Construction Loans: A Detailed Guide for Construction Companies

Construction loans are important for funding building projects but the approach may differ depending on the borrower. For construction companies, these loans support large developments with specific financial requirements. Similarly, they are helpful tools in helping to manage cash flow and financing big projects.

Identically, it is important to understand construction budgeting, so that your project stays within financial limits and doesn’t run up unexpected costs.

This guide combines insights for timelines and incentives, pros and cons of each type of loan primarily focuses on construction company loans. It can be helpful to navigate construction financing and choose the right loan that fits your company’s business needs.

Table of Contents

- Construction Loan vs. Business Construction Loans

- Common Scenarios When Construction Companies Seek Loans

- Types of Construction Loans

- How Does a Construction Loan Work?

- Benefits of Construction Loans

- Challenges of Construction Loans

- Tips for Getting a Construction Loan

- Common Myths About Construction Loans

- Alternatives to Construction Loans

- The Bottom Line

Construction Loan vs. Business Construction Loans

A construction loan is a short-term loan to cover the cost of building or renovating a home. Unlike traditional mortgages, which finance the purchase of an already existing property, construction loans are designed for construction projects.

Business construction loans refer to short-term, high-interest loans to finance costs associated with building or renovating structures. The lenders of these loans offer them in installments matched with project milestones, ensuring that the borrower utilizes funds effectively and that the lender gets to keep track of how the money is being expended.

💡 However, homeowners fund personal building and renovation projects with distinct processes and goals. In this context, FHA construction loans and home construction loans are relevant tools for financing personal projects.

Common Scenarios When Construction Companies Seek Loans

Construction companies often rely on loans for various needs, such as covering initial project costs like land acquisition and permits. Loans are also used to purchase or rent essential equipment and bridge cash flow gaps caused by delayed payments.

Moreover, they can support business growth, including hiring staff or expanding operations, and provide funds to manage unexpected costs, like weather damage or regulatory changes. Loans help ensure projects continue smoothly and companies maintain financial stability. Common scenarios can be:

- Starting New Projects

Most construction companies borrow money to cover the initial expenses of new projects, which may include land acquisition, permits, and site preparation. These costs usually come before revenue accrues, hence the importance of up-front capital.

- Covering Equipment Costs

Construction work is very much dependent on heavy machinery and specialized tools. Companies can take out loans to purchase or rent equipment, ensuring that they are well-resourced to perform any project most efficiently.

- Filling in the Gaps in Cash Flow

Construction projects, in particular, are notorious for late client payments. Loans can help cover payroll, purchase materials, and meet operational costs when payments are delayed.

- Expansion of Business Operations

Expansion of a construction business usually involves large capital investment, whether in hiring more staff, acquiring new facilities, or taking on bigger projects. Loans can provide the financial boost needed to scale operations.

- Handling Emergency Expenses

Unforeseen circumstances, like weather damages or sudden regulatory changes, can throw a construction project off track. Loans offer a safety net to handle those unexpected expenses without halting work.

Types of Construction Loans

Construction loans can be helpful in any given construction process since this would help during needed times in the project stages; be it purchasing equipment or other requirements. They vary based on types, allowing various options for construction companies within specific project demands.

- Construction-to-Permanent Loan: These loans cover construction costs and then convert into a traditional mortgage once the project is completed. Perks include:

- A simplified financing process means loan options are great and it is a simple way of getting the money you need.

- Cost savings can be a result for investors as they can have one loan package to avoid separate closing costs.

- Easier qualification is acquired with one loan application, simplifying the underwriting process.

- Seamless transition is what you need when moving from construction to a permanent mortgage. It makes sure borrowers won’t need to apply for another loan or go through more paperwork.

- Stand-Alone Construction Loan: This is ideal for those who plan to refinance after construction, and the loan covers only the building period for:

- Disbursement Stages – money is given out in parts during different stages.

- Mitigated Financial Risk – money is provided specifically for construction expenses.

- Separated Permanent Mortgage takes the place of the short-term construction loan becoming the long-term way for the payment of the loan.

🧠 Make things easier with Construction Budgeting Software

Within the span of construction loans, no matter the type of loan you take, construction cost tracking is still worth your attention. And there is the need to prevent construction budget overruns. However, if you use the right tools and approaches, the process not only takes a shorter time but also is trouble-free.

- Equipment Loan: Caters specifically to the purchase or leasing of equipment and machinery.

- Business Lines of Credit: A revolving loan in which a company has the freedom to draw cash up to a pre-agreed limit.

- Bridge Loan: Mostly used in covering short-term financing needs, these prove helpful in handling costs incurred until longer-term financing is achieved.

- Green Construction Loan: These are specialized loans for eco-friendly projects and often have favorable terms.

How Does a Construction Loan Work?

Construction loans are different from standard loans. The funds are released in stages, or “draws,” as each phase of construction is completed. Within this scope, funds are disbursed at pre-determined milestones, which may be after the pouring of the foundation or when the framing is completed. The borrower typically pays interest on the amount disbursed until the project is complete.

Thus, to secure a construction loan, lenders typically require:

- Detailed Construction Plans: Borrowers need to provide project blueprints, timelines, and budgets. For example, the lender might require a schedule outlining when the foundation will be laid, the walls constructed, and the roof installed.

- Approved Builders: Lenders prefer licensed, experienced contractors to ensure that the project is viable. For example, a builder with experience in delivering similar projects on time and within budget is more likely to win lender approval.

- Down Payment: Most of the time, borrowers will need a down payment of 20% to 30%, which is much more than most traditional mortgages. This reflects the higher risk associated with construction projects.

- Strong Credit and Financial Stability: A good credit score and reliable financial history are important. Lenders want assurance that borrowers can manage the financial demands of the projects and repay the loan.

🏆Benefits of Construction Loans

Construction loans have plenty of advantages for companies dealing in building projects, and they give room for financial flexibility that sees the project through to completion. The listed advantages can enable a company to effectively manage a construction project and maintain seamless operations.

- Designed for Projects

Construction loans are tailored for construction projects by having terms that relate to project timelines and phases, hence making sure that funds are available when needed.

- Controlled Disbursement

The money is paid out in project installments, which again makes it likely to be effective in its utilization and minimizing the possibility of mismanagement.

3. Smarter Cash Flow

Construction loans pay for all the initial costs, thereby freeing a company to build the project without concern over the high upfront costs, thus assuring good cash flow and improved returns on the investment.

4. Scalability

This gives the company the ability to access funding that allows the company to undertake larger projects and expand its operations.

5. Emergency Preparedness

Construction loans avail additional funds in quick time, thus enabling one to handle sudden issues or delays without impacting the progress of the project.

🎯 Challenges of Construction Loans

Construction loans offer financing for building projects, but operating them, still, can be troublesome. A construction loan involves higher interest rates and the details in the approving process require consideration. So, understanding risks and steps is important to ensure that funding goes as smoothly as possible.

Construction loans could come up with potential complications including:

- Higher Interest Rates: These loans typically have higher interest rates because of their short-term nature and risks. Accordingly, lenders may charge rates 1% to 2% higher than traditional mortgages.

- Complex Approval Process: The approval process involves detailed documentation and appraisals, which can be time-consuming. Borrowers might need to provide contractor agreements, detailed budgets, and proof of financial stability.

- Potential for Delays: Construction projects are exposed to all kinds of weather risks, labor shortages, or supply chain disruptions that can delay and increase costs and time.

- Risk of Cost Overruns: Unexpected expenses can arise during construction. For example, discovering poor soil conditions after breaking ground might require additional funds for stabilization.

Here is a breakdown of construction loan details for a clearer understanding:

| Category | Details |

| Loan Purpose | Financing the construction of new homes, commercial properties, or renovations. |

| Loan Structure | Line of credit with staged disbursements tied to project milestones. |

| Loan Term | Short-term, typically 6 to 18 months. |

| Interest Rate | Higher than traditional mortgages; adjustable rates based on the prime rate plus margin. |

| Repayment | Interest-only payments during construction; principal repayment or refinancing after completion. |

| Down Payment | 20% – 30% of the total project cost. |

| Disbursement Process | Funds are released in stages (draw schedule) after inspections. |

| Required Documentation | Detailed construction plan (timeline, cost estimates).- Licensed contractor approval.- Proof of income and good credit score. |

| Risk Factors | Project delays, cost overruns, difficulty refinancing, or inability to complete the project. |

| Transition to Permanent | Option to convert into a long-term mortgage (construction-to-permanent loan). |

💡 Tips for Getting a Construction Loan for Companies

Getting a construction loan for your company requires a great deal of planning and preparation. It is possible to navigate the process much more smoothly if you follow working tips such as:

- Hiring experienced builders.

Work with established contractors to build lender confidence and fast-track approval. Check out builders’ previous work and customer reviews to verify their reliability.

- Preparing Detailed Plans:

Accurate project plans and budgets show preparedness and increase the likelihood of approval. Consider having a consultation with architects or project managers to have extensive documentation.

- Comparing Lenders:

Shop around with different lenders and compare terms and interest rates on your construction loan. Some lenders specialize in construction financing and may offer more competitive rates.

- Planning for Unplanned Expenses:

Build in some slack in case of delays or cost overruns. For example, 10% to 15% of the total project cost can help you handle surprises without financial strain.

- Improving Your Credit Score:

Work on improving your credit score before applying. Paying off outstanding debts and avoiding new credit inquiries can strengthen your financial profile.

- Consulting Experts:

Consider working with financial advisers or mortgage brokers who have expertise in construction loans. They can guide you in the application process and find you the best terms possible.

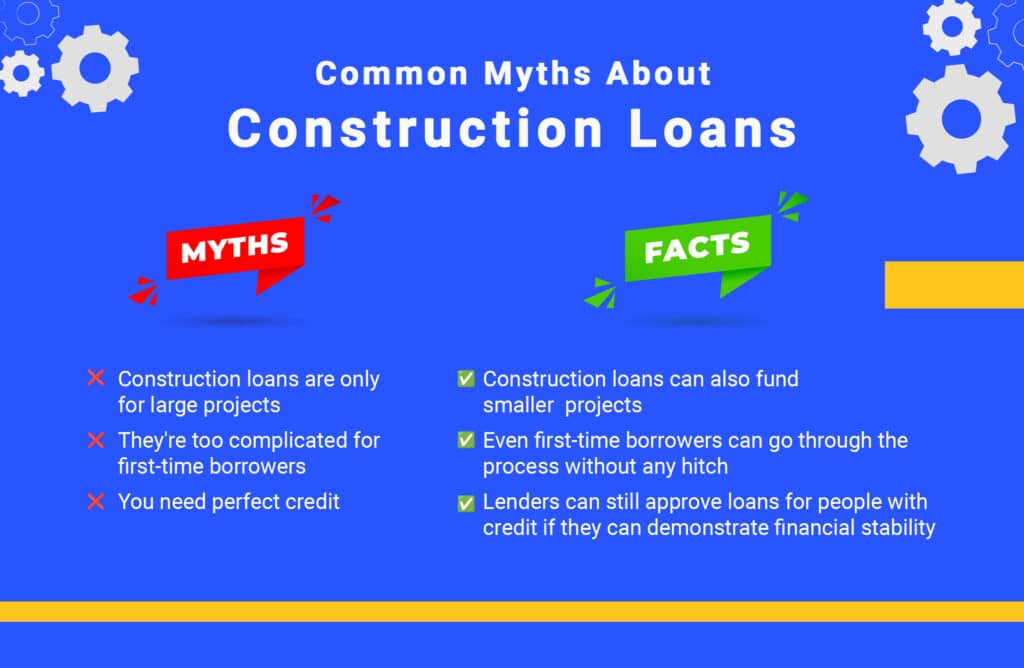

Common Myths About Construction Loans

There’s a lot of misinformation about construction loans, which sometimes makes the process more complicated than it is. Following are a few common myths that often confuse:

Myth #1: Construction loans are only for large projects.

While construction loans are often applied to new homes, they can be well utilized even in minor projects like home renovations or even home additions. The loans are very flexible and thus can apply to big or small needs for construction.

Myth #2: They’re too complicated for first-time borrowers.

First-time borrowers often think construction loans are too complicated to handle, but if someone is well-prepared and supported, the process will be fairly simple. The lenders will take you through the steps involved, and proper documentation is the major key to a smooth process.

Myth #3: You need perfect credit.

While a strong credit score is a plus, it isn’t a deal-breaker. Lenders can grant loans to those with poor credit, provided they show financial stability and a clear vision for the project.

Alternatives to Construction Loans

Besides the construction loan, there are a couple of other options that may better suit your project or financial situation. These would be more flexible or be better for your situation to help you raise the required funds, without having to stick closely to traditional credit structures.

Consider these alternative options:

Home Equity Loans

If you already own a home, a home equity loan enables you to borrow against the equity that has been built in the property. These kinds of loans are often one lump sum with a fixed interest rate.

| ✅ Best for: Larger renovation projects or additions where you know the cost upfront. |

| 💡 Benefits: Fixed rates mean predictable monthly payments. Lower interest rates than personal loans because the loan is secured by your property. |

| ❗ Considerations: Your home is used to secure the loan, so failure to make payments could mean losing your property. |

Personal Loans

Sometimes personal loans are unsecured meaning you receive a lump sum of money upfront, and then you pay it back over time, along with interest.

| ✅ Best for: Smaller projects, like kitchen upgrades, bathroom remodels, or even minor repairs. |

| 💡 Advantages: Generally faster approval with less paperwork; no home equity requirement, and funds often can be used for almost any purpose. |

| ❗ Considerations: It tends to have higher interest rates than secured loans, particularly for poor credit scorers. |

Cash-Out Refinancing

You replace your existing mortgage with a new, larger loan through cash-out refinancing. The difference between your current loan balance and the new loan amount is given to you in cash.

| ✅ Best for: Larger construction or renovation projects where you’d want to roll financing into a mortgage refinance. |

| 💡 Benefits: Allows you to tap significant funds while saving you potentially on your mortgage interest if rates have fallen. |

| ❗ Considerations: Increasing the loan term or the loan amount might result in paying more in interest over time. |

The Bottom Line

Construction loans are tools for companies to finance building projects. From understanding different types of loans to the aspects of construction budgeting, proper planning is paramount for a successful project.

Some of the advantages associated with these loans include flexibility, control over projects, and possible cost savings, but some disadvantages include higher interest rates and complex approval processes. Companies can greatly simplify the process and even reduce the risks involved if they work with practical tools, well-developed plans, and well-chosen lenders.

Ultimately, by choosing the correct type of loan and being active during the project, construction companies can ensure they meet financial goals and the successful completion of projects.