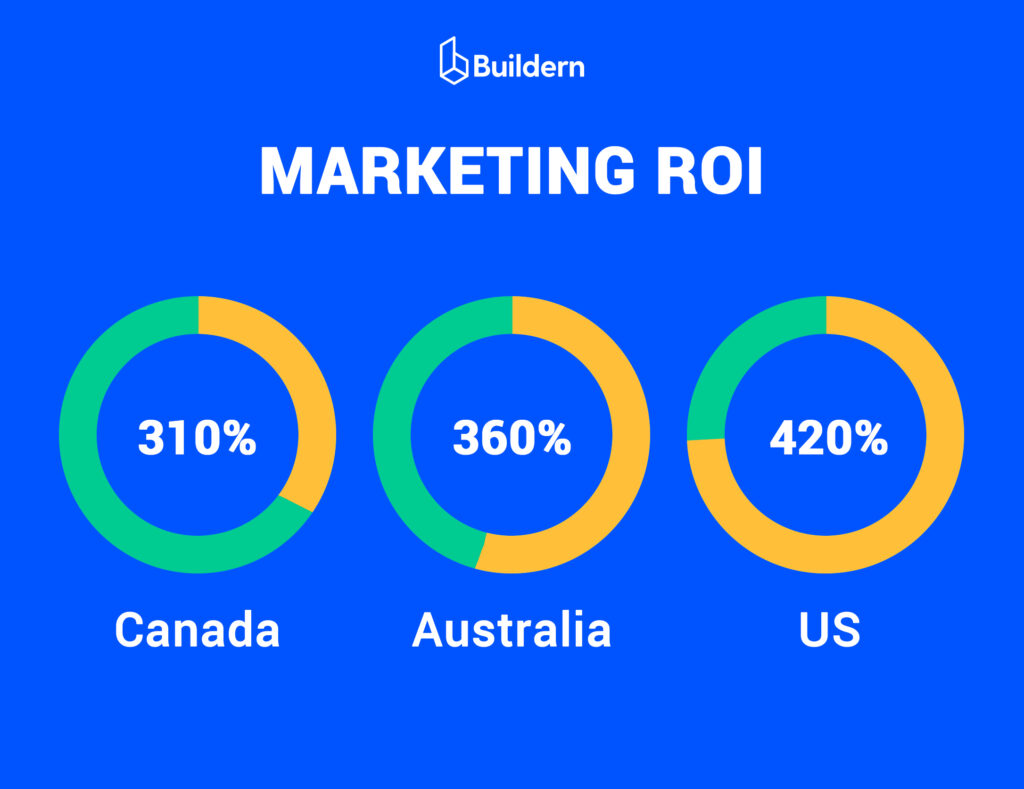

The majority of budgets went toward SEO (28%), paid search and display (24%), and referral-based campaigns (18%). Average ROI across all channels reached 380-420%, driven by strong lead conversion in the Sun Belt and Midwest regions, where construction demand remains steady.

Digital maturity is highest among U.S. companies, with roughly 65% using integrated CRM and automation tools, allowing tighter control over lead tracking and campaign attribution.

Canada and Australia

Both Canada and Australia report stable marketing budgets but modest ROI growth. In Canada, builders spend approximately 2.4% of revenue on marketing, generating an average ROI of 310%, constrained by slower housing starts and elevated borrowing costs.

Australian companies invest slightly more, around 2.7% of revenue, and report ROI averaging 360-380%, largely due to higher adoption of client portals, review management systems, and local SEO strategies.

Regional variations remain pronounced: Canadian companies in Ontario and Alberta perform above average, while Australian builders in Queensland and Victoria report stronger online lead flow linked to sustained housing activity.

United Kingdom

U.K. residential builders face one of the toughest marketing environments in 2026. Spending averages 2.1% of annual revenue, but ROI has dropped to 280-300%, the lowest among developed markets.

Tightened lending, stricter ad compliance rules, and slower private development have reduced returns, particularly for smaller firms relying on paid search and social media ads.

Anyhow, builders investing in long-term content and local SEO strategies continue to outperform peers, achieving higher lead-to-sale ratios and lower acquisition costs over time.

Emerging Markets

In emerging regions, particularly parts of Eastern Europe, the Middle East, and Southeast Asia, marketing budgets remain lean but are growing rapidly. Builders typically spend 1.5-2% of revenue, yet ROI levels often exceed 400% due to lower ad competition and stronger reliance on organic and referral-based channels.

Adoption of digital tools is accelerating, with over 40% of mid-size companies now using localized CRM systems or online quoting portals. As infrastructure spending expands, these markets are expected to close the digital maturity gap within the next two years, positioning them for stronger long-term marketing returns.

Residential Construction Marketing Outlook for 2026 and Beyond

Residential construction marketing in 2026 will be shaped by budget discipline, smarter channel selection, and measurable impact. Builders are shifting from broad exposure tactics to performance-driven strategies that link every campaign to revenue outcomes.

Budgets are expected to rise by 4-6%, mostly within digital and referral-based channels, while traditional advertising continues to decline. Companies investing in automation, CRM platforms, and analytics tools will maintain a clear advantage, achieving higher conversion rates and lower acquisition costs.

AI forecasting and automated reporting will continue to define top performers. Companies utilizing real-time insights already record up to 25% stronger lead-to-contract ratios, a trend expected to accelerate next year.

The Growing Role of Sustainability and Client Relationships

In 2026, the most competitive builders will focus on two pillars: long-term client relationships and sustainability.

Retention programs, transparent communication, and community-driven branding are becoming as valuable as direct lead generation. At the same time, sustainability messaging is moving from optional to essential.

Similarly, builders who showcase energy-efficient design, eco-materials, and compliance with green standards attract higher-quality leads and stronger brand trust.

The companies best positioned for growth will be those that align financial precision, digital maturity, and authentic client engagement within a unified marketing strategy.

Buildern’s Recommendations for Smarter Marketing Investment

Smarter marketing investment in the upcoming years will rely on precision, not expansion. Builders who evaluate every channel through measurable performance data will outperform competitors still relying on intuition or legacy advertising models.

Our goal is to create a marketing system that tracks ROI in real time, aligns with sales outcomes, and protects cash flow during slower cycles. Here are some practical recommendations that you might find helpful:

#1 Track ROI Continuously Using Centralized Dashboards

Reviewing results quarterly is no longer enough. Builders using live dashboards that consolidate campaign metrics, lead sources, and cost per acquisition maintain stronger visibility over performance trends.

Real-time tracking prevents overspending and helps redirect budgets toward high-performing channels more quickly.

#2 Align Marketing and Sales Data for Lead Conversion Accuracy

Disconnected data remains one of the biggest reasons for wasted marketing spend. Linking marketing campaigns directly to CRM and job management systems allows teams to track which channels produce actual contracts instead of just form submissions.

Construction companies adopting this approach report 15-20% higher marketing ROI and shorter conversion cycles.

#3 Prioritize High-Intent Leads Over Traffic Volume

The best-performing builders are reducing focus on reach-based metrics. Instead of paying for broad traffic, they emphasize lead quality and intent signals such as time-on-site, project inquiry depth, and repeat engagement.

Mid-size firms adopting content-focused inbound strategies have reduced average acquisition costs by up to 30%, driven by refined targeting, stronger lead qualification, and continuous optimization of campaign data instead of higher ad spend.

#4 Leverage Integrated Software to Control Spend and Attribution

Using separate tools for campaigns, CRM, and budgeting often leads to data loss and poor attribution accuracy. Integrated construction management software eliminates those gaps, giving builders unified visibility across financial and marketing functions.

Our platform, for instance, helps align marketing analytics with project profitability metrics to ensure every dollar supports measurable business outcomes.

#5 Use Industry Benchmarks to Guide Budget Adjustments

Benchmarking ensures that budgets stay realistic and competitive. Builders comparing their digital ROI and cost-per-lead ratios to verified industry data make more informed allocation decisions.

As 2026 approaches, the most financially disciplined companies will rely on benchmarking not to imitate competitors but to identify underperforming areas and refine investment priorities.

![Detailed Construction Project Cost Breakdown [Examples Included]](https://buildern.com/resources/wp-content/uploads/2024/09/BLOG_Cover_Construction-project-cost-breakdown-2-copy-768x501.webp)