Construction Cost Codes: Tips to Build Smarter, Not Harder

Last updated January 2026

I have yet to see a construction project run into trouble because people worked too hard. Most problems come from something more basic: costs were not structured clearly from the start. When dealing with too many spreadsheets, invoices, and vague budget lines, teams lose visibility fast.

Construction cost codes exist to solve that exact problem. In my experience, they are not an accounting formality or a reporting afterthought. They are the backbone of how a project’s financial logic holds together.

Therefore, I’d like to focus on how construction cost codes actually work in real projects. Not in theory, and not as a compliance exercise, but as a practical system for organizing costs, tracking performance, and keeping budgets grounded in reality. If cost tracking has ever felt reactive or unclear on your projects, cost codes are usually where the conversation needs to begin.

Table of Contents

- What Is a Cost Code in Construction?

- Cost Codes vs a Chart of Accounts

- Benefits of Implementing Construction Cost Codes

- The Smartest Way to Get Started with Cost Codes

- 5 Insider Tips to Develop a Flexible System of Cost Codes in Construction

- Standard Cost Code Systems vs Custom Structures

What Is a Cost Code in Construction?

A construction cost code is a structured way to label and organize where money is planned to go and where it actually goes during a project. In practice, it is a numeric or alphanumeric identifier assigned to a specific scope of work, cost category, or activity.

I treat cost codes as the financial language of a project. If that language is unclear or inconsistent, everything built on top of it becomes harder to manage.

Cost codes usually follow a multi-level structure. Each level adds detail, moving from broad categories down to specific tasks or components. Depending on how they are set up, cost codes can be used to classify and track:

- Labor by trade or activity

- Materials and equipment

- Subcontractor work

- Project phases or cost centers

- Changes and additional scope

This structure allows everyone working on the project to reference costs using the same framework, whether they are estimating, approving client invoices, or reviewing job performance.

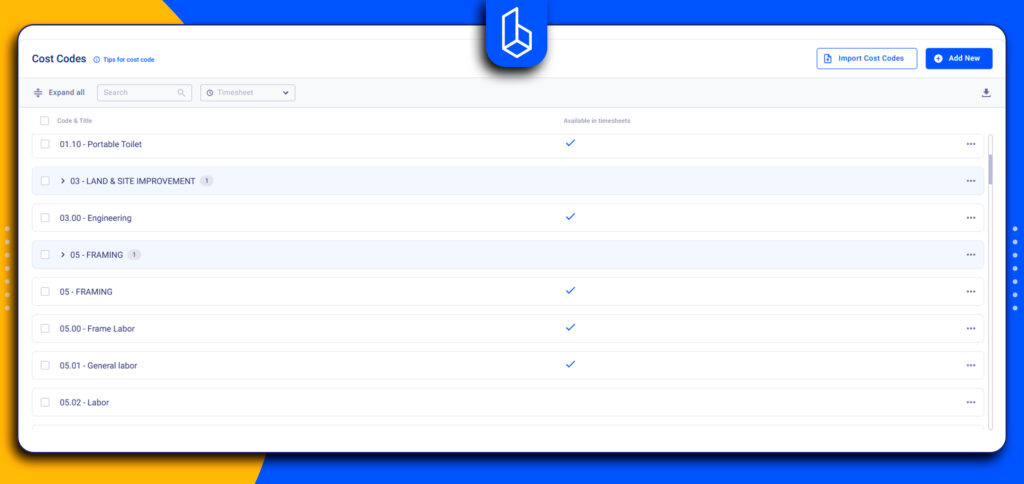

Many cost code lists are loosely based on the Construction Specifications Institute structure. That said, there is no requirement to follow any standard list. Cost codes are company-specific, not project-specific. In my experience, the most effective systems are the ones tailored to how a company actually builds, estimates, and reports, not ones copied blindly from an external template.

What Is the Ideal Number of Cost Codes for Effective Management?

Unfortunately, no one-size-fits-all answer to the ideal number of cost codes exists.

Though it’s important to strike a balance. Too few codes may result in insufficient granularity, while an excessive number of codes can become overwhelming and cumbersome to manage.

The number of cost codes you’ll need to manage your construction projects depends on the complexity and scope of the project. Generally, builders divide their projects into various cost categories, such as labor, materials, equipment, subcontractors, permits, and overhead costs. Each category can be further broken down into specific cost codes that capture the project’s unique aspects.

A good strategy is to begin by establishing a selection of fundamental cost codes that encompass the vital components of your projects and can be consistently applied across various jobs. As you become experienced and come across specific cost items unique to your projects, you can expand the code library accordingly.

Just remember, the goal is to have an adequate number of codes to offer valuable information and facilitate efficient cost management, all while avoiding needlessly complicated processes.

Cost Codes vs a Chart of Accounts

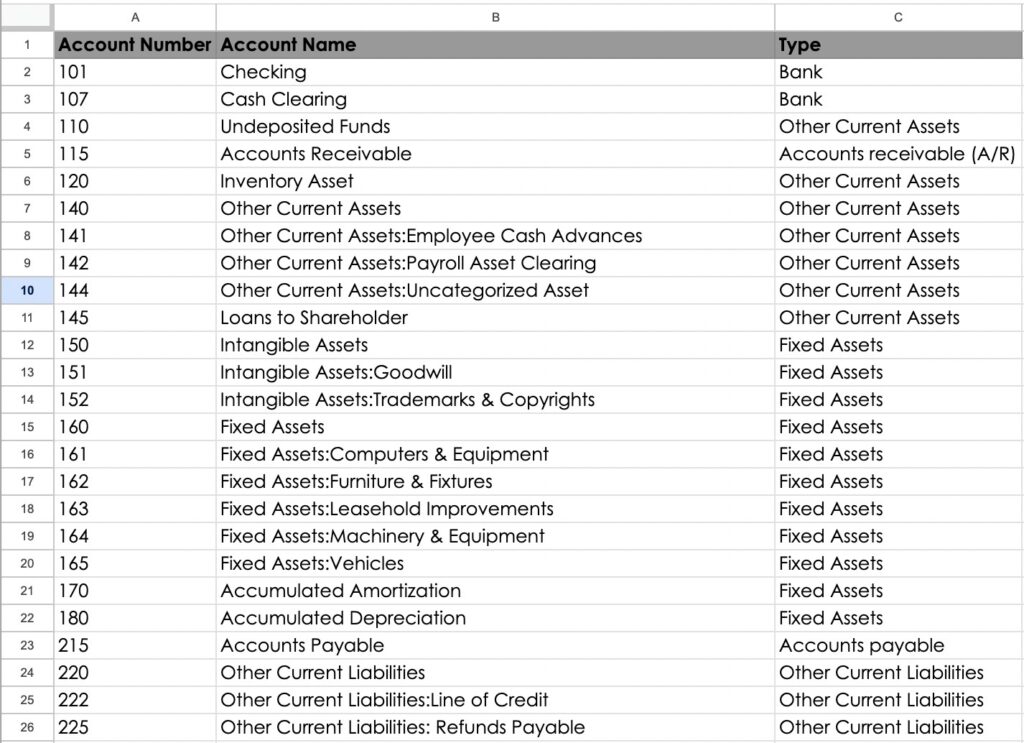

Cost codes and a chart of accounts are often confused, but they solve different problems. Treat the chart of accounts as a company-wide accounting structure, while cost codes operate at the project level.

A chart of accounts is designed for financial reporting and compliance. It shows how money flows through the business overall, such as revenue, expenses, assets, and liabilities. It rarely changes and is usually owned by accounting.

Cost codes, on the other hand, are built to explain where and why money is spent on a specific project. They break work into scopes, phases, or trades and make job-level cost tracking possible in real time.

In practice, the two should work together. Cost codes provide detailed project insight, while the chart of accounts rolls that information up into company-level financial statements. When cost codes are forced to replace the chart of accounts, or vice versa, visibility is lost at one level or the other.

Benefits of Implementing Construction Cost Codes

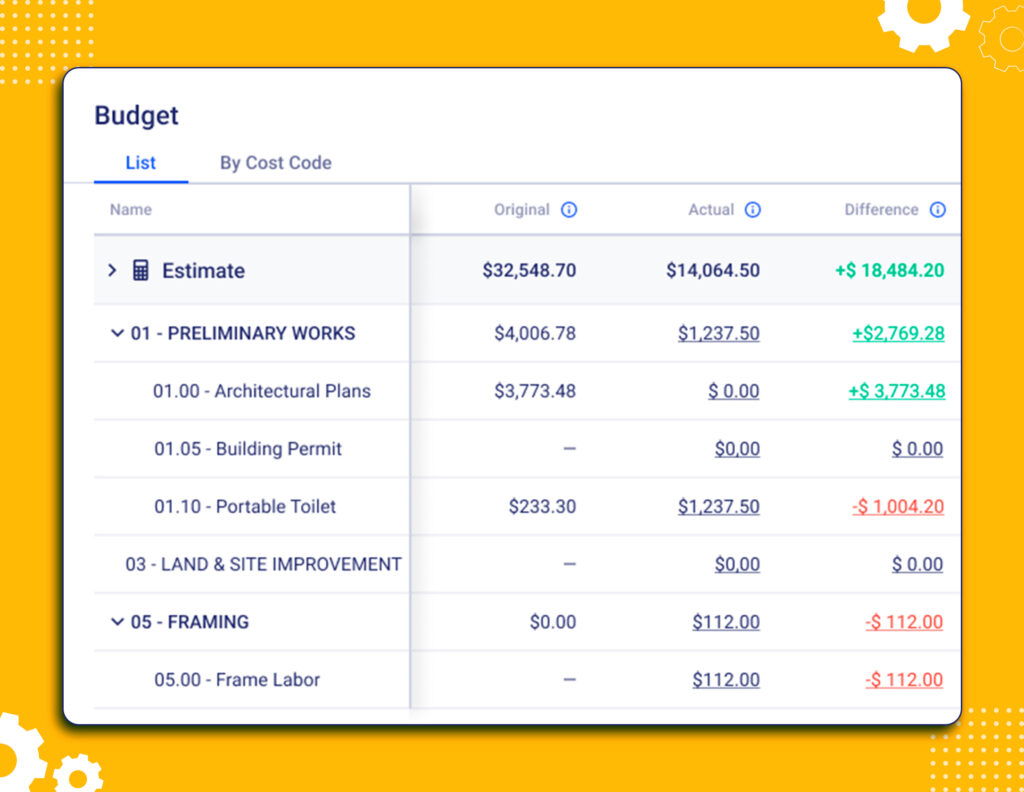

I have found that cost codes start paying off only when they are used consistently across estimating, job tracking, and accounting. When that happens, they stop being an administrative layer and become a working system. The benefits show up quietly but persistently, especially on projects with tight margins.

Accurate Cost Estimates

Cost codes sit at the core of structured construction cost estimation. When estimates are built using the same cost codes that will later track actual costs, assumptions become visible early.

By breaking work into clearly defined codes, I can assign labor, materials, and subcontractor costs with far less ambiguity. That makes bids easier to evaluate and refine. More importantly, it reduces the gap between estimated and actual costs, which is usually where profitability erodes.

Better Record-Keeping

Contributing to enhanced record-keeping practices within the construction industry, cost codes provide an easy way to create and track project-specific data across various teams and departments. With a well-defined system in place, you can easily review job performance and translate data into meaningful insights.

Accessing accurate and comprehensive records through cost codes enhances transparency and facilitates compliance with regulatory requirements. This, in its turn, accelerates the entire process from start to finish.

Data Standardization and Sharing

One of the biggest advantages of cost codes is that they give everyone the same reference point. Estimators, project managers, and accounting teams can all speak the same financial language.

When cost codes are used consistently:

- Data moves cleanly between estimating, accounting, and project tracking

- Purchase orders, invoices, payroll, and change costs stay aligned

- Reporting becomes comparable across jobs and time periods

Whether a team uses a single accounting tool or a broader construction project management system, standardized cost codes reduce mismatches and manual reconciliation. They do not remove complexity, but they prevent it from spreading quietly across systems.

The Smartest Way to Get Started with Cost Codes

In my experience, the hardest part of cost codes is not the software. It is deciding what the codes are supposed to do for the business. Many teams jump straight into tools and templates before they agree on how costs should be structured, reviewed, and acted on. That usually leads to a system that exists on paper but fails under real project pressure.

The smartest way to start is by defining the role cost codes play across the full project lifecycle. Cost codes should support estimating, budgeting, commitments, billing, and cost reviews using the same structure. If a code only makes sense in accounting or only during estimating, it will break once the project is underway.

Start with Structure, Not Software

Before any system is configured, I focus on a few fundamentals:

- Decide the level of detail that actually matters. Overly granular codes slow teams down. Overly broad codes hide problems.

- Align codes with how work is executed. Codes should follow the scopes of work and trade responsibility, not abstract accounting logic.

- Keep the structure consistent across projects. Cost codes are a company asset, not something reinvented for each job.

This upfront work is what allows cost codes to scale from small projects to complex ones without constant restructuring.

Coordinate Cost Codes Across Teams Early

Cost codes only work when estimating, project management, and accounting all use the same definitions. I have seen well-designed systems fail simply because each department interpreted the codes differently.

To avoid that:

- Estimators define how codes break down the scope and pricing

- Project teams use the same codes for commitments and progress tracking

- Accounting applies those codes consistently to invoices and payroll

When ownership is clear, cost data stays aligned instead of drifting apart across systems.

Integrate Cost Codes Where Decisions Are Made

Technology matters, but only after the structure is sound. Whether teams use standalone accounting software, financial management platforms, or a combination of both, cost codes should flow through every financial touchpoint.

That includes:

- Budgets and bid breakdowns

- Purchase orders and subcontracts

- Invoices, payroll, and change costs

- Job cost reports and margin reviews

The goal is not automation for its own sake. It is to ensure that every dollar lands in the same place, no matter where it enters the system.

Treat Cost Codes as a Living Framework

Cost codes are not set-and-forget. I revisit them regularly to see which codes produce insight and which ones add noise. If a code is never reviewed or never informs a decision, it usually does not belong in the structure.

The teams that get the most value from cost codes treat them as a shared operating framework. They document it, train around it, and refine it as their projects and business evolve. That discipline, more than any tool, is what turns cost codes into a competitive advantage.

5 Insider Tips to Develop a Flexible System of Cost Codes in Construction

- Design codes around how you build, not how you report

Start from the real scopes of work and trade responsibilities. If a code does not reflect how work is executed on-site, it will not hold up during tracking or reviews. - Set the level of detail intentionally

Too much granularity slows teams down. Too little hides overruns. Define codes at the level where decisions are actually made, not where data looks impressive. - Involve the estimating, project, and accounting teams early

Cost codes fail when each department interprets them differently. Align on definitions upfront so the same codes work from bidding through closeout. - Use hierarchy to control complexity

A clear parent-child structure allows high-level visibility without losing detail. Broad categories should roll up cleanly while still allowing you to drill into problem areas. - Review and refine after every project

Treat cost codes as a living framework. Remove codes that add noise, split ones that hide issues, and adjust the structure based on how the data was actually used.

Well-built cost codes do not need to be perfect on day one. They need to be usable, consistent, and willing to evolve as the business grows.

Standard Cost Code Systems vs Custom Structures

When teams first start formalizing cost codes, the natural question is whether to follow an industry standard or build something from scratch. In practice, this is rarely a binary choice. Standard systems provide a proven starting point, while custom structures are what make cost codes usable in day-to-day operations.

Standard cost code systems are designed for consistency and shared understanding across the industry. They work well when projects need to align with architects, engineers, lenders, or external reporting requirements. They also reduce setup time by offering a ready-made hierarchy that has already been tested across thousands of projects.

That said, standard systems are intentionally generic. They describe construction work broadly, not how a specific builder prices, executes, and reviews jobs. This is where custom structures become necessary. Most builders I have worked with start from a standard list, then adapt it to reflect their trade mix, project types, and internal workflows.

The goal is not to choose between standardization and flexibility, but to balance the two. A good cost code system borrows the structure of industry standards while adjusting detail levels, naming, and grouping to match how the business actually operates.

Standard Construction Cost Codes List

Of course, coming up with a unified and well-structured system of cost codes is not easy. You can use the standardized CSI (Construction Specifications Institute) or NAHB standard home builder cost codes systems to get started. These systems provide a clear, logical structure that can be adapted rather than reinvented.

Here’s a brief list of general cost codes to better understand each system.

CSI Standard Construction Cost Codes

The CSI MasterFormat organizes construction work by divisions, each covering a major scope category:

- 00: Procurement and contracting requirements

- 01: General requirements

- 02: Existing conditions

- 03: Concrete

- 04: Metals

- 06: Woods, plastics, and composites

- 07: Thermal and moisture protection

- 08: Openings

- 09: Finishes

- 10: Specialties

Find out more at CSI’s MasterFormat.

Each division includes multiple sub-levels, allowing costs to be broken down into increasingly specific components. This structure works well for commercial projects and for coordination with design and specification documents.

NAHB Standard Home Builder Cost Codes

For residential construction, the National Association of Home Builders offers a cost code system designed specifically around homebuilding workflows. Instead of organizing by specification divisions, it focuses on budgeting, profit tracking, and cost reporting at the builder level.

For example, land development is grouped under a single umbrella code, with detailed subcodes beneath it:

- 02-01-0101: Appraisal fees

- 02-01-0102: Attorney fees

- 02-01-0103: Environmental reports

- 02-01-0104: Extension fees

- 02-01-0105: Option fees

- 02-01-0110: Land acquisition expense

Find out more at MCBIA’s official website.

This approach is often more intuitive for residential builders because it mirrors how costs are planned and reviewed internally.

Both CSI and NAHB systems are best viewed as foundations, not final answers. They provide structure and consistency, but the most effective cost code systems are the ones adjusted to fit how projects are estimated, managed, and evaluated in real conditions.

Key Takeaways

Cost codes appear to be a core part of how we manage construction budgets, reports, and overall workflows. When they are structured well, they bring clarity to estimating, tracking, and reviewing costs across the full project lifecycle.

Industry standards such as CSI and NAHB provide a solid foundation, but they rarely fit a builder’s workflows without adjustment. The real challenge is not choosing a system, but shaping it into a structure that reflects how work is priced, executed, and reviewed in practice.

In modern project environments, cost codes work best when they live inside a unified digital cost catalog. A single, shared structure reduces duplication, keeps financial data consistent, and allows teams to track performance without constant reconciliation. That shift, more than any individual tool, is what moves cost control from reactive to intentional.

Should Construction Cost Codes Be the Same for Every Project?

Yes, at the company level. Cost codes work best when they are consistent across projects, even if some codes are unused on smaller jobs. Changing structures from project to project makes comparisons unreliable and weakens long-term cost insight.

How Detailed Should Construction Cost Codes Be?

Cost codes should be detailed enough to support decisions, not reporting vanity. If a code never changes how a team acts, it is probably too granular. If overruns cannot be traced to a specific scope, it is too broad. The right level of detail sits where performance is actually reviewed.