What are Construction Draws? Key Processes and Challenges Explained

If you’ve been in construction long enough, chances are you’ve already dealt with construction draws, even if you don’t call them that. It’s one of those terms that pops up around contracts, payments, and bank-financed projects, usually when you’re knee-deep in paperwork or waiting on a bill.

Construction draws are a central part of the billing method used to break down large project payments into smaller chunks.

Let’s walk you through how construction draws actually work, what’s required at each stage, and why even experienced builders run into headaches with them.

Table of Contents

- What are Construction Draws?

- What is a Construction Draw Schedule?

- What is a Draw Request in Construction Projects?

- Challenges Builders Face with Construction Draws

- How Does the Construction Draw Process Work?

- Construction Draw Documentation Checklist

- Final Thoughts

What are Construction Draws?

Construction draws refer to the payment requests a builder submits throughout the lifecycle of a project, usually tied to specific milestones or completed work. Instead of receiving the full upfront payment or waiting until the job is completed, you get paid in stages as the project progresses.

Such a draw-by-draw method is commonly used in bank-financed projects or when working with owner-lenders who expect control and visibility into the money spent. These draws act as invoices that trigger partial payments for the work completed up to a certain point.

Each draw can include documentation like photos, subcontractor invoices, lien waivers, inspection reports, and so on. This ensures the billed work has indeed been finished and corresponds to the expectations.

For builders, this process helps maintain a steady cash flow throughout the project.

What is a Construction Draw Schedule?

In simple terms, a construction draw schedule refers to a roadmap outlining the timelines of each draw and actions to be completed to trigger the next payment. This schedule is typically agreed upon before construction begins and is often attached to the contract or loan agreement.

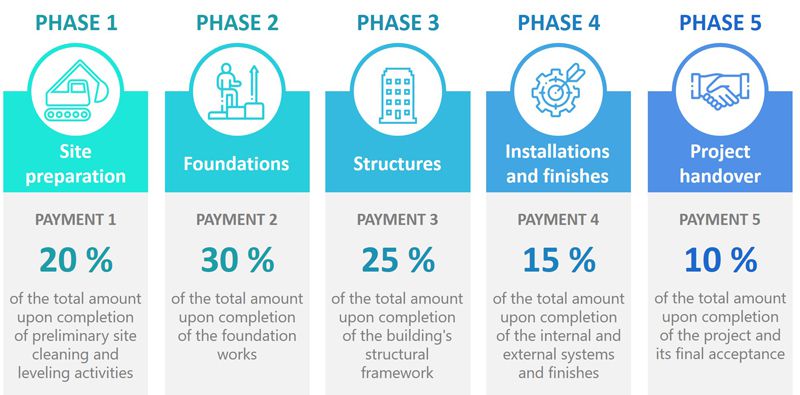

Draw schedules vary depending on the project scope and financing terms, but they commonly include 5 to 7 phases, such as:

- Site preparation

- Foundations

- Framing and structures

- Installations and finishes

- Project handover

Each stage is associated with a percentage of the total budget. As work progresses, the builder submits draw requests aligned with the schedule. Lenders or owners often bring in an inspector to verify that the listed work is complete before releasing payment.

What is a Draw Request in Construction Projects?

A draw request is the formal documentation a builder submits to request payment for completed work. Think of it as an invoice but with more detail and scrutiny.

A typical draw request package may include:

- A detailed breakdown of the work completed

- Photos or inspection reports

- Subcontractor and vendor invoices

- Updated project schedule

- Lien waivers

- Budget-to-actual cost comparisons

Submitting a draw request isn’t as simple as sending a bill. Especially when a lender is involved, each document must be accurate and align with the draw schedule.

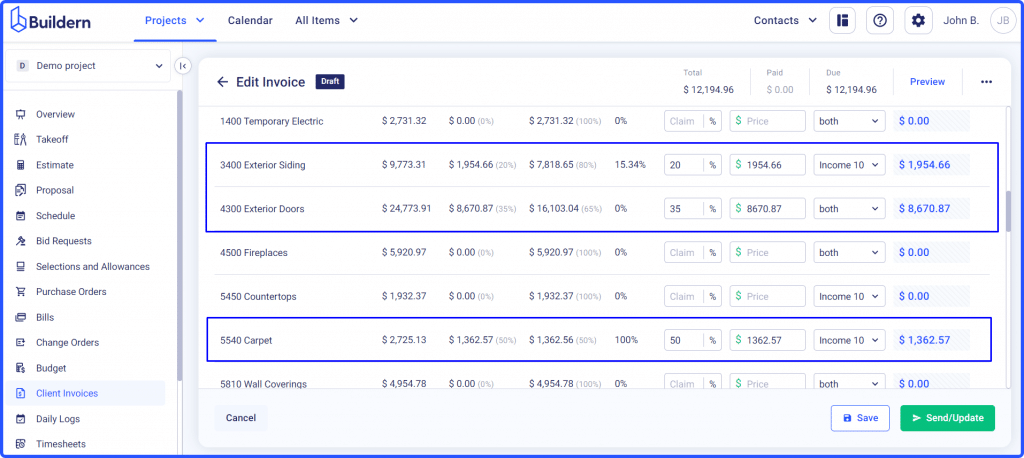

For busy construction teams, the admin side of draw requests can be just as time-consuming as the build itself. Therefore, having a platform to manage and track all draws along with the required documentation can significantly reduce delays, miscommunications, and rework.

Challenges Builders Face with Construction Draws

Construction draws are a lifesaver for managing cash flow, but when they stall, the consequences can be awful. A 2025 survey by Built found that 70% of contractors regularly face draw/payment delays, with 10% of payments stalled for more than 30 days.

The delays force builders to dip into savings, credit lines, or even skip subcontractor payments, thus resulting in cost overruns, slowed schedules, and damaged reputations.

1. Delayed Draw Approvals and Slow Payment Processing

The issue:

Lenders and clients often hold off on releasing draw funds due to admin bottlenecks like missing paperwork, required inspections, or just manual processes.

The impact:

- Projects stalled

- Subcontractor trust eroded

- Builders raise bids (an 8% average increase to cover payment risk)

💡Our solution: Explore Buildern’s advanced features.

- Automated reminders ensure that draw requests are submitted fully and on time.

- Digital submission portal lets stakeholders review and approve instantly, cutting traditional wait times.

- Status tracking dashboards allow you to monitor where a draw sits and send follow-ups when needed.

2. Incomplete Documentation and Recordkeeping

The issue:

Missing lien waivers, photos, or receipts are a common culprit behind stalled draws. In fact, incomplete and disorganized paperwork is the #1 reason lenders push back on draws.

The impact:

- Extra back-and-forth slows approvals

- Raises the risk of errors or disputes

- Creates audit vulnerabilities

💡Our solution: Buildern keeps everything organized and at hand.

- Unified document repository (photos, invoices, and all construction-related documents are kept in your profile).

- PIN-protected documents and folders for guided access.

- Automated reminders for license and other document updates.

3. Inspection Delays and Verification Issues

The issue:

Draws often require inspections from lenders or third parties to verify progress.

The impact:

- Cash flow stops, even when work is physically done

- Builder schedules get messed up waiting on approvals

- Subs and suppliers may walk if not paid on time

💡Our solution: Buildern offers integrated tools.

- Scheduling tools with Gantt charts and flexible To-Do lists, so everyone knows their job.

- Digital inspection logs with photos and other crucial information to support reporting.

How Does the Construction Draw Process Work?

Let’s now break down each major step from a typical construction draw process, following a structured cycle.

Step 1: Set Up the Draw Schedule

Before any ground is broken, the project team (builder, client, and lender if involved) agrees on a draw schedule. This is a breakdown of the total project cost into payment installments based on specific milestones (e.g., 10% upon excavation) or completed phases (e.g., roofing, framing, HVAC).

- The draw schedule is usually part of the contract or lending agreement and acts as the financial roadmap.

- It’s important to align payment points with actual labor and material expenses so you’re not fronting too much of the work without compensation.

Step 2: Complete the Work Tied to the Current Draw

Once the current phase is complete, it’s time to initiate the draw payment process. The builder ensures that all subcontractors have completed their part and that the work matches what’s outlined for that stage in the draw schedule.

- For example, if Draw #2 is tied to “foundation poured and framing started,” you’ll need to have visual proof and inspection-ready conditions.

- Delays often occur here when progress isn’t clearly documented or communication with field crews isn’t tight.

Step 3: Prepare and Submit the Draw Request

This is the most documentation-heavy step. The draw request must include:

- An updated budget/cost report

- Invoices and receipts for labor and materials

- Progress photos

- Lien waivers from subcontractors and vendors

- Any required compliance documents or inspection certificates

Each lender or client may require a slightly different package. The key is to make sure it’s all organized and easy to review.

Step 4: Inspection and Verification (If Required)

For financed projects, most lenders will send an inspector to verify that the work claimed in the draw has actually been done. They’ll walk the site, compare against the draw schedule, and submit a report. Only then is the draw approved.

- If the inspection fails or reveals incomplete work, the draw is rejected or reduced.

- In some cases, multiple inspections may be needed if the project involves complex systems or phased approvals.

Step 5: Approval and Fund Release

Once the draw is approved, funds are released directly to the builder or through an escrow account. In some cases, payments are disbursed to subcontractors or vendors directly.

- Most lenders take 5-10 business days to release payment after approval, but delays can stretch longer without proper follow-up.

- At this point, the builder can move forward with the next stage of work while prepping for the following draw.

Construction Draw Documentation Checklist

| Document | Purpose | Required By | Notes |

|---|---|---|---|

| Draw Request Form | Formal request for payment | Lender / Client | Usually includes project details, draw number, and requested amount. |

| Schedule of Values | Itemized breakdown of work and associated costs | Lender / Internal Team | Should align with approved budget and draw schedule. |

| Progress Photos | Visual proof of completed work | Lender / Owner | Helps speed up approvals and reduce disputes. |

| Inspection Report | Verifies that work has been completed as claimed | Lender / Inspector | Required before fund release in most financed projects. |

| Subcontractor Invoices | Shows cost of labor and materials already incurred | Lender / Accountant | Must be accurate and dated within the draw period. |

| Vendor / Supplier Receipts | Supports proof of purchase and material delivery | Lender / Client | Especially useful for early-phase draws (e.g. site prep, materials). |

| Lien Waivers (Conditional/Unconditional) | Protects against future claims once payment is made | Lender / Owner | Signed by subcontractors and vendors for the amount invoiced. |

| Updated Project Schedule | Shows current timeline and % of work completed | Lender / Client | Keeps all parties informed about delays or accelerations. |

| Budget vs. Actual Cost Report | Compares forecasted and real expenses | Internal / Lender | Highlights overruns or savings for transparency. |

| Change Order Logs | Lists approved changes that impact the budget or timeline | Lender / Owner | Must be signed and accounted for in the payment request. |

| Permit Approvals / Certificates | Proves regulatory compliance for the stage being billed | Municipality / Lender | Depends on local requirements and draw phase. |

Final Thoughts

Construction draws may sound like just another layer of administration, but in fact, they’re the financial backbone of any successful and long-running construction project. Draws keep the cash flowing, subcontractors paid, and projects moving forward without extra delays and spending.

But for all their benefits, managing draws isn’t always straightforward. Between coordinating inspections, gathering lien waivers, tracking budget-to-actuals, and ensuring every document is in place, things can quickly get overwhelming.

That’s why builders today need more than spreadsheets and emails to handle it all. A single software solution like Buildern can help you settle every project phase from estimating and scheduling to invoice and draw management. No guesswork, no delays, just streamlined and transparent project management and billing that works with you, not against you.

What is a draw in a building?

The term construction draw refers to a scheduled payment issued to a builder or contractor as specific portions of the project are completed. Instead of receiving the full payment upfront or waiting until the entire job is finished, builders are paid incrementally through a “draw schedule” tied to project milestones.

Each construction draw acts as an invoice, but has a more detailed structure and requires certain verification steps.

How should builders submit a draw request?

To submit a draw request, a builder must compile a detailed package that documents the work completed since the previous draw. This often includes a draw request form, progress photos, subcontractor and vendor invoices, lien waivers, inspection reports (if required), and an updated project schedule.

Ensure the package is agreed-upon draw schedule and demonstrates the current project stage is complete and verifiable.

Who’s involved in the construction draw process?

Several team members may be involved in the construction draw submission process, depending on its type and the financing structure. At the center is the builder or general contractor, who performs the work and submits draw requests at each milestone. They coordinate with subcontractors and vendors, whose invoices and lien waivers are often required to support the draw documentation.