Construction Taxes 2026: USA, Australia, New Zealand, and Canada Guide

Are you still struggling to navigate the complex web of construction taxes, uncertain about deductions, credits, and compliance requirements that could impact your bottom line?

Lucky for you, we are calling all the builders in the USA, Australia, New Zealand, and Canada as we have gathered all the essential information about construction taxes.

Save our guide and combine it with our construction accounting tools and integrations for further assistance.

Table of Contents

- What Are Construction Taxes?

- Tax Authorities in the USA, Australia, New Zealand, and Canada

- A Secret Weapon to Manage Your Construction Taxes

- What Are the Main Types of Taxes for Builders?

- Final Thoughts

Let’s start from the basics.

What Are Construction Taxes?

The idea behind construction taxes implies various fees and obligations imposed on construction activities and related transactions. These are levied by governmental tax authorities at the local, state, and federal levels, serving as a means to fund public infrastructure, services, and regulatory oversight.

In essence, construction taxes can take several forms, including sales taxes on materials and equipment, property taxes on owned or developed real estate, and income taxes on profits generated from construction projects. It doesn’t matter where your construction business is located. Understanding the nuances of these taxes is crucial to effectively manage their financial obligations and optimize their project budgets.

Tax Authorities in the USA, Australia, New Zealand, and Canada

A tax authority is a so-called governmental body responsible for administering and enforcing tax laws within their respective jurisdictions.

There are several tax authorities relevant to the construction industry in the countries we are discussing today:

The United States

- Internal Revenue Service (IRS): The IRS is the federal agency responsible for administering and enforcing tax laws related to income, employment, and certain excise taxes in the United States.

- State Revenue Departments: Each state has its revenue department responsible for administering state-level taxes.

- Local Tax Authorities: Entities such as counties and municipalities, may also impose taxes relevant to construction activities, such as local sales taxes or property taxes.

Australia

- Australian Taxation Office (ATO): The ATO is the principal revenue collection agency of the Australian government, responsible for administering various taxes, including income tax, Goods and Services Tax (GST), and Fringe Benefits Tax (FBT).

- State Revenue Offices: Each Australian state and territory has its own revenue office responsible for administering state-based taxes, such as stamp duty on property transactions and payroll tax.

- Local Councils: Local governments in Australia may levy taxes and fees related to property development and construction, such as development application fees and infrastructure levies.

Canada

Canada Revenue Agency (CRA) is the federal agency responsible for administering and enforcing tax laws related to income, goods and services, excise, and other taxes in Canada. Also known as the Agence du Revenu du Canada, it is responsible for collecting and managing taxes, as well as delivering social and economic benefit programs.

New Zealand

Inland Revenue Department: The IRD is the government agency responsible for administering and collecting taxes in New Zealand, including income tax, goods and services tax (GST), and excise duties.

When a taxpayer receives an audit letter from the Inland Revenue Department (IRD), it marks the commencement of a comprehensive review process of their tax affairs. This initial communication is crucial as it not only notifies the taxpayer of the audit but also specifies the scope, including the types of taxes and fiscal years involved.

Regardless of location, tax authorities not only enforce tax compliance but are also responsible for collecting revenues and providing guidance and support to taxpayers.

To become an honest construction taxpayer, you should always stay alert to the obligations and requirements set forth by these authorities. This will also help you to ensure compliance and mitigate potential risks.

A Secret Weapon to Manage Your Construction Taxes

We will further break down and explain the main types of construction taxes available for builders operating in the USA, Australia, New Zealand, and Canada.

But before that, it’s crucial to have a versatile platform to assist you through the intricacies of construction accounting, invoicing, job estimations, etc.

Regardless of the location of your professional activity, your construction business may have faced issues with navigating the complexities of construction taxation.

With the constant changes in tax laws and regulations, construction managers can easily become overwhelmed and fall behind in their daily duties. Not speaking of the paperwork it takes to file your taxes accurately.

This is not the case for builders using Buildern as their primary construction project management software.

How Can Buildern Help?

💡If you open an account from Australia, the taxes and insurance configurations, translations, date formats, and other localisations will be automatically set for you.

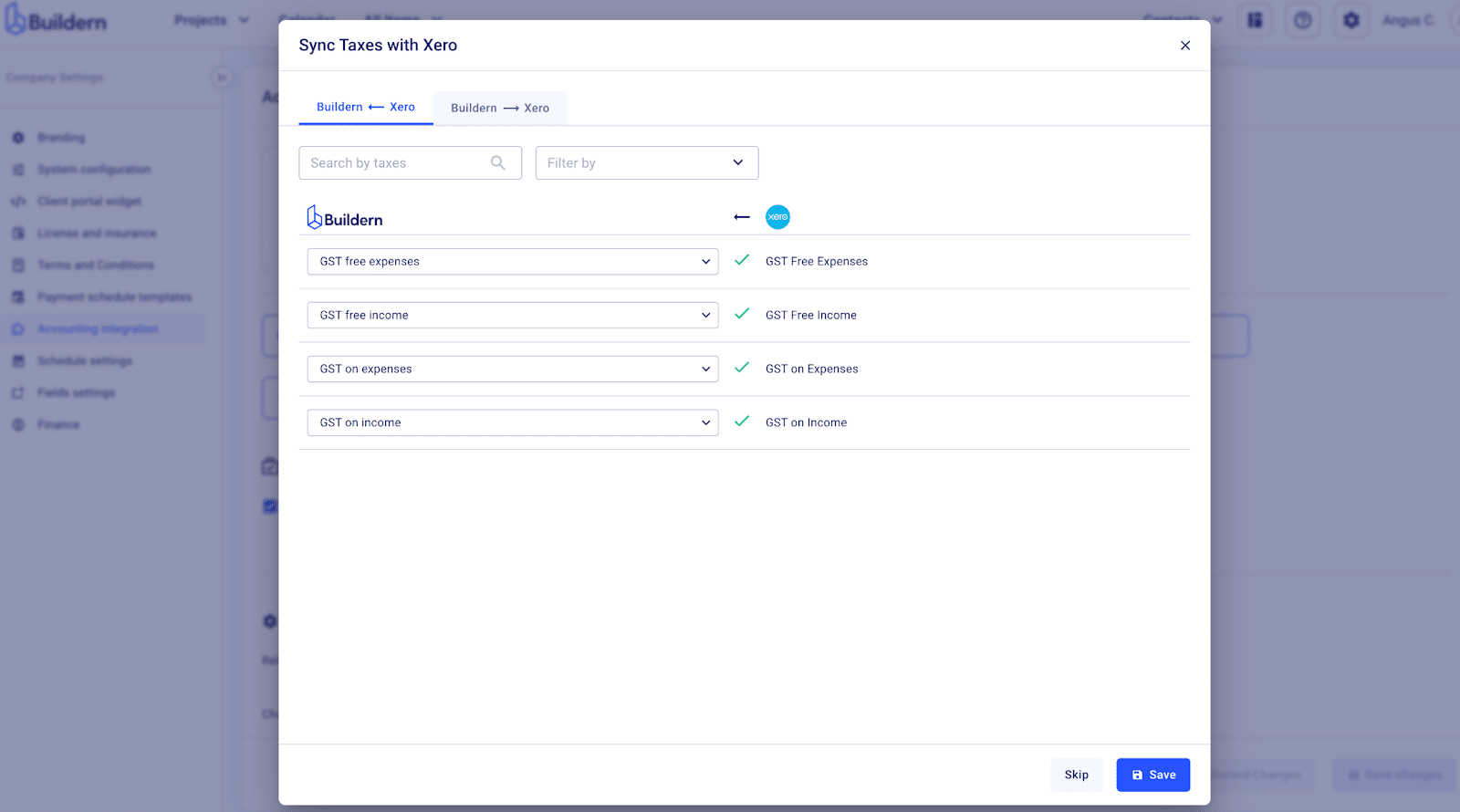

Additionally, as a builder, you’re likely acquainted with Xero and QuickBooks accounting software. With Buildern, users can enhance their experience with construction accounting functionality by seamlessly integrating it with construction-specific financial tracking tools, thereby fully automating the entire process.

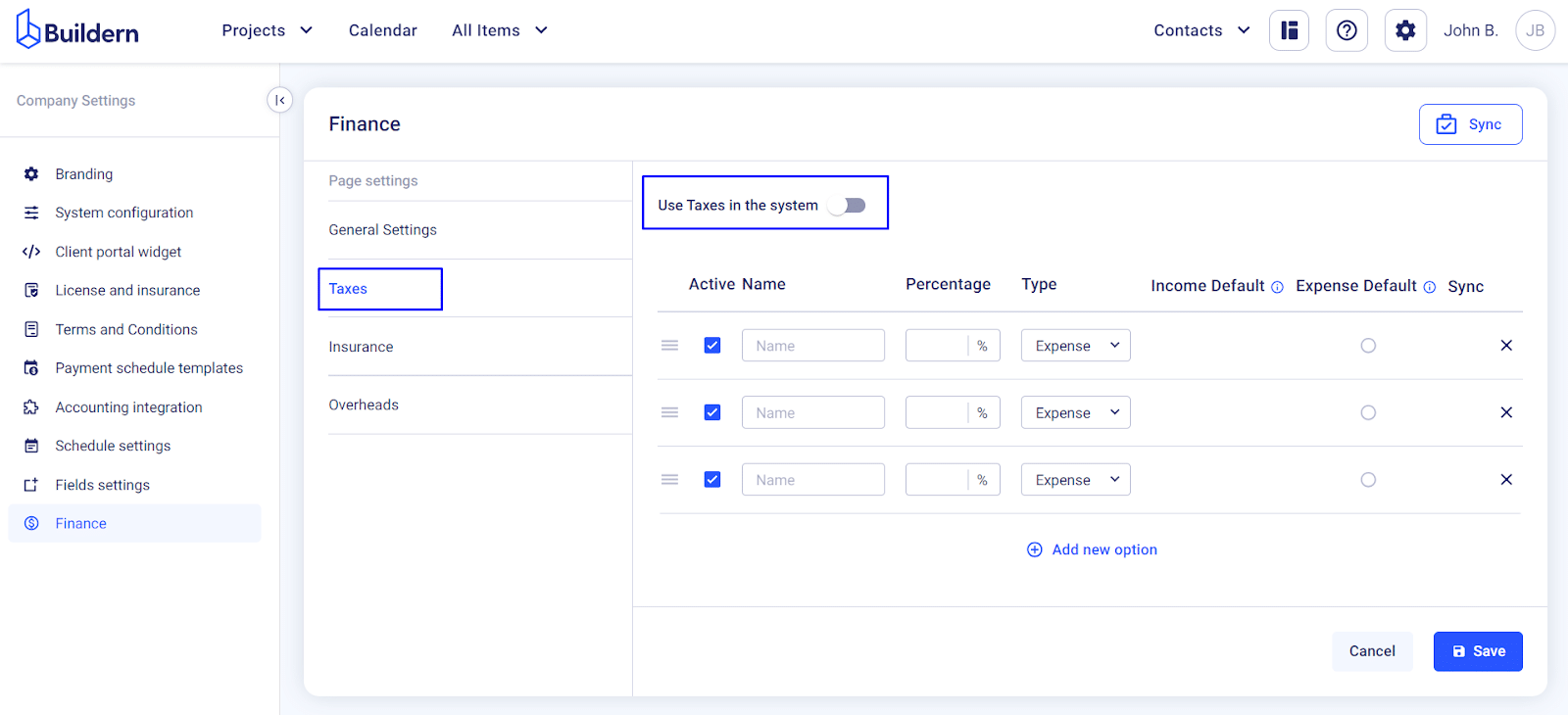

Enabling your taxes in Buildern allows you to manage them through all financial tools, including:

- Estimates

- Bills

- Purchase orders

- Bid requests

- Change orders (Variations)

- Budget

You can have a two-way integration for all your cost codes, sub/vendors, and clients to ensure smooth workflows throughout the project lifecycle.

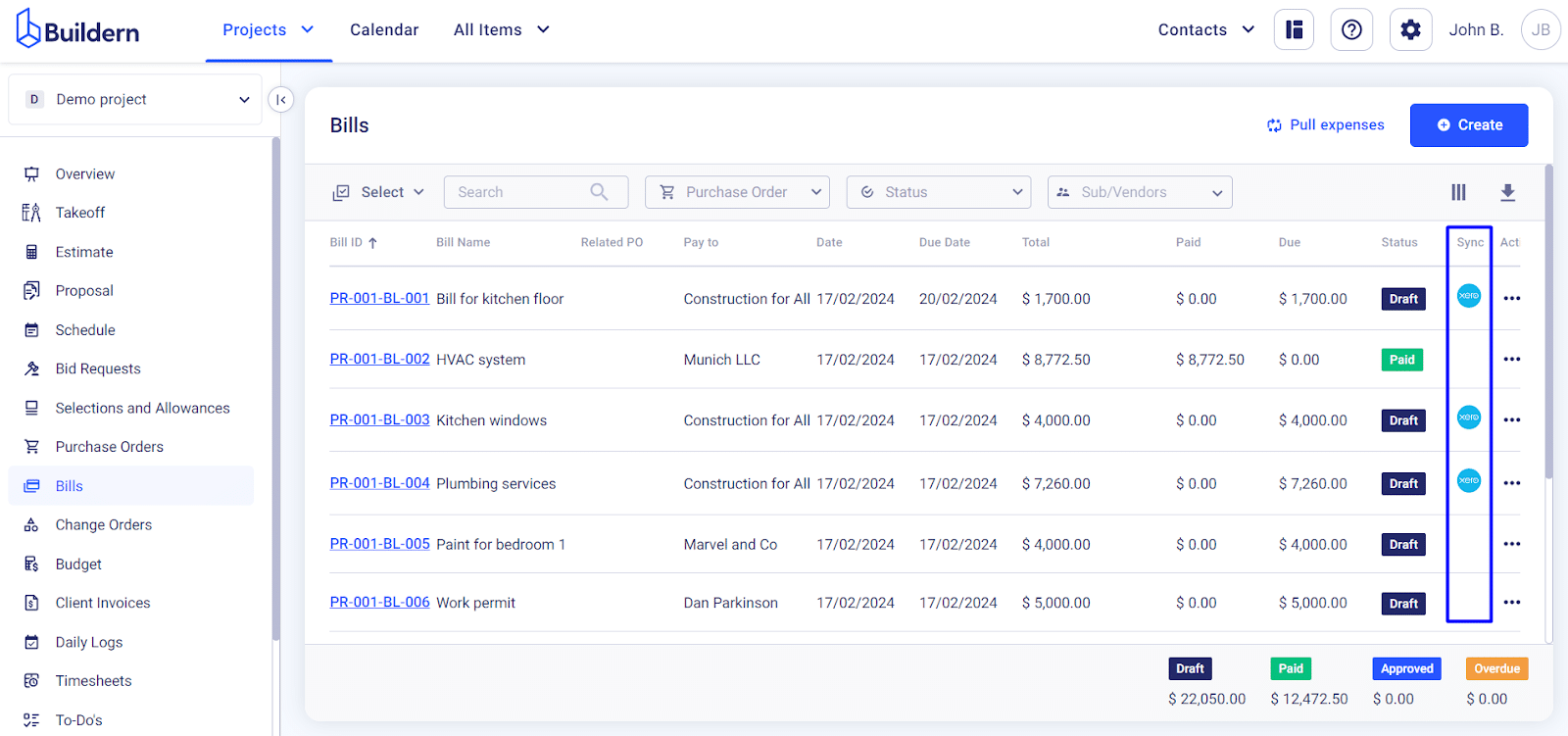

For instance, in the image below, you can see how easy it is to move your taxes from QuickBooks or Xero to Buildern and vice versa.

It will only take a few minutes, but the benefits of integrating Buildern with the accounting software for your construction business are immense. Not only will it save you time and money, but also reduce the risk of errors and manual calculations.

Syncing Taxes: Step-by-Step Explanation

Packed with tools and unique solutions for construction project management, Buildern has gone the extra mile for its users. Syncing construction taxes between your accounting and project management software platforms has never been simpler!

Here’s how to do it:

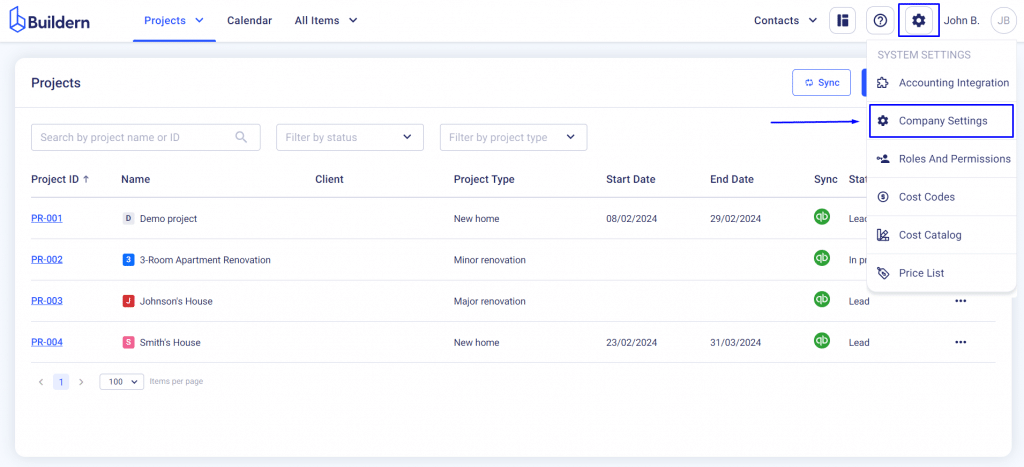

1. Find Your Company Settings

2. Go to the Finance section to add the taxes and don’t forget to turn on using the taxes in the system (to have them accessible through all your financial calculations)

And that’s pretty much it!

Once you save changes, Buildern will automatically include the tax percentage in all calculations.

Sync Bills with Your Accounting Software

Once Buildern connects to your accounting software, it starts to simplify all your financial workflows, including the bills issued by your sub/vendors.

Everything synced with the accounting software will be shown as such in your Buildern account.

Again, thanks to the two-way integration, anything happening with the bills in one software will be automatically updated in the other one. This level of automation will give you peace of mind because you won’t need to double-check every little detail to stay up-to-date. The software will do it for you, ensuring all your records are accurate and synchronized across platforms.

What Are the Main Types of Taxes for Builders?

Enough for the basics.

So, what are the construction taxes you as a builder operating in the USA, Australia, Canada, and New Zealand will need to pay?

Let’s break it into the following buckets:

- Types of Construction Taxes in the USA

- Types of Construction Taxes in Australia

- Types of Construction Taxes in New Zealand

- Types of Construction Taxes in Canada

Construction Taxes in The United States

Depending on the nature of your construction projects, your business may be subject to various types of taxes in the USA. These can include:

Income Tax

Builders and construction companies are typically subject to federal and state income taxes on profits generated from construction activities.

Federal income tax rates for builders vary depending on their earnings, with marginal tax rates ranging from 10% to 37%. This progressive tax system ensures that businesses pay a higher rate as their income increases, affecting how construction companies plan their finances and tax obligations.

Deductions and Credits

Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits.

For builders, this might include deductions for business expenses such as materials, labor, and equipment or credits for adopting energy-efficient practices. Effectively managing deductions and credits can significantly reduce taxable income, thus reducing the overall tax obligation and aiding in the financial planning of construction projects.

Property Tax

This is another significant financial consideration for construction businesses. Property tax is levied on real estate by the local government and is based on the assessed value of the property. Construction companies that own or lease property used in their business operations will find themselves subject to property taxes.

The rate and assessment process can vary greatly depending on the location of the property. Builders must understand the local tax laws to accurately budget for property taxes, as these costs can impact the overall financial health of the operation.

Construction Sales Tax

Technically, there isn’t a specific “construction sales tax.” However, in some states, sales and use taxes apply to the sale or utilization of particular construction services and materials by companies. Regulations regarding sales tax on construction endeavors are dictated by state, and at times, local laws, rules, and ordinances. These criteria differ based on the state, occasionally even by city or county, and can vary depending on project type, client, and various other considerations.

For instance, New Hampshire, Oregon, Montana, Alaska, and Delaware do not impose statewide sales or use taxes. Nevertheless, there are some local jurisdictions in Alaska that levy local sales and use tax for certain construction activities.

Payroll Tax

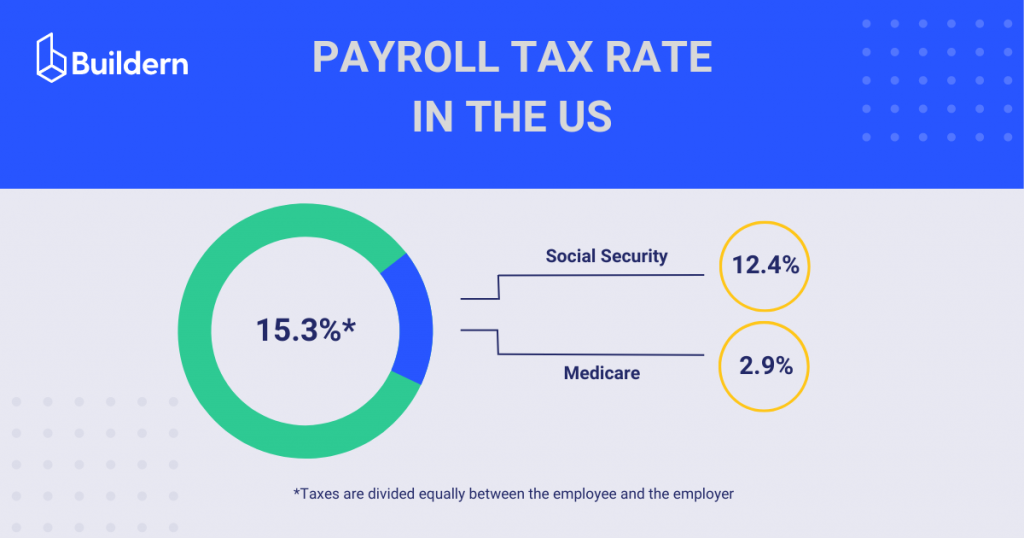

Employers in the USA are also liable to pay payroll tax on wages paid to employees above certain thresholds.

Thus, the payroll tax rate amounts to 15.3% of an employee’s gross taxable wages. This comprises 12.4% for Social Security and 2.9% for Medicare. However, it’s also important to note that these taxes are divided equally between the employee and the employer.

For construction companies, payroll tax compliance can be notably complex due to the nature of the construction workforce, which often includes a mix of full-time employees, part-time workers, and subcontractors. The classification of workers is crucial as it determines who is subject to payroll taxes.

Full-time and part-time employees are typically subject to the aforementioned 15.3% payroll tax, split between the employer and the employee. However, subcontractors, who are considered self-employed, are responsible for the full amount themselves, known as the self-employment tax.

Additionally, construction companies may face different state-level payroll tax rates and obligations, further complicating payroll management. Proper classification and diligent record-keeping are essential to ensure compliance and avoid costly penalties.

Excise Tax

This construction tax refers to a specific type of tax imposed on certain goods and services. While excise taxes are more commonly associated with industries like alcohol, tobacco, and fuel, they can also apply to construction materials and equipment in some jurisdictions.

The construction industry excise taxes may be levied on specific items like heavy machinery, trucks, or any other type of specialized equipment. Custom home builders can also be liable for a luxury excise tax, which is imposed on upscale residences valued over $1 million US dollars.

Australian Construction Taxes

Now, let’s shift our focus to the southern hemisphere.

The Australian construction industry is subject to a diverse array of tax regulations, and staying alert on the latest updates is paramount for builders aiming to thrive in this dynamic environment.

💡Recommeded Reading: Extensive Guide to Australian Construction Industry Peculiarities!

Goods and Services Tax (GST)

Set at a rate of 10%, GST is levied on the selling price of goods and services, with sellers entrusted to collect and remit the tax to the Australian Taxation Office (ATO).

For construction firms, GST compliance also entails accurately computing and disclosing all goods and services transacted within their business operations. This encompasses procurement of materials, subcontractor services, and provision of construction services to clientele.

According to the construction tax regulations, builders operating in Australia must register for GST if their annual turnover surpasses a designated threshold. Post-registration, they should collect GST on taxable sales, issue tax invoices to customers, and report and pay the collected GST to the ATO.

As such, construction companies with a turnover of $75,000 in their first year should register for GST. Yet, this remains optional for businesses with a turnover below the set threshold.

Payroll Tax

If an employer pays $1.3 million AU dollars or more in Australian taxable wages within a fiscal year, payroll tax becomes obligatory. In most cases, the definition of taxable wages encompasses payments made to builders.

Registration for payroll tax must be completed with the Queensland Office of State Revenue (OSR) within seven days following the conclusion of the month in which payments exceeding $25,000 per week in Australian taxable wages are made.

PAYG Instalments

Pay As You Go or PAYG implies regular prepayments of the expected business and investment income. Such installments enable builders to make regular payments towards their expected tax liability throughout the financial year, thereby averting potential cash flow constraints and unexpected tax burdens come tax season.

The PAYG system may be equally beneficial for builders and the government, providing a steady flow of revenue for the latter.

There are specific ways of calculating the PAYG installment rates. So, we suggest you check the official Australian Taxation Office website for an in-depth explanation.

Main Construction Taxes in New Zealand

New Zealand’s tax system is relatively straightforward and has some unique features that set it apart from other countries. Here are some of the key taxes to be aware of in New Zealand:

Goods and Services Tax (GST)

This is a tax on most goods and services in New Zealand, currently set at 15%. Builders must register for GST if their taxable supplies exceed $60,000 in a consecutive 12-month period or if they expect their annual turnover to exceed $60,000.

Once registered for GST, builders must regularly file GST returns and pay the appropriate amount of tax on their sales.

To calculate the GST return, you need to work out your total sales and income, including zero-rated supplies, alongside any debit adjustments. Furthermore, it’s critical to account for your purchases and expenses as well as any credit adjustments. This comprehensive approach ensures accurate reporting and compliance with New Zealand’s tax requirements.

For a more comprehensive guide on calculating GST and other related topics, visiting the IRD website is highly recommended.

Construction Taxation in Canada

Canada Revenue Agency (CRA) provides detailed information about the home construction industry taxation. It all evolves around the PST/GST/HST Regulations.

PST/GST/HST

First of all, you need to know whether you refer to small suppliers or not.

Thus, according to CRA’s definition, small suppliers are:

- If you operate as a sole proprietor and the combined revenue (prior to expenses) from all your global taxable supplies and those of your associates (if associated at the start of the specific quarter) amounts to $30,000 or under in any given quarter and the past four successive quarters.

- If you are a partnership or corporation with total revenues (pre-expenses) not exceeding $30,000 in any single calendar quarter or the last four consecutive quarters, including your associates’ revenues, you may qualify.

- If your organization classifies as a public service entity and the combined revenue (pre-expenses) generated from all global taxable transactions, including those of your affiliates, does not exceed $50,000 within a single quarter and over the past four consecutive quarters, you fall within the threshold. Additionally, charities and public institutions are subject to a gross revenue cap of $250,000.

Register for PST/GST/HST once your total revenues from taxable sources exceed $30,000 in a single calendar quarter or over the past four consecutive calendar quarters.

PST/GST/HST in Quebec and other Provinces

Quebec has a unique position in the administration of GST/HST due to the province’s distinct agreements with the Canadian government. If your business operates within Quebec, the responsibility for filing PST/GST/HST returns falls under Revenu Québec, which involves using specific forms provided by this provincial authority.

This exception underscores Quebec’s autonomous tax framework, distinctly separating it from the rest of Canada’s tax administration procedures. However, there are special considerations for selected listed financial institutions (SLFIs), which are subject to different filing requirements for GST/HST and Quebec Sales Tax (QST) purposes.

This bifurcation of tax filing responsibilities emphasizes the need for businesses and construction companies in particular to thoroughly understand the administrative obligations imposed by their geographical location within Canada, especially if operating in Quebec, to ensure compliance with local and national tax laws.

As for other provinces, the tax percentage differs based on location:

| Province | Type | PST | GST | HST | Total Tax Rate |

|---|---|---|---|---|---|

| Alberta | GST | – | 5% | – | 5% |

| British Columbia | GST + PST | 7% | 5% | – | 12% |

| Manitoba | GST + PST | 7% | 5% | – | 12% |

| New Brunswick | HST | – | – | 15% | 15% |

| Newfoundland and Labrador | HST | – | – | 15% | 15% |

| Northwest Territories | GST | – | 5% | – | 5% |

| Nova Scotia | HST | – | – | 15% | 15% |

| Nunavut | GST | – | 5% | – | 5% |

| Ontario | HST | – | – | 13% | 13% |

| Prince Edward Island | HST | – | – | 15% | |

| Quebec | GST + *QST | 9.975% | 5% | – | 14.975% |

| Saskatchewan | GST + PST | 6% | 5% | – | 11% |

| Yukon | GST | – | 5% | – | 5% |

Final Thoughts

So, what’s the bottom line here?

We now know that construction taxes demand diligence, understanding, and effective management. Whether you’re operating in the USA, Australia, New Zealand, or Canada, the complexities of tax regulations can present significant challenges for your construction projects. However, amidst these challenges, there are tools that can help you streamline tax management and focus on stuff that do require your attention.

With features designed to adapt to local tax regulations and streamline financial workflows, construction management software like Buildern is what every builder needs.

Integrating construction taxes with your accounting and project management software will save you even more time and effort. You will have the process automated and will also be able to track the progress and profitability from a single source of truth.

Try Buildern today and see how easy managing construction taxes can be! 🏗️