Home Construction Loans Explained: Steps, Requirements and More

Last updated August 2025

When planning to build a dream home, understanding the work process with home construction loans is equally crucial for homeowners and builders.

Designing and building a house from scratch seems exciting and straightforward on paper – choosing custom finishes, new furniture, and watching your vision take shape.

But as soon as the construction begins, the reality hits. Costs can add up quickly, unexpected delays mess with the timelines, and invoices start rolling in faster than expected.

Whether you are the owner or the builder, let us help you stay sane by breaking down everything you need to know about construction loan processes.

Table of Contents

- What is a Construction Loan?

- Step-by-Step Explanation of the Construction Loan Process

- 3 Main Types of Construction Loans

- 3 New Construction Loan Requirements

- Construction Loan Interest Rates and Terms

- Construction Loan Draw Schedule

- Final Thoughts

What is a Construction Loan?

These are short-term, high-interest loans designed to cover construction and renovation costs. Unlike traditional mortgages, construction loans fund a project that is yet to come into being. The lender provides funds through a draw schedule aligned with construction milestones. This ensures the money is spent specifically for the intended purposes.

Home construction loans typically are given for a year and borro wers usually make interest-only payments while the construction is underway. Conversely, once the project is complete and the loan is converted to a traditional mortgage, the borrower begins making payments that include both principal and interest.

It’s important to note that construction loans often come with higher interest rates compared to conventional home loans, mainly due to the heightened risk perceived by lenders.

Step-by-Step Explanation of the Construction Loan Process

The application for home building loans is similar to the process of applying for a mortgage. It may seem daunting, but breaking it down into a few steps makes everything straightforward.

Here’s how the process typically unfolds:

1. Prequalification

The future homeowner should work with a builder who has a proven record of quality work and a solid reputation. Lenders assess your financial stability through certain criteria, like:

- Credit score

- Income

- Existing debts

Prequalification sheds light on the project budget, so builders should have accurate estimates to aid at this stage.

💡Pro Tip for Builders: Use construction project management software to automate the estimating process and significantly reduce the risk of human error in numerous calculations.

Having precise measurements with digital takeoff plans is the key to precise budget allocation and project planning. Automation not only enhances accuracy but also allows for a clear breakdown of construction costs, helping you provide transparent financial insights to your clients.

By integrating Buildern into your workflow, you ensure that the project budget is correctly accounted for, thus fostering client confidence in your commitment to excellence.

2. Application

Upon prequalification, the formal application process begins.

This involves collecting and submitting all plans and specifications for the proposed construction. Documents including blueprints, cost estimates, and schedules should be ready, so the loan lender can review them and proceed with the home building loan approval.

Considering that at this stage they will evaluate the feasibility of the project, maximum attention to detail can significantly influence the outcome and the speed of decision-making.

3. Approval and Documentation

At this point, legal documentation outlining the loan agreement is prepared. Builders must review these documents carefully to understand the terms, and interest rates to draw construction loan schedules.

This signals the financial backing of the project and sets the stage for the actual construction phase. Clear communication with lenders throughout the whole project period will help you mitigate any misunderstanding and set a solid foundation for a successful partnership.

3 Main Types of Construction Loans

Designing and building homes comes in so many shapes and sizes that having a single construction loan option does not suffice. Therefore, lenders offer different types of construction loans to cater to various needs in the real estate market.

Let’s review the three most frequently used types.

Construction-to-Permanent Loans

This type of loan automatically converts to a traditional fixed-rate mortgage after the construction is complete. Construction-to-permanent loans best suit people who prefer a seamless transition from construction to home ownership.

You can consolidate what might otherwise be multiple loan closings into just a single payment, thus saving time and money on closing costs. Additionally, it provides the opportunity to lock in a fixed interest rate for the subsequent mortgage. This provides peace of mind, knowing the long-term financial commitments upfront.

As for builders, construction-to-permanent loans provide the advantage of predictable payments and reduce any administrative burdens that may arise after completion.

Stand-Alone Construction Loans

Unlike the previous type, standalone construction loans don’t turn into long-term mortgages. Instead, these are given a year-long term to build the home. After completion, you must pay off the loan in full or submit for a separate mortgage to pay the principal amount.

Stand-alone construction loans are suitable for people who have savings they can use to cover their living expenses and mortgage payments during construction. This can provide additional flexibility but may also come with extra costs post-construction.

Among the benefits of standalone construction loans is the flexibility for adjustments in financial strategies as the market shifts. This, in turn, offers the opportunity to secure better mortgage rates once construction is complete.

On the other hand, while construction-to-permanent loan rates are higher they still come with greater stability.

Renovation and Remodel Construction Loans

Another type of construction loan is specifically designed for people who need money for renovation projects. Renovation and remodel construction loans support projects that enhance property value without the need for a complete rebuild.

When comparing renovation loans with other construction loans, here’s what you need to consider:

| Renovation and Remodel Loans | Construction Loans |

|---|---|

| Typically based on the home’s post-renovation value. | Based on the cost of construction and land value (if applicable). |

| Faster approval as it focuses on renovating existing structures. | More complex approval due to project scope and land acquisition (if applicable). |

| Slightly higher interest rates due to smaller amounts and shorter terms. | Rates may vary but are often competitive due to longer loan terms and larger amounts. |

| The existing home serves as collateral. | Land (and eventual home) serve as collateral. |

| Generally shorter, ranging from 6 months to 5 years. | Typically longer terms, ranging from 1 to 30 years, depending on the loan structure. |

| Usually requires a lower down payment, sometimes as low as 5%. | Often requires a larger down payment, usually around 20% or more. |

3 New Construction Loan Requirements to Keep in Mind

Understanding construction loan requirements prepares both homeowners and builders for a smooth application process.

Here are some common prerequisites:

- Lenders typically require a solid minimum FICO score for construction loan that is usually above 680. Check this with a particular lender and ensure your financial health is in good standing before applying.

- Have a construction plan with detailed timelines and cost estimates. Builders must provide this to demonstrate project feasibility and commitment to completion.

- Make a down payment that is at least 20%-25%.

Construction Loan Interest Rates and Terms

Before committing to the years of loan payments, keep in mind that no lender will finance 100% of your construction project. It’s a common practice to require borrowers to cover a portion themselves, typically through a down payment ranging from 20% to 25%. For some projects, it may go up to 40% with the exact percentage of the down payment depending on:

- Loan-to-Cost (LTC) Ratio

- Your credit score and overall financial history

- Risk assessments

- Project type and scope of work

- Property appraised value

- Builder’s track record

And many other factors.

Having a high credit score and a good Debt-to-Income Ratio that is below 43% will greatly impact the loan’s interest rate.

It’s essential to understand that construction loans have variable rates because their financing is short-term and tied to current market conditions.

Additionally, it’s important to consider how construction taxes might impact your overall project budget, as these can vary depending on location and the type of construction involved.

The lender has no assurance of what interest rates will look like when your project ends. Once the construction comes to an end, you will be required to get a separate mortgage to pay off the construction loan balance.

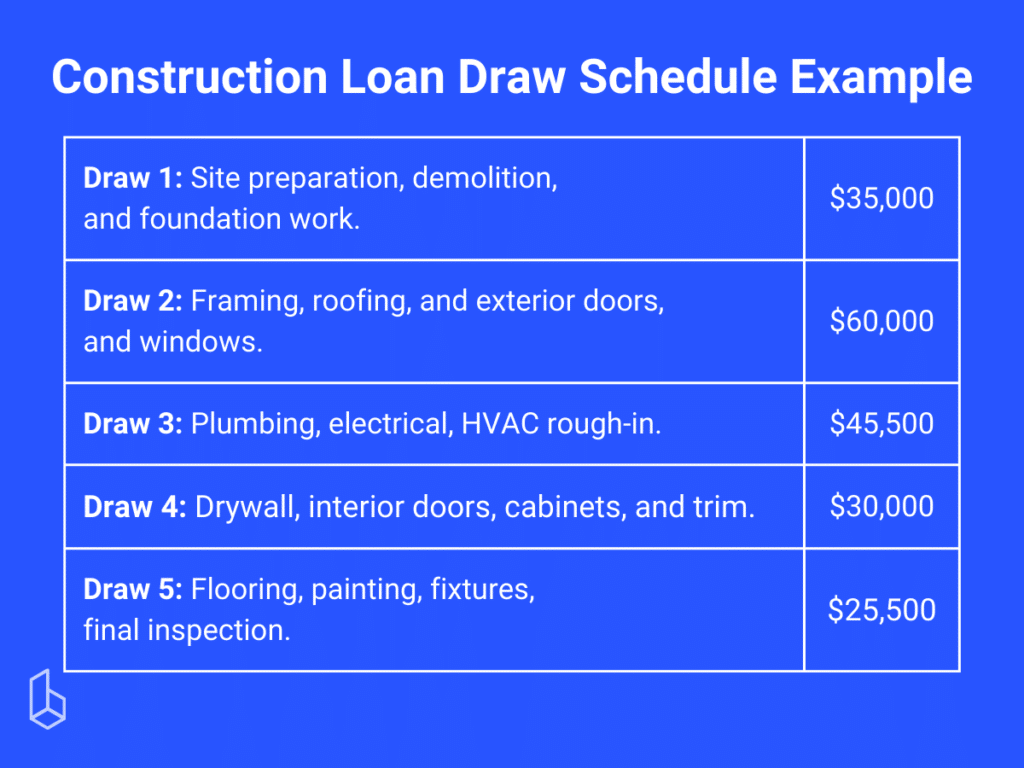

Home Construction Loan Draw Schedule

Knowing that construction loan funds won’t be given in a single transfer, let’s now talk about the draw schedules.

The draw schedule is a payment plan that outlines how and when your lender will disburse funds as construction progresses.

Builders should work closely with the homeowners and loan lenders to establish a realistic draw schedule that aligns with the project timeline. This collaboration is crucial to maintain a steady cash flow and meet all the construction deadlines.

There are certain tips and strategies to negotiate a fair payment plan. One thing is providing a precise and honest construction cost breakdown for the lender to see. Based on this, you can come up with a home building loan draw schedule that works for all the parties involved.

Submitting a realistic draw schedule is one thing, but sticking to it is another matter entirely. Builders must remain diligent in adhering to their contractual obligations and loan agreements to ensure financial control and compliance. You should record and try to address any deviations from the schedule to submit payment requests and have proof of expenses to justify them.

What Type of Loan is Best for Construction?

Most borrowers choose a construction-to-permanent loan, combining the short-term financing needed to build with the long-term mortgage once the home is complete. This way, you only go through one closing process and save on fees. Other options include stand-alone construction loans or owner-builder loans, depending on your circumstances.

What is the Minimum FICO Score for a Construction Loan?

Most lenders require a minimum FICO score of 680 to qualify. However, the higher your score, the better your chances of approval and favorable terms. Some banks may ask for 700 or above if you are financing a custom build with a larger loan amount.

How Much Down Payment Do You Need for a Construction Loan?

Construction loans usually require a down payment of 20% to 30% of the total project cost. The exact percentage depends on your lender, creditworthiness, and whether you’re building a primary residence, vacation home, or investment property. Try to aim for at least 20%-25%.

How Long Do You Have to Build with a Home Construction Loan?

Most construction loans have a 12-18-month build window, depending on your lender’s policies. If delays push your project past that period, you may need an extension or refinancing arrangement.

Key Takeaways

New home construction loans provide the safe and flexible financing that homeowners and builders need to complete their dream projects. Knowing how the system works and how you can use it to your advantage will help you make the most out of your loan.

If you’re planning to build a new home or apply for a construction loan for remodeling, choose reliable partners and keep an open communication with your lender.

With a well-planned budget, realistic draw schedules, and commitment to sticking to the plan, you can successfully build your dream home without any financial hiccups.