What is General Contractor Financing for Homeowners? [Types, Benefits, and Builder Tips]

![What is General Contractor Financing for Homeowners? [Types, Benefits, and Builder Tips]](https://buildern.com/resources/wp-content/uploads/2025/07/BLOG_COVER_General-Contractor-Financing-for-Homeowners-768x501.jpg)

Financing has become a quiet dealbreaker in residential construction. Even motivated clients hesitate when they hit the funding wall. For builders, that’s time spent quoting jobs that never break ground.

The solution is to offer clear, accessible financing and construction loan options upfront. When builders understand the tools available and frame them properly, projects move faster, scopes grow, and clients stop shopping around.

Let’s break down how general contractor financing works, what builders can offer, and how it benefits both sides of the deal.

Table of Contents

- What Is General Contractor Financing?

- 5 Common Types of Contractor Financing Options

- Benefits of Financing for General Contractors

- Benefits of Financing for Homeowners

- 5 Tips to Improve Your Financing Options as a Builder

What Is General Contractor Financing?

General contractor financing refers to any arrangement where a builder connects their client with funding options to help pay for a construction or remodeling project. The financing isn’t issued by the contractor, but it’s often built into the process, quoted alongside the estimate, discussed early, and positioned as part of the full project experience.

Such options aren’t about offering handouts but helping clients start the work they’ve already decided they want to do. Whether it’s a $20,000 kitchen upgrade or a $100,000 Accessory Dwelling Unit (ADU), financing smooths the path from plan to execution.

Builders that offer financing options or even just guide clients toward them position themselves as more than tradespeople. They become trusted partners in the process. And that makes a measurable difference in close rates, job sizes, and client confidence.

Difference Between Contractor-Arranged Financing vs. Homeowner-Initiated Loans

The key difference lies in who takes the lead and when.

With contractor-arranged financing, the builder partners with a third-party financing provider or platform. The client gets an offer as part of the estimate or proposal, often right on the spot. It’s fast, streamlined, and doesn’t require the client to leave the conversation.

With homeowner-initiated loans, the client independently applies for financing through a bank, credit union, or online lender. It’s separate from the builder’s process. The timeline is slower, the approval terms may vary, and the builder often isn’t looped in until funds are released.

Contractor-arranged options tend to result in fewer drop-offs and cleaner project starts. Clients don’t need to pause, research lenders, or delay decisions. Everything’s integrated, and that makes a real difference when momentum matters.

5 Common Types of Contractor Financing Options

Below is the detailed comparison table of the most common ways clients fund projects when financing is involved. Not all of these will be arranged by the builder directly, but understanding each gives contractors a stronger hand at the table.

| Financing Option | Type | Who Arranges It | Best For | Key Pros | Key Cons |

|---|---|---|---|---|---|

| Home Improvement Loans | Unsecured Personal Loan | Client or Builder | Clients needing upfront cash | Fast approval, no collateral, fixed monthly payments | Higher interest than secured loans |

| Home Equity Loans / HELOCs | Secured Loan (Home Equity) | Client | Larger, long-term projects | Lower interest, higher borrowing limits | Slower process, more paperwork |

| BNPL (Buy Now, Pay Later) | Short-Term Installment Plan | Builder via BNPL Provider | Small to mid-sized projects (≤ $20K) | Quick approval, no upfront payment for client, builder gets paid upfront | Limited to lower-cost, simpler scopes |

| Trade Credit | Deferred Payment to Vendors | Builder | Material and labor cost management | Preserves cash flow, supports scaling, improves vendor relationships | Not client-facing, credit terms vary |

| Business Credit Cards | Revolving Credit Line | Builder | Covering short-term or emergency costs | Flexible, easy access to funds | High interest if not repaid quickly, can lead to debt if misused |

Home Improvement Loans

These are unsecured personal loans tailored for renovations or repairs. Because they don’t require collateral, they’re easier to obtain than home equity loans. Lenders look at credit score, income, and project scope. Approval is often fast, sometimes in minutes.

For builders, this is the go-to recommendation when a client needs upfront cash. Many financing platforms used by builders (like Enhancify) are built around this loan type.

The appeal? Predictable monthly payments, fixed interest rates, and project funds that arrive in a lump sum. That means clients can say “yes” without waiting weeks, and builders can start without chasing deposits.

Home Equity Loans & HELOCs

These financing methods tap into the client’s existing home equity. A home equity loan gives them a fixed lump sum with a set repayment schedule, while a home equity line of credit (HELOC) functions more like a credit card.

For larger projects, especially those with long timelines or higher costs, this can be a smart move for homeowners who qualify. Interest rates tend to be lower since the house backs the loan, but the process takes longer and involves more paperwork.

From a builder’s perspective, these aren’t typically arranged directly, but clients will often ask if this route is viable. Knowing how these work and when they make sense helps builders keep the conversation moving and avoid being caught off guard when money questions arise mid-scope.

Buy Now, Pay Later (BNPL) Plans

In construction, the BNPL general contractor financing options work through special financing providers that offer short-term installment options (often with 0% interest for the first few months). For homeowners, that can be a compelling reason to approve the quote on the spot.

These platforms typically handle credit checks, approvals, and payments. The builder gets paid upfront, while the customer spreads the cost over several installments. The entire process is fast and embedded in the estimate or proposal.

This option is gaining traction for small to mid-sized jobs like kitchen remodels or outdoor upgrades. It’s not ideal for complex builds, but for everyday projects under $20K, it removes the sticker shock that might otherwise derail the sale.

Trade Credit

Builders themselves sometimes receive financing through trade credit, though it’s less about client payments and more about easing contractor cash flow.

Suppliers and vendors may offer 30-, 60-, or even 90-day payment terms on materials. That gives builders breathing room to get paid by the client before settling their invoices. When used well, this financing method helps general contractors front-load materials and labor without draining operating capital.

It’s not a customer-facing solution, but when structured carefully, trade credit supports the builder’s ability to manage bigger jobs without tying up cash. It also strengthens supplier relationships that matter for long-term margins and project speed.

Business Credit Cards

A more accessible form of short-term financing, business credit cards are often used by small contractors or remodeling companies to float smaller project expenses. From material purchases to emergency rentals, cards offer flexibility.

However, interest rates can be steep if balances aren’t paid off quickly. Still, for experienced builders who manage cash flow tightly, it’s a viable bridge between milestones or draw payments.

💡It’s important to note: these are tools for builders, not clients. But they become part of the larger financing picture, especially when a job requires upfront work before client financing clears.

Benefits of Financing for General Contractors

When contractors make financing part of the project conversation early, they make it easier to close deals and shape the entire sales process. This allows gaining better control over how and when the job moves forward.

Below are the key benefits general contractors gain when they offer or support financing options for their customers.

- Faster Project Approvals: Presenting financing upfront shortens the time between estimate and agreement. Clients can get pre-qualified while reviewing the proposal, reducing delays and helping jobs move forward without stalling in the decision phase.

- Larger Project Scopes: With financing options available, clients are more likely to commit to the full scope of work rather than trimming back due to cash limitations. This leads to higher contract values without upselling pressure.

- Improved Close Rates and Client Trust: Estimates that include financing options look more professional and complete. Clients appreciate the clarity and simplicity, making them more likely to choose the builder who offers a smoother experience.

- More Predictable Cash Flow: Financing platforms often pay the contractor directly within days of approval. This minimizes reliance on client deposits and ensures builders have the funds needed to start work on time.

- Competitive Advantage in Crowded Markets: Offering or supporting financing positions a builder as organized and solution-oriented. It gives clients confidence and often becomes a deciding factor when comparing bids.

Benefits of Financing for Homeowners

Most clients know what they want done. The hesitation often begins when they see the final number. Even motivated homeowners start second-guessing their project once it feels like too much money all at once.

Contractor financing gives them breathing room. It turns a large, one-time cost into a structured plan, something easier to understand, manage, and move forward with.

- Reduced Upfront Cost Pressure: Most homeowners know exactly what they want until the quote lands. With financing, they can follow through on the original plan without watering it down.

- Clear, Predictable Monthly Payments: When clients see a fixed amount they’ll owe each month, it gives them something real to work with, something they can plan for. That turns a several-thousand-dollar project into a manageable decision.

- Faster Financing Decisions: Left on their own, clients might spend days emailing banks or comparing loan offers. When you show them financing options during the estimate, that whole waiting game disappears. They can get approved and get moving.

- Increased Client Confidence and Trust: Bringing financing to the table shows you’re thinking ahead. It tells the client, “I’ve done this before. I know how to help you get there.”

How to Offer Financing as a Contractor

You don’t need to become a lender to help clients fund their projects. Most of the time, your role is simply to connect the dots linking the right customer to the right financing tool at the right moment in the sales process.

Builders have two main ways to do this effectively:

- Partnering with a financing provider

- Integrating options into the estimate itself

Both approaches work. Most builders use a mix of the two, depending on project size, client readiness, and their internal systems.

Option 1: Partnering with Contractor-Partnered Financing Platforms

Some builders assume financing is out of their hands. However, today, several platforms make it easy to connect clients with pre-vetted lenders, eliminating the need for a license and handling funds yourself. These platforms are built for contractors and designed to simplify the approval process.

Here are two standout options from the industry:

Hearth

Hearth provides a financing portal that contractors can share with clients through email, QR code, or directly inside proposals. The platform lets homeowners check rates and offers through multiple lenders, without affecting their credit score. Funds are sent to the homeowner once approved, and the contractor gets paid as usual.

What makes Hearth effective is its speed and simplicity. Homeowners get real loan options within minutes, and contractors can track pre-approvals to keep the job on schedule.

Finance of America Home Improvement

This platform focuses on offering fixed-rate installment loans for residential projects, including remodels, additions, and energy upgrades. Contractors apply to become approved partners, and once enrolled, can walk homeowners through the financing process.

The loans are designed with homeowners in mind, but contractors benefit by keeping the sale moving without waiting for third-party approvals. It’s a strong fit for mid-size residential projects where sticker shock might otherwise derail the scope.

Option 2: Integrating Financing into Proposals

Financing shouldn’t be an afterthought. The most effective time to introduce it is with the estimate, not a week later. Builders who include financing options directly in their proposals keep the process tight and reduce the chance of a deal falling apart in the follow-up.

Instead of forcing homeowners to search for loans on their own, you’re offering a direct next step. This builds trust and speeds up decision-making.

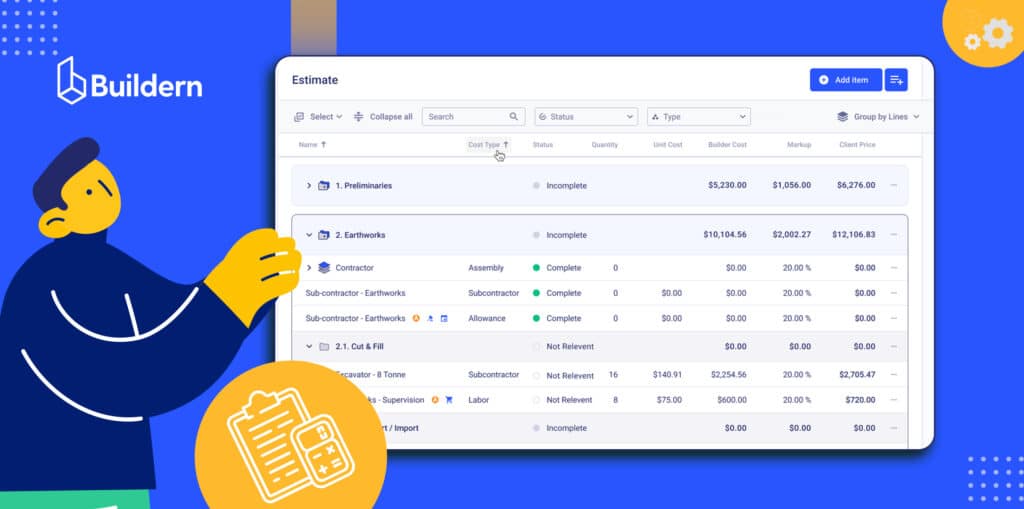

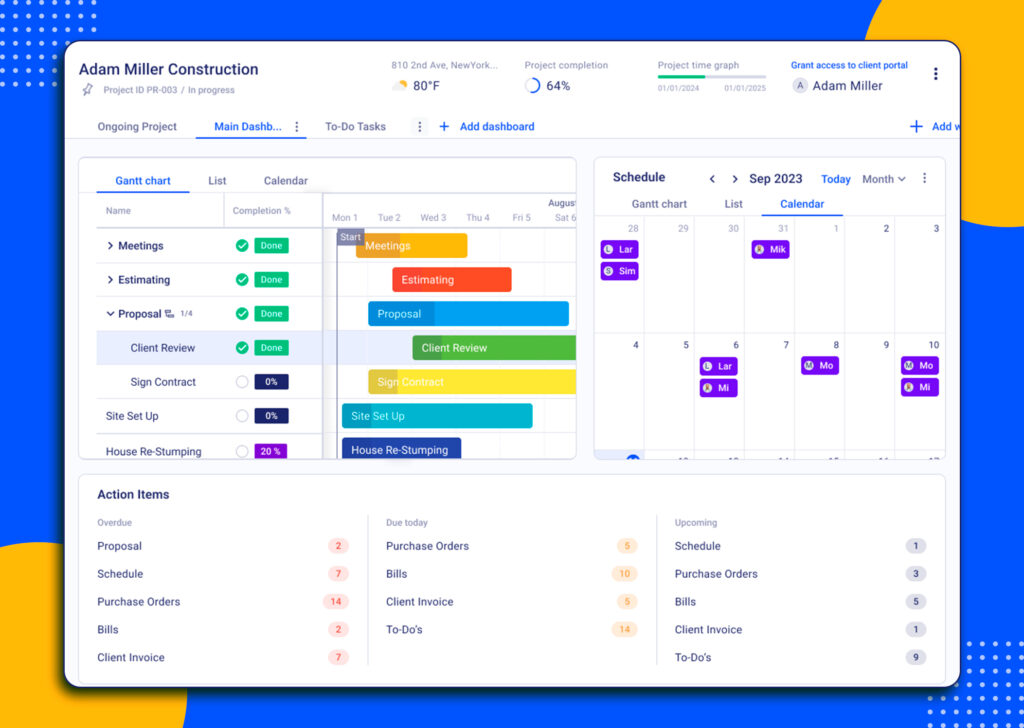

Specialized estimating software can make the process even easier. You can create detailed, line-item proposals that include cost breakdowns, payment structures, and space to note available financing options. That way, the client sees the full picture, not just what the project costs, but how it can be paid for.

You don’t need to offer financing directly. You just need to make it part of the conversation early. When it’s integrated into the estimate, clients stop thinking “Can we afford this?” and start thinking “How do we get started?”

5 Tips to Improve Your Financing Options as a Builder

Not all financing offers are equal, and not every contractor gets access to the best tools. Lenders and platforms often look beyond your trade skills. They want to work with builders who show stability, professionalism, and good track records.

Here’s how to strengthen your position and give clients better financing options.

#1 Maintain Strong Licensing and Insurance Records

General contractor financing providers want assurance that the builder is reliable and fully compliant. Therefore, we suggest keeping your contractor’s license active and up to date, with no lapses or unresolved issues.

The same goes for general liability insurance and workers’ compensation coverage. Some lenders won’t work with contractors who aren’t insured, even if the client is the one applying for the loan.

#2 Keep Clean Payment Histories and Professional Documentation

If you’ve been in business a while, lenders may look at how you manage billing and collections.

- Are your client invoices clear?

- Do you avoid disputes or late payments?

- Do you document change orders, work approvals, and progress billing properly?

Even when you’re not applying for credit, your track record matters. Clean paperwork and consistent communication give financing partners more confidence that your jobs won’t stall or get messy.

#3 Build Relationships with Local Lenders and Fintech Platforms

You don’t have to rely on national providers. Many local credit unions and regional banks offer home improvement loans, and they’re often more flexible than big-name institutions.

Reach out to lenders in your area, introduce your business, and ask if they work with contractors. Some will be happy to send brochures or set up a referral partnership.

#4 Use Construction Management Software to Track Project and Payment Data

Financing is easier to manage when your business is organized. If your estimates, schedules, and payment milestones are scattered across spreadsheets, it’s harder to prove reliability to a lender or the client applying for one.

With all your project documents, proposals, and cost tracking in one place, you can show real numbers when needed. It’s also easier to manage draw schedules and invoice clients who are paying through third-party loans.

Can general contractors directly offer financing to clients?

Yes, but “offering financing” typically means partnering with a lender or using a platform (not lending your own money). Builders often use platforms like Hearth, Acorn Finance, or Joist to embed third-party financing tools into proposals or invoices, allowing customers to apply without affecting credit initially and keeping funds flowing quickly.

What are the risks of offering financing as a builder?

The biggest risk isn’t your money, but the paperwork and timing. Financing platforms usually pay you upfront; nevertheless, if clients delay approvals or miss payments, you might face job slowdowns or administrative hassle. Clean documentation and clear scopes help protect both sides.

Is financing available for small-scale renovation projects?

Absolutely. Many specialized platforms support loans from $1,000 up to $100,000+, with fast approval and funding in 1-2 days. BNPL options also work well for projects under $10K, giving homeowners accessible monthly payments and builders predictable cash flow.

Does offering financing affect when I get paid as a builder?

When done right, financing gets you paid faster. With integrated tools, clients apply early, lenders advance funds to the contractor within a couple of business days, and invoicing lines up with the loan draw. That means fewer delays, less chasing down payments, and steadier cash flow.