Construction Retainage: Risks and Solutions for General Contractors

Updated September 22, 2025

The construction industry is a risk-intensive business. Owners have to make sure that their investment is secure while contractors try to maximize their profit margins.

Considering the sensitive nature of construction projects, where each party has its own vested interests, each party tries to add security for its benefit.

One such measure is the use of a retainage fee, which is a percentage of the contract amount that an owner withholds from a contractor until the completion of the project.

In my article, I will discuss construction retainage, where it comes from, whether it is still relevant in today’s construction industry, and how construction management software can help in calculating it.

Table of Contents

- What Is Retainage in Construction? A Detailed Definition

- How Retainage Works?

- Why Retainage in Construction Is a Threat to Contractors

- Construction Retainage Based On Your Location

- How to Calculate Retainage with Software?

- Key Takeaways

What Is Retainage in Construction? A Detailed Definition

Retainage fee (I can also call it contract retention or holdback) is usually 5-10% of the contract value that an owner holds or retains from the general contractor’s payment until the project is substantially complete.

From an owner’s perspective, it serves as a form of security against potential risks such as contractor default or incomplete work. Meanwhile, contractors can fairly argue that retainage poses a significant financial burden and cash flow issues for them.

What is Substantial Completion?

The word “substantially” is the key word here. It indicates that retainage is not released upon completion of the project but only when it reaches a certain level of completion defined in the contract.

Usually, this term is used when the project is ready for its intended use or occupancy, even though minor work items may still need to be completed. It largely depends on how the contract for the specific project defines substantial completion.

It’s of the utmost importance to ensure no ambiguity in the contract language when it comes to defining what is meant by “substantial completion,” as it could result in disputes between owners and contractors, resulting in receiving your complete payment, including construction retainage, later than expected (or not receiving it at all, pardon our pessimism).

Here are some nuances you should know about retainage.

💡A quick explanation of terminology before we move forward:

Quite often, you will see the terms of construction retainage and construction retention used interchangeably. While retainage refers directly to the sum of money withheld, retention is more about the process of withholding that money. In this article, we use both terms to refer to the same thing – withheld money.

How Retainage Works?

Dealing with client invoices is one of the most complicated tasks the general contractors face. Add retainage to the financial management, and the process becomes even trickier.

Calculations

If your retention of payment is 10% ($10,000 from a $100,000 total contract), then 10% will be withheld from each progressive payment.

Most importantly, it’s not a total of $10,000 from your last payment or at the very beginning of the project. It’s a distinction that contractors should keep in mind to avoid cash flow issues during the project.

When Are Contractors Paid Retainage?

Typically, contact retention is released, and the general contractor receives their complete payment at the end of the project.

However, no law or rule says it has to be done this way. It’s a subject of negotiation between the owner and contractor and can be determined by the contract itself.

Some contracts may have a specific milestone or percentage of completion where retainage is released, while others may hold it until final completion.

Percentages Can Vary

Though a typical retainage percentage is 5-10%, this can vary depending on the project and jurisdiction. Certain states set upper limits on retainage, such as “no more than 5%” or “no more than 10%”. Others leave it up to the parties involved to negotiate the percentage.

If you are wondering which rate to apply, I would recommend studying local and federal laws and regulations. Understanding industry standards can help contractors protect themselves from unreasonably high retainage percentages.

Besides, retainage is not always mandatory. The use of retainage also depends on the type of project and its complexity. For example, smaller residential projects may not include retainage, while larger commercial or public projects usually do.

Subcontractors Feel the Impact More Than General Contractors

There is a chain effect when it comes to construction retainage. An owner holds back money from the general contractor, who, in turn, holds back money from their subcontractors and so on.

And since subcontractors usually perform only a specific part of the project, their work is considered completed far before the general contractor’s work is completed.

As a result, subcontractors may wait longer to receive their retainage, especially if their part of the project is completed in the first stages of the project. Meanwhile, even if they aren’t yet paid for their completed work, subcontractors are still expected to pay their workers and suppliers on time.

This can create a significant financial burden for subcontractors, who may struggle to maintain positive cash flow throughout the project.

Why Retainage in Construction Is a Threat to Contractors

From my experience, maintaining a positive cash flow is already a challenge for constructors because of the long payment cycles. Meanwhile, withholding a specific sum of money from each payment can result in an even more significant financial burden.

Let me list some challenges that contractors face:

- Retainage can be higher than the contractor’s profit margin, which means the contractor works with no financial gain for the whole project duration.

- There are frequent retainage abuses. Some owners or general contractors may try to hold back retainage as long as possible, even after the project is completed and all necessary approvals have been obtained.

- In some cases, owners try to avoid paying the retainage altogether, which means contractors have to pursue legal action to receive the money they are entitled to.

Thus, while retainage is meant to protect owners, it often creates serious financial difficulties for contractors.

Construction Retainage Based On Your Location

Except for the countries or states where having a retainage in construction is obligatory, you are free to negotiate its absence or some other, safer alternative with the individual entity you do business with.

I will provide you with an overview of the retainage specifics by location, as retainage regulations differ by country or state.

Retainage Fee in the USA

Retainage is a common practice in many states across the United States. However, the rules differ depending on the location and project type.

Retainage is banned on federally funded projects. Meanwhile, private/commercial construction projects are mainly subject to retainage in 49 states. However, there is an exception that works in the case of New Mexico. This state enacted sweeping reform legislation in 2007 that prohibits retainage for most public and private construction projects.

Many states in the US are required by law to reduce the maximum rate of retainage to 5% or even less. Several states, including Missouri, Kansas, and Tennessee, allow construction project stakeholders to have substitute security on private projects.

💡As state regulations frequently change, I recommend that contractors consult local laws and regulations before signing a contract, verifying any information about retainage provided by this article at the time of reading.

How Are General Contractors Protected From Not Receiving Retainage?

Owners have the right to withhold retainage, but they have to release it once contractors, subcontractors, or suppliers fulfill their contract obligations. If retainage isn’t paid after project completion, contractors must act quickly to secure their rights.

For private projects, the most common option to act is filing a mechanics lien. If the homeowner refuses to pay, the lien can ultimately lead to foreclosure, forcing the sale of the property to satisfy the debt.

Moreover, to enforce lien rights, contractors must follow strict deadlines and usually provide a preliminary notice at the start of the project. Missing these steps can simply make the claim invalid.

But what works for private projects does not work for public constructions. Here, mechanics’ liens don’t apply. Instead, contractors rely on payment bond claims. They file a claim against a surety bond posted for the project. The surety then investigates and, if the claim is valid, pays out the retainage.

In both cases, the process is time-consuming and requires a lot of paperwork.

Retainage Fee in Australia

Withdrawing retainage in construction is not forbidden in Australia, so owners have the right to withhold retention. It usually ranges from 5 to 10% of the general contract price, and it’s largely dependent on the type of construction contract signed.

There is a retention clause in construction contracts that describes the amount that is retained. It is also mentioned when and how the amount will be paid to the contractor.

In Australia, they have a liability period clause. It’s a period of 3-12 months after the reference date of the final payment or the date specified in the construction contract. During this time, a building expert inspects the property and assesses the quality of the contractor’s work. They determine if any defects need to be improved before final payment is made.

In case of any dispute, you can refer to a qualified person, known as an adjudicator, to start an alternative dispute resolution process.

How to Calculate Retainage with Software?

When a general contractor runs several projects with multiple invoices and contract types, in my experience, it’s better to choose automation to avoid mistakes.

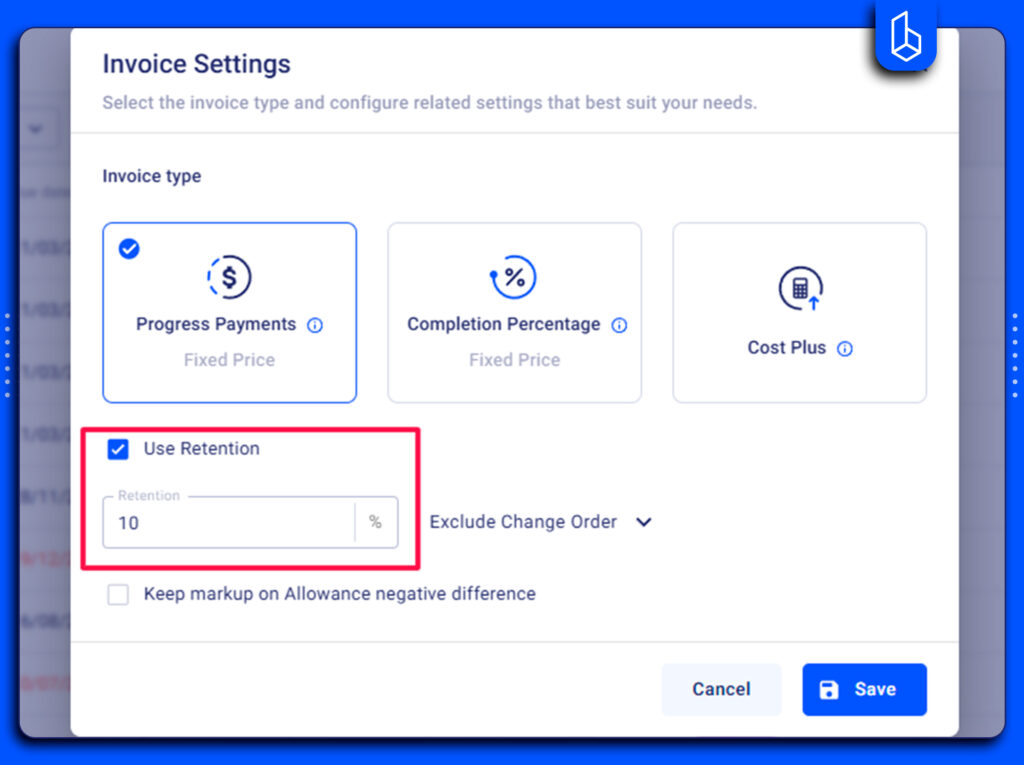

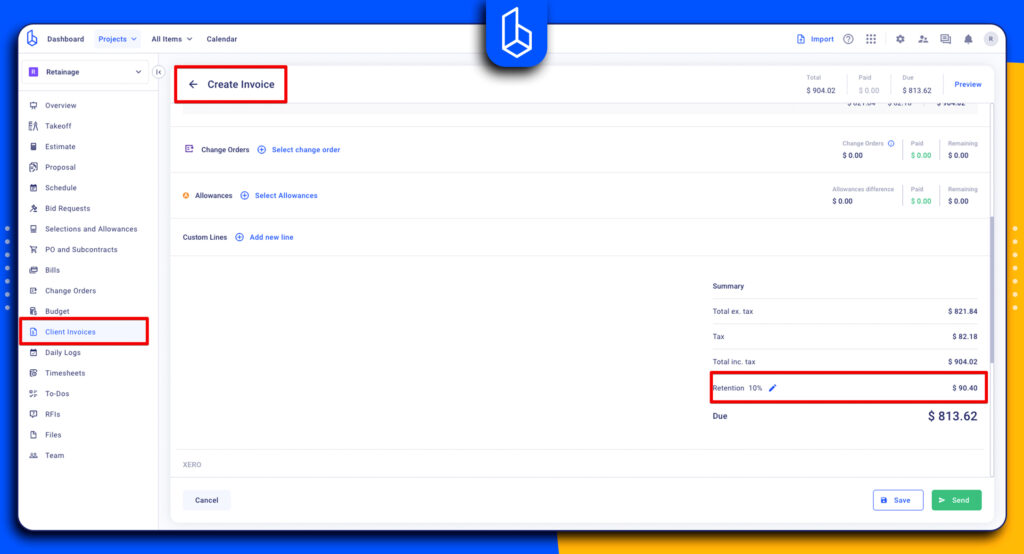

With software, contractors simply set the retainage percentage once in the project, and it is applied to all invoices. Regardless of the invoicing type, you set the retention for the entire project. There is no need to calculate everything manually or enter data each time you write an invoice.

By automating retainage calculations, you save time and prevent disputes. Overall, with software, you have real data of the project, including bills, excluding and including taxes, so there is no need to monitor data through different spreadsheets and platforms.

What is the Typical Retainage Percentage in Construction?

Retainage in construction usually ranges from 5% to 10% of the contract value. However, it mainly depends on the contract terms. Besides, there are projects like public construction where retainage is not permitted in some countries. The percentage also varies depending on the local regulations.

Can Subcontractors Also Be Affected by Retainage?

Yes, as general contractors often pass retainage to subcontractors. Thus, subcontractors may wait even longer to receive their payment. It creates significant problems and cash flow challenges for smaller businesses.

Can Retainage be Managed with Software?

Construction management software can include retention as part of the financial management. Thus, when a client sees the invoice, there can be a percentage of the retention along with other information. Usually, the percentage is included at the beginning of the project.

Key Takeaways

- Retainage is a security measure: Owners withhold 5–10% of payments to ensure contractors complete work and fix defects before getting paid.

- Substantial completion: Retainage is typically released when the project is ready for use, not necessarily fully finished.

- Abuse risks exist: Some owners delay or avoid paying retainage, forcing contractors to pursue legal action.

- Location matters: It’s essential to study the local laws and regulations to understand how retention is managed in your location.

- Software simplifies retainage: Automating calculations across invoices prevents errors, saves time, and improves visibility.