In-Depth Guide to Maximizing Construction Payment Management

Construction payment management can be a challenging process, as common issues such as payment disputes, lack of proper documentation, and poor cash flow management often occur. These issues can lead to financial instability, strained relationships with clients, and legal disputes.

To help construction business owners and managers overcome these challenges, we’ve created an in-depth guide to maximizing construction payment management. This article provides practical tips and strategies for managing payment disputes, creating proper documentation, and optimizing cash flow management.

By implementing the strategies outlined in this guide, construction businesses can streamline payment processes, reduce disputes and delays, and ensure financial stability for long-term success. If you’re looking to improve your construction payment management, this guide is the only resource you need.

Understanding Construction Payments

Construction payments refer to the process of managing financial transactions related to the construction industry, including payments for goods, services, and labor. This process is essential for ensuring that builders complete construction projects on time and that all parties receive payment for their contributions.

One of the unique characteristics of payment management in the construction industry is the complexity of the contracts. Construction contracts typically involve multiple parties, including owners, contractors, subcontractors, and suppliers, each with its specific requirements and obligations. The payment terms and schedules can also be complex, with progress payments and final payments often tied to specific project milestones.

Detailed contracts that outline payment terms and schedules and define the scope of work, materials, and responsibilities of each party can be a great life-saver here. A contract’s clarity can help to avoid disputes and ensure that all parties involved are aware of their obligations and responsibilities.

Construction contracts often include retention payments, which allow clients to withhold a percentage of the total payment until the project meets their expectations. This provides an incentive for builders to complete the project to the highest standards and can help to ensure client satisfaction.

Different Types of Construction Contracts

Construction contracts are legal agreements that outline the scope of work, responsibilities, and payment terms between the client and contractor. There are several types of construction contracts, each with its own specific characteristics and advantages. In this article, we’ll cover the six main types of construction contracts.

Time and Materials Contracts

Time and materials contracts are preferred for projects where the scope of work is not well-defined, as opposed to lump sum contracts. Such contracts help reimburse contractors for the cost of materials and establish an hourly or daily pay rate. Time and materials contracts offer certain benefits and drawbacks that both parties cannot neglect.

Benefits

- More agile: With customers reimbursing for time and materials, unexpected delays, roadblocks, and changes to scope are covered.

- Simple negotiations: It is simple to set rules for what materials will be covered and what the hourly wage will be.

Risks

- May not reward efficiency: With time and materials contracts paying by the hour or day, there’s no real incentive to finish a project early. Therefore, it is common to stipulate a bonus for finishing ahead of schedule.

- Potentially time-consuming: It is not an easy task to log each and every material cost on a project, and failure to provide an accurate number upon completion results in lower profit margins.

Owners bear a considerable amount of risk with time and materials contracts, given the unpredictable nature of any given construction project. They must pay the contractor for any unexpected costs, changes, or time overruns that occur during the project, which may cost them more than they initially planned for. Time and materials contract best suit projects that lack a well-defined scope of work.

Lump Sum Contracts

The most basic type of construction contract is the lump sum contract, which is the same as a fixed-price contract. Such contracts set one fixed price for all the work, making them common in construction.

Most contractors have likely entered into several lump-sum contracts in the past. Despite the simplicity of the one-price formula, however, lump sum contracts have a few advantages and disadvantages.

Benefits

- Simplified bidding: Owners and general contractors can select a contractor more easily by naming a total price rather than submitting multiple bids.

- Potentially high-profit margins: Because the project price is set, finishing the work under budget means contractors can keep the savings.

Risks

- Costly miscalculations: As there is only one set price, any unexpected issues during the project result in reduced profit margins.

- Increased risk for larger projects: Any setbacks from subcontractors are paid for out of the lump sum price, making larger projects more risky.

Therefore, lump sum contracts involve significant risk for contractors because they don’t account for unexpected costs or delays during the project, which could cause contractors to lose money. These contracts are great for smaller projects with predictable scopes of work.

Cost-Plus Contracts

Cost-plus contracts, also called cost-reimbursement contracts, involve the owner paying the contractor for the project costs incurred plus a profit amount, which may be a percentage of the total project cost.

These costs may include direct costs such as labor and materials, indirect costs such as travel, insurance, or overhead, and profit. Below are the pros and cons of using a cost-plus contract for construction projects.

Benefits

- Flexible and adaptable: Contractors can accommodate design changes during the project, and owners know they will pay for the additional time or materials required for those changes.

- Handles miscalculations: Inaccuracies in the initial bid are less critical than they are with lump sum contracts.

Risks

- Difficult to justify some costs: Contractors need to justify all costs, and some expenses, such as administrative costs or mileage, can be difficult to justify for reimbursement.

- Upfront material costs: Since cost-plus contracts work on reimbursement, paying more than expected for materials could cause a shortage of funds for the rest of the project. In cost-plus contracts, most of the risk is borne by the owner. The contractor is paid for all project costs, and the owner bears any unexpected expenses.

Best for: Projects that require a lot of flexibility and creativity.

Unit Price Contracts

Unit price contracts are measurement contracts, measure and pay contracts, or remeasurement contracts, which break down the total work required to complete a project into distinct units. Instead of providing an estimate for the project as a whole, the contractor gives the owner a cost estimation for each unit of work.

Unit price contracts are ideal for projects that rely heavily on material costs and are repetitive, and the extent of the work required is not evident before the project begins.

Here are some advantages and disadvantages of unit price contracts:

Benefits

- Simplified Invoicing: As the price of each unit is pre-determined, owners can easily comprehend the cost of each item that goes into the final price of the contract.

- Consistent Profit Margin: Any additional work required can be added as another pre-priced unit, making it easier to manage change orders and other changes to the scope of work.

Risks

- Difficult to Predict Total Volume: Owners may end up paying more than they expected if the amount of units needed to complete the project isn’t immediately known.

- Remeasurement can delay payment: Payment can be slowed down as the owner must compare the cost of each unit with the overall project cost.

Although unit price contracts pose more risks to the owner because they must reimburse the cost of added unexpected units, they provide transparency, which is a significant benefit to all involved parties.

Best for: Projects with repetitive tasks where it is difficult to determine the amount of work needed.

Guaranteed Maximum Price (GMP) Contracts

Construction contracts with Guaranteed Maximum Price (GMP) determine a cap on the contract price, which ensures that the property owner won’t have to pay more than the contract price.

The contractor should cover any labor or material costs exceeding the cap. In some cases, you can attack a GMP clause on another type of contract, like a cost-plus contract.

GMP contracts are commonly used in construction projects with few unknowns, such as the construction of a retail chain. Here are the advantages and disadvantages of using Guaranteed Maximum Price contracts.

Benefits

- Streamlined bidding and financing: The final contract price allows quick bidding and makes financing easier since the lenders know the maximum project cost in advance.

- Incentivizes savings: The fixed overhead cost encourages contractors to reduce expenses and finish the work ahead of schedule, with the owners sharing any cost savings with the contractors.

Risks

- Tough for contractors: These contracts require the contractors to pay for cost overruns if the contract price maximum is exceeded.

- Prolonged negotiations: Contractors may try to increase the maximum price of the contract to protect themselves from exceeding the price cap, potentially prolonging negotiations.

As the property owner won’t pay for any cost overruns, guaranteed price contracts shift a lot of risk to the contractors. Hence, contractors can minimize risk by using reliable cost estimation software and accurate job costing to avoid overcharging or undercharging the owner.

Best for: Construction projects with a limited number of unknown variables and for incentivizing contractors to complete the project within budget and ahead of schedule.

Incentive Construction Contracts

Incentive construction contracts help the client when they want to encourage the contractor to complete the project quickly or with high quality. In these contracts, the contractor receives a bonus for completing the project on schedule or meeting specific quality targets. This incentivizes the contractor to work efficiently and effectively but can also result in a higher cost for the client.

Benefit

- Cooperative process: Apart from controlling costs and timelines, incentive contracts also have the potential to foster a more cooperative process, with the contractor having a greater sense of ownership. Through the phased incentive approach, there is more interaction and collaboration between the contractor and the owner, who may develop innovative approaches to complete the job.

Risks

- Time-Consuming: Negotiating the incentives for an incentive contract can be time-consuming and requires careful consideration to ensure that the deadlines and costs are practical.

- Unclear terms and conditions: This can result in disputes, so it is critical for contractors to explicitly define what constitutes meeting the incentives to avoid miscommunications during the project’s delivery.

By agreeing to an incentive contract, the contractor expects a specific payment for completing the project by a particular date and standard. If the contractor can deliver the project at a lower cost and/or before the deadline, they may receive an additional payment, which is specified in the contract and may be determined by a sliding scale. Essentially, these contracts motivate the contractor to manage expenses and adhere to the schedule.

Payment Terms in Construction Contracts

Construction contracts include payment terms that outline the terms and conditions of payment for work completed. Payment terms in construction contracts generally define the schedule of payments, payment methods, and any penalties or incentives related to payment.

The most typical payment schedules for contractors are payment in full upon completion of the work, payment in installments based on the completion of specific stages of the project, or a combination of both. Payment terms usually define when each installment is due and any penalties for late payments. Additionally, payment methods may include checks, direct deposit, or electronic funds transfer.

Incentives and penalties are also common elements of payment terms in construction contracts. Incentives can be awarded for early completion, meeting or exceeding project goals, or staying within a certain budget.

Penalties may be assessed for late completion, exceeding the budget, or failing to meet certain performance metrics.

It’s important to review and understand payment terms in a construction contract before agreeing to them. This will help avoid disputes and misunderstandings. For contractors, payment terms should be negotiated carefully to ensure that they are practical and achievable. For clients, payment terms should be clear and reasonable to ensure that the work is completed to satisfaction.

Overall, payment terms in construction contracts are essential to managing successful projects. By setting clear payment expectations, contractors and clients can ensure that work completes on time, within budget, and to satisfaction.

The Role of Construction Payment in Risk Management

Construction projects are complex endeavors that involve multiple stakeholders, significant investments, and numerous risks. Managing these risks is crucial to the success of any construction project, and payment management plays a crucial role in mitigating financial risks.

Let’s see how payment schedules, performance bonds, and applications for payment help to secure builders and their clients against financial risks.

Payment Schedules

Payment schedules are a critical component of any construction contract, as they define the payment terms and timeline for the work. A payment schedule should clearly outline the payment amounts, the dates on which payments are due, and any penalties or incentives associated with payment.

By setting clear expectations for payment, payment schedules help minimize the risk of financial disputes and ensure that the project stays on track.

The payment schedule should also include milestones that trigger payment, such as the completion of a particular phase of the project. This ensures that payment is only made for work completed to satisfaction, reducing the risk of overpayment or payment for incomplete work.

Additionally, builders can structure payment schedules to incentivize the project’s timely completion, which helps minimize the risk of cost overruns and delays.

Performance Bonds

Performance bonds are another important tool for managing financial risks in construction projects. A performance bond is a type of surety bond that guarantees that a contractor will fulfill their obligations as outlined in a contract.

The bond provides assurance to the project owner that if the contractor defaults, they will receive compensation for any financial losses resulting from the contractor’s failure to complete the project as specified.

Performance bonds typically serve for large construction projects, providing additional protection for the project owner. They can also secure payment to subcontractors and suppliers, ensuring they receive financial compensation even if the general contractor defaults.

Performance bonds are typically issued by a third-party surety company, which assumes responsibility for paying the bond amount in the event of a default.

Applications for Payment

Applications for payment are another important mechanism for managing financial risks in construction projects. The application for payment process allows contractors to request payment for work completed.

The application for payment process involves submitting a written request, along with any necessary documentation, to the client. The client then has a specified amount of time to review and approve the application.

Applications for payment provide a structured process for requesting payment, which helps to minimize the risk of disputes over payment.

By requiring contractors to submit documentation to support their payment requests, payment applications ensure payments only for work corresponding to the standards and the client’s expectations. This helps to reduce the risk of overpayment or payment for incomplete work.

Payment management plays a crucial role in mitigating financial risks, and payment schedules, performance bonds, and applications for payment are important tools for securing builders and their clients against financial risks.

By setting clear expectations for payment, providing additional protection against default, and providing a structured process for requesting payment, these mechanisms help to ensure that construction companies complete their projects on time, on budget, and to satisfaction.

Common Issues: Discover to Avoid Them

Payment Disputes

Payment disputes can be a common issue in the construction industry, often leading to significant delays and costly legal battles. These disputes can arise due to a variety of reasons, including contract disagreements, poor communication, or incomplete work.

To avoid payment disputes, it is crucial to establish a clear payment schedule and ensure that all parties involved understand and agree to it.

The payment schedule should outline the due payment dates, payment amounts, and the conditions for payment. It is also important to include provisions for dispute resolution in the contract, such as mediation or arbitration, to avoid costly litigation.

Change Order Disputes

Change order disputes can occur when there is a disagreement about the scope of work, project specifications, or pricing. These disputes can lead to delays, cost overruns, and strained relationships between contractors and clients.

To avoid change order disputes, it is essential to establish clear project specifications and scope of work at the outset of the project. Both parties should understand and agree to any changes that occur during the project, and these changes should be documented in writing. Establishing a change order process and ensuring that all participating parties sign the change orders is also important.

Delays

Delays can be a significant issue in the construction industry, resulting in increased costs, reduced profitability, and strained relationships with clients. This can be caused by a range of factors, including weather, labor shortages, material shortages, and changes in project specifications.

To avoid delays, it is important to establish a realistic project timeline at the outset of the project. The project schedule should include allowances for unexpected delays, and regular updates should be provided to all parties involved. Communication is also key to avoiding delays, and it is important to establish clear lines of communication between all parties involved in the project.

Unauthorized Payments

Unauthorized payments can occur when there is a lack of oversight in the payment process, leading to overpayments, double payments, or payments for work that has not been completed. These payments can lead to significant financial losses and damage to a contractor’s reputation.

To avoid unauthorized payments, it is important to establish a clear payment process with checks and balances to ensure that payments are only made for work that has been completed and approved.

Regular audits of the payment process will help identify discrepancies while promptly addressing any issues.

Best Practices for Construction Payments

As a crucial aspect of construction project management, payments should be handled carefully to avoid disputes and ensure timely and accurate payment to all parties involved. Buildern offers a flexible toolset for construction project management that includes financial tools with integrations, scheduling, and document management.

Now, we will outline some best practices for construction payments you can easily implement using Buildern’s powerful software solution.

Prepare Payment Schedules

Preparing payment schedules is a crucial step in ensuring that payments are made on time and according to the agreed terms. A payment schedule is a document that outlines the timing and amount of payments for each construction project.

By preparing a payment schedule, you can ensure that all parties involved are aware of the payment milestones and the due dates for each payment. This helps to prevent payment disputes and delays and promotes transparency and trust between the parties.

In Buildern, creating payment schedules is a breeze with ready-to-use templates. You can create any payment schedule by clicking on “Payment Schedule Templates” on the left-side menu and choosing “+ Create a Template” signal.

Once done, you can add payment milestones and the percentage of the total payment expected for that milestone. You can add unlimited milestones and break down the payment into multiple parts.

Document Everything

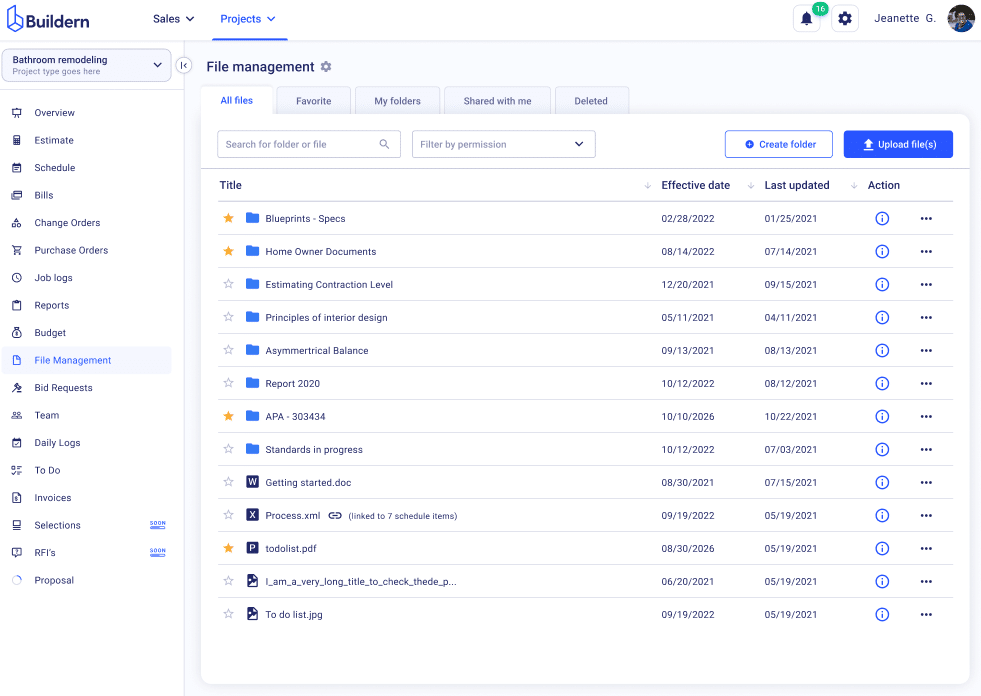

Construction document management is another critical aspect of construction payment management. Keeping accurate records of all payment-related documents, including contracts, invoices, change orders, payment applications, lien waivers, and receipts, is important. This helps to ensure that all parties involved have access to the same information and can easily track payments throughout the project.

With Buildern’s document management tool, you can easily store and organize all payment-related documents in one place. The tool also allows you to upload, share, and collaborate on documents with all parties involved in the project. You can also set up access controls to ensure that only authorized personnel can view or edit the documents.

Follow the Standards

Construction payment management is subject to local legal regulations that vary by jurisdiction. It is important to be aware of the legal requirements and to follow the industry standards for payment practices.

In Australia, for example, the most commonly used standard form of the construction contract is the Australian Standard AS 2124-1992. This contract provides a framework for the legal and commercial relationships between the parties involved in a construction project.

Buildern’s software solution is flexible and customizable to meet the specific needs of each construction project. You are free to configure the software settings to comply with local legal regulations and industry standards.

Additionally, Buildern’s team of experts can provide guidance and support to ensure that your payment management practices align with the relevant legal requirements.

Invest in Advanced Solutions

While many construction companies still rely on outdated payment management methods such as spreadsheets and paper documents, investing in advanced solutions can help to streamline the payment process and reduce the risk of errors and disputes.

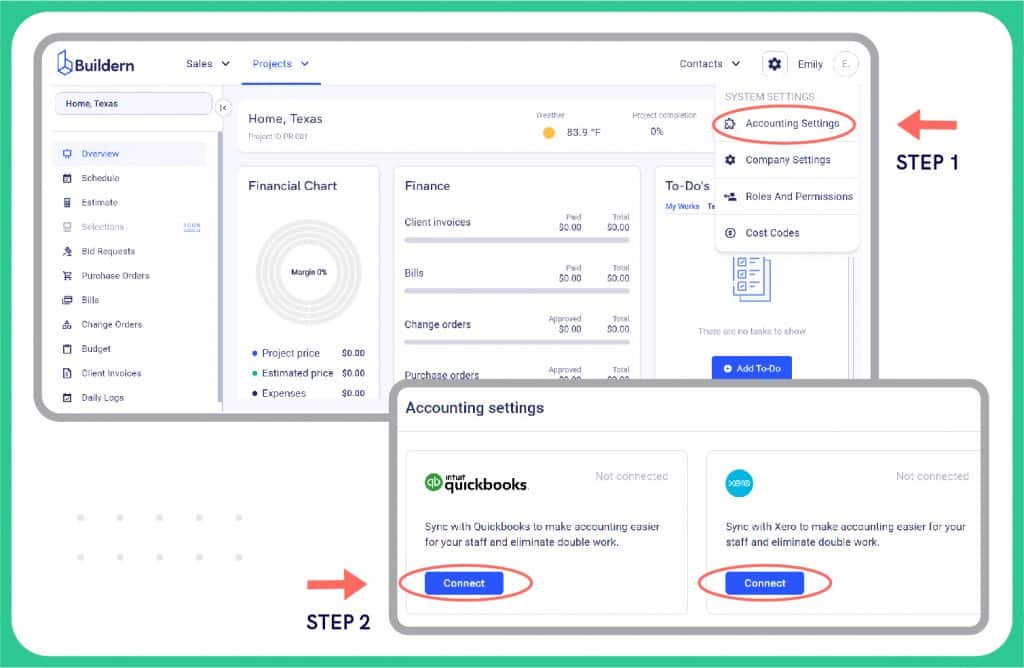

Buildern offers a powerful construction accounting software solution that can automate payment processing, track expenses, and provide real-time financial insights.

With Buildern’s financial tools, you can easily manage all financial aspects of your construction project, including billing, invoicing, and payroll. The software integrates with popular accounting platforms such as QuickBooks and Xero, making it easy to track payments and expenses in real-time.

Additionally, the software provides detailed financial reporting and analytics, allowing you to make informed decisions and improve your payment management practices over time.

In conclusion, construction payment management is a critical aspect of any construction project. By implementing the best practices outlined in this article and using a powerful software solution like Buildern, you can streamline the payment process, reduce the risk of disputes and delays, and ensure timely and accurate payment to all parties involved.

The Bottom Line

In summary, construction payment management is a critical aspect of any construction project. The inability to effectively manage payments can lead to project delays, financial loss, and disputes between parties.

Here are the key takeaways from this article:

- Payment disputes, change order disputes, delays, and unauthorized payments are common issues that can be avoided with effective construction payment management.

- Preparing payment schedules, documenting everything, and following the standards are best practices that can help you manage payments effectively.

- Advanced solutions, such as Buildern, can provide a range of tools for effective construction payment management, including financial tools with integrations, scheduling, and document management.

Thus, with the right approach and tools, construction payment management can be an effective process that ensures timely and accurate payments, reduces disputes, and promotes successful project outcomes.

If you are looking for a comprehensive solution for construction payment management, consider Buildern. Visit our website to learn more and start your streamlined construction project management today.