Extensive Guide to Australian Construction Industry Peculiarities 2026

The Australian construction industry is a vital contributor to the country’s economy, generating billions of dollars in revenue and employing hundreds of thousands of workers.

However, the industry also faces its unique challenges and peculiarities that require careful consideration for businesses and individuals operating within it.

In this extensive guide to the Australian construction industry, we will provide valuable insights, industry statistics, regulatory framework, construction practices and techniques, and the use of construction management software by Aussie builders.

Table of Contents

- Australian Construction Industry in Facts and Figures

- Australian Construction Laws and Regulations Breakdown

- Australian Construction Taxes and Accounting

- How Can Australian Builders Handle Construction Accounting?

- Construction Insurance Types in Australia

- Understanding Aussie Building Jargon

- Bottom Line

Australian Construction Industry in Facts and Figures

The Australian construction industry is a major contributor to the country’s economy, and it employs over a million people. In fact, the industry reported a gross value added (GVA) of around 175 billion Australian dollars as of December 2024.

However, despite its economic importance, the industry faces some challenges. One of the most critical issues is the ongoing skilled labour shortages. Rising material costs and high rates of project deferral or abandonment continue to pressure businesses nationwide.

Australia Construction GDP Share

The 2025 industry report shows the construction industry composed 7% of the country’s GDP.

The residential construction sector is a key driver of the industry’s growth. However, the non-residential and commercial property sectors have also been buoyant, with a surge in demand for office spaces and commercial buildings in recent years.

The demand for commercial and non-residential building work has shown signs of stabilising, but the broader office market remains mixed due to changing work patterns and varying vacancy levels in some cities.

As a result, construction companies are adapting with innovative design approaches, digital tools, and sustainable practices to better meet the needs of clients.

Recommended reading:

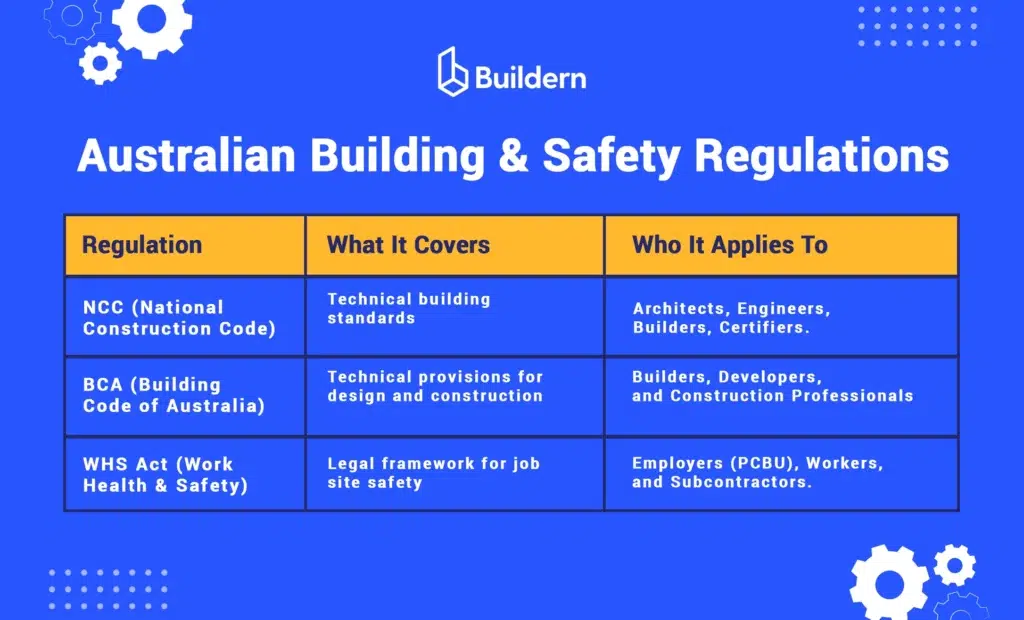

Australian Construction Laws and Regulations Breakdown

Now, let’s examine standards, various laws, and regulations that ensure the safety of workers and the general public in Australia.

I will cover some of the core fundamentals to give you a better understanding of your rights and obligations.

The Building Code of Australia (BCA)

As one of the key pieces of legislation, the BCA sets out minimum requirements for the design and construction of new buildings, renovations, and alterations. It covers areas such as fire safety, energy efficiency, and accessibility to ensure safe and sustainable building and plumbing systems.

Due to regular updates, the BCA reflects changes in building technology and safety standards. However, it best works in collaboration with local laws, resulting in deeper enhancement and protection of the building environment.

Thus, in addition to the BCA, state and territory governments have their building and construction laws, which may vary slightly depending on the jurisdiction.

For example, some states may require builders to hold a specific license or registration, while others may have different rules.

OSHA Occupational Health Services Australia

The OHSA protects the workers’ health, safety, and welfare, as well as those who may be affected by work activities, such as visitors to a worksite or members of the public. The main purpose of the OHS Act 2004 is to prevent work-related injuries, illnesses, and fatalities.

That said, all workers have the right to get protection under this Act, including employees, contractors, sub-contractors, and outworkers in State Government departments.

In Australia, the OHS Act is governed by the Work Health and Safety Act (WHS), which is a national law that applies in all states and territories. The WHS Act sets out the general duties and provides a framework for managing health and safety risks.

It is also supported by a range of regulations, codes of practice, and guidelines, which provide more detailed guidance on specific issues.

Some of the key areas that OHSA law regulates in Australia include the following:

- Workplace hazards

- Consultation and participation

- Training and instruction

- Incident reporting and investigation

- Rehabilitation and return-to-work programs

The National Construction Code (NCC)

Falling under the responsibility of the Australian Building Codes Board (ABCB), the NCC combines regulations for the design, construction, and performance of buildings, plumbing, and drainage systems across Australia.

It’s a set of technical standards to ensure the safety, health, and amenity of buildings for their occupants and the wider community.

There are strict minimum requirements for those willing to comply with NCC:

- fire safety

- health

- sustainability

- accessibility compliance

The NCC aims to harmonise building regulations across Australia, reduce red tape and compliance costs. It also responds to emerging trends and issues, such as sustainability, climate change, and digital technologies.

Recommended reading:

Australian Construction Taxes and Accounting

Construction taxes in Australia differ from those in other parts of the world. As an authoritative federal regulator, the Australian Taxation Office (ATO) defines the compulsory tax requirements of the country’s construction industry.

Businesses involved in the construction sector must register for tax and comply with the Goods and Services Tax (GST). The list includes the Pay As You Go (PAYG) withholding and the Taxable Payments Annual Report (TPAR).

What Is GST for Construction?

The Goods and Services Tax (GST) is a value-added tax that applies to most goods and services sold or consumed within the country. GST is applied at a rate of 10% on the sale price of goods and services.

For construction companies, GST reporting involves accurately calculating and reporting all goods and services provided or received as part of their business activities. This includes materials and supplies, subcontractor services, and selling construction services to clients.

Under the GST system, construction companies are required to register for GST if their annual turnover exceeds a certain threshold. Once registered, they must collect GST on all taxable sales, issue tax invoices to customers, and regularly report and pay the collected GST to the ATO.

Thus, new businesses should register for GST if they expect their turnover to be $75,000 in the first year. Registration is optional for businesses with a turnover below the set threshold.

In the construction industry, the turnover is tricky, so even if your actual profit is less, you still have to register.

Example: If you take on a kitchen renovation for $80,000, but $50,000 of that goes straight to materials, your “turnover” is still $80,000. You must register for GST immediately, even though the profit might be only $30,000.

Business Activity Statement (BAS)

BAS is a form that businesses in Australia use to report and pay various taxes to the ATO. The BAS is used to report and pay taxes such as GST, PAYG income tax instalments, PAYG withholding tax, and other taxes and duties.

For construction companies, BAS reporting is an important aspect of their tax obligations as it includes reporting on the GST collected and paid on their construction services and supplies.

It is recommended that construction companies seek professional advice or use construction accounting software to ensure accurate BAS reporting and compliance with Australian tax laws.

Recommended reading:

What Is PAYG?

Pay As You Go (PAYG) is a system used in Australia to collect income tax from individuals and businesses throughout the year rather than in a lump sum at the end of the financial year.

Under the PAYG system, employers must withhold tax from their employees’ wages. Then, they remit it to the Australian Taxation Office (ATO) on their behalf.

Construction companies can benefit from PAYG instalments in several ways:

- Cash flow management: PAYG instalments allow construction companies to spread their tax payments throughout the year. Thus, it is easier to manage their cash flow and avoid any sudden or unexpected tax bill at the end of the financial year.

- Avoiding penalties: By making regular payments, construction companies can ensure they meet their tax obligations and avoid penalties or interest charges for late payments and underpayment of tax.

- Eligibility for discounts: Companies that make their PAYG instalments on time and in full may be eligible for a discount on their overall tax liability. This can reduce the overall tax burden.

The system provides greater flexibility, predictability, and control over the payments, helping to improve their financial management and reduce the risk of non-compliance.

What Is TPAR?

Standing for Taxable Payments Annual Report, it is used to report the total payments made to contractors for building and construction services.

TPAR generally applies to B2B transactions. For example, companies that pay subcontractors for building and construction services must report the payments on TPAR.

Contractors should submit the report to the ATO by 28th August each year. The report should provide detailed information regarding the entire year’s transactions from 1 July to 30 June.

Does your company need to lodge?

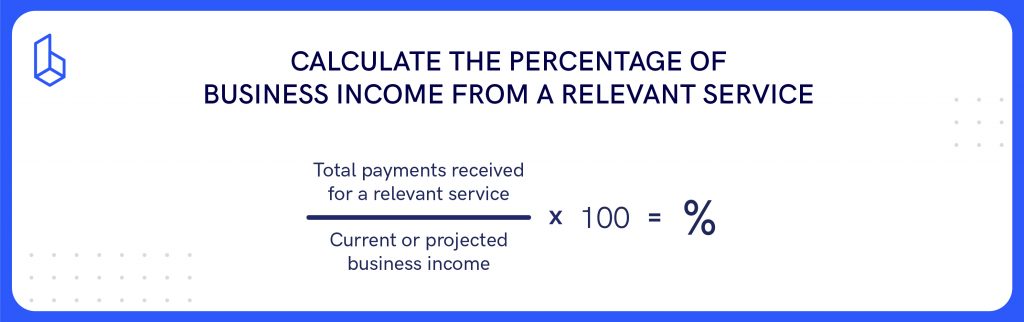

According to the ATO, any construction company with 10% or more of its business income for the financial year from a relevant service should lodge a TPAR.

Here are a few simple steps to see if your business falls into this category:

- Estimate the total payments you have received from contractors for each applicable service. Include payments received when your employees, contractors, or subs performed services on your behalf.

- Calculate current income.

- Calculate the percentage of business income from a relevant service for each financial year. Use the formula below.

Your business will lodge a TPAR if:

- 10% or more of the income is from a relevant service

- You paid contractors for a relevant service during the year

While dealing with construction taxes in Australia is a practice for professionals, having a basic understanding of it will help you make a sound decision.

How Can Australian Builders Handle Construction Accounting?

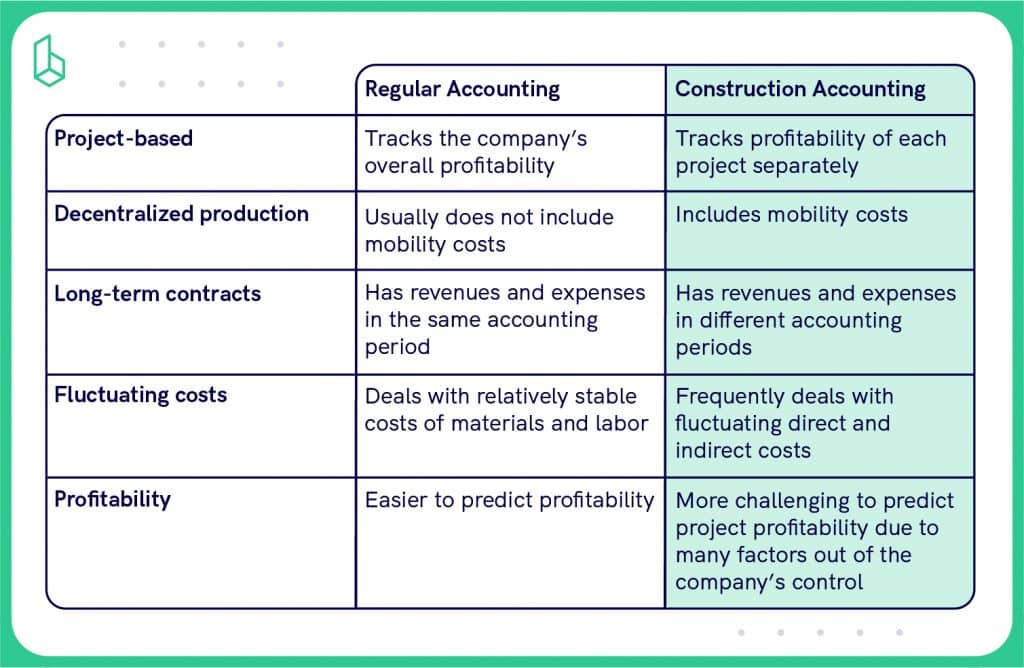

Construction accounting has some unique challenges compared to general business accounting. Builders often deal with complex project-based costs, materials, subcontractor payments, retainage, and progress billing.

As a result of this workflow, calculating GST and preparing BAS is probably more complicated for builders. Aussie builders usually use accounting software like Xero or QuickBooks (Xero is more popular, though).

The Australian construction software supports these tasks by tracking income and expenses across multiple projects and ensuring accurate tax reporting.

In the case of using construction project management software, it’s important to have a two-way sync integration with Xero to minimise errors and have a smooth transition from one to another.

The same is about GST calculations. If you are searching for construction management software, pick the one that can fully support Australian taxes.

Next, I will explore the main types of construction insurance, so you understand your rights, obligations, and the protections available on a job site.

Read more about taxes:

Construction Insurance Types in Australia

Let me list down the main types of construction insurance in Australia, designed to protect your business, workers, and projects from common risks.

Workers’ Compensation Insurance

Workers’ Compensation Insurance is mandatory in Australia and provides financial protection to employees in case of work-related injuries or illnesses. Covering medical expenses, lost wages, and rehabilitation costs for injured workers, it ensures companies are liable for any accidents or injuries that happen in the workplace.

In the construction industry, this type of insurance is essential to protect employees and ensure compliance with Australian construction law. Australia has 11 workers’ compensation schemes, including those for each state in addition to 3 Commonwealth schemes, each with its own laws and specific operations.

QLeave Australia

QLeave is a type of long-service leave scheme available to eligible workers in the construction industry in Queensland, Australia. The scheme provides a safety net for workers who have worked in the industry for an extended period and may not have accumulated sufficient long-service leave entitlements through their employer.

Under the QLeave scheme, eligible workers in the construction industry can accrue long service leave entitlements based on their service in the industry.

Construction employers should register with QLeave and pay the levy on behalf of their workers. They also need to provide sufficient information about their workers’ service to QLeave to ensure the entitlement calculations are accurate and timely.

Public Liability Insurance

Public Liability Insurance covers businesses and individuals in Australia from third-party financial loss and damage claims.

It provides coverage for legal fees and compensation costs associated with injuries, property damage, or other losses suffered by members of the public that occur on the insured’s premises or as a result of their business activities.

Practically, it covers a range of situations like damage to the property of others or accidental death and injury caused to third parties.

Still, there is a strict list of cases that this insurance does not cover. Some of these include the following:

- Damage to self-owned property. This may refer to your corporate or personal car, tools, equipment, and other business assets your company owns. You can take the Business Insurance Pack in addition to the Public liability insurance to cover such risks.

- Faulty workmanship. The point refers to any damage or injury caused by defective designs, plans, and specifications due to your or your team’s unprofessional approach.

- Fines and penalties. The insurance covers nothing regarding financial penalties, punitive, exemplary, or other damages imposed through the court of law.

Decennial Liability Insurance

Decennial Liability Insurance covers construction companies for damages caused by structural defects or failures within ten years after closing the construction project.

It aims to protect construction companies from potential financial losses due to claims arising from defects in their construction work. This insurance covers the cost of repairing or replacing any defective work that may cause harm to third parties or damage to property.

The coverage provided by Decennial Liability Insurance typically includes structural defects that may occur due to design or construction issues. For example, it can be foundation failures, building collapse, or cracking of load-bearing walls.

It may be mandatory for all construction projects exceeding a certain value, which varies by state or territory. Contractors, builders, or developers responsible for the construction project can obtain it to ensure the safety and quality of their work.

Understanding Aussie Building Jargon

The construction industry in Australia, like any other industry, has its own unique jargon and construction terminology that can be too complicated for those unfamiliar with it.

Here I will briefly cover the most common Aussie construction jargon to help you better navigate the industry.

- Chippie – Australian term for a carpenter

- Request for a quote: (same as the bid request), a formal request to potential subcontractors or suppliers for a detailed cost estimate.

- Site diary: (daily log), a record of important information about a construction project on a daily basis.

- Sparkie – Australian version for an electrician

- Variation – (same as the change order) is a formal written document that details any changes or modifications to the original scope of work, contract, or plans.

Australian Construction Acronyms

- BASIX – The Building Sustainability Index (BASIX) is a sustainability assessment tool that aims to reduce the environmental impact of residential buildings in New South Wales.

- BOQ – a Bill of Quantities (BOQ); a detailed list of materials and labour required for a construction project used to estimate costs and facilitate procurement.

- DA – A Development Application (DA) is a formal request to the local council for permission to carry out a development or construction project on a particular site.

- EOT – an Extension of Time (EOT); a formal request from a contractor to the project manager seeking an extension of the project deadline.

💡Tip: If you are used to Australian terms, choose construction project management tools that adapt to the Australian workflow, including specific terms used in the construction industry.

Bottom Line

Australia’s construction industry continues to be a major economic force. Yet the industry still faces significant structural challenges. They include persistent skilled labour shortages, rising material and compliance costs, and competitive pressures.

Effective financial and operational management has never been more important. Construction businesses with robust accounting practices will be better positioned to manage complexity and reduce errors.

By combining solid financial controls with data visibility and process automation, Australian contractors can keep pace with regulatory requirements and strengthen their competitive position.