Cash Flow Management in Construction: Everything You Need to Know

Did you know that 82% of construction companies fail not because of their profits, but due to improper financial management? And, it is not surprising that when cash does not come up on time to cover what is needed, the entire operation can start fluctuating, leading to failure.

Therefore, cash flow management isn’t just important; it is crucial for the survival of your business.

In this article, I will explore what cash flow management in construction is, how to calculate it precisely, and what you can implement in your construction business to improve your cash flow.

Table of Contents

- What is Cash Flow Management and Why is it Important?

- Cash Flow VS Net Profit

- Types of Cash Flow

- How to Calculate Cash Flow in Construction?

- Benefits of Cash Flow Management in Construction

- Tips to Improve Cash Flow Management in Construction

- Final Thoughts

What is Cash Flow Management and Why Is It Important?

Cash flow refers to the movement of your cash in and out of your construction business within a specific time frame.

Proper cash flow management in place reflects the financial health and stability, especially when you work to grow a construction business. Stable flow is an important part of any project, and in many cases, unexpected missed or delayed payments can have devastating consequences.

In the construction industry, cash flow is the ultimate survival metric because of the “gap” problem. Most projects require you to pay for labor, expensive materials, and equipment rentals weeks or months before you receive your first milestone payment.

Besides, many construction companies operate on thin margins and long payment cycles, making cash flow timing especially critical.

Cash Flow VS Net Profit

There is a misconception among many entrepreneurs that gaining enough profits is what leads them to success. Yet in many cases, such companies fail in their business due to the negative cash flow.

Confusing cash flow with net profit can lead to costly mistakes. While they both are a part of financial management, they represent different aspects of construction finance. Therefore, understanding their differences is essential for keeping construction companies intact.

| Aspect | Cash Flow | Net Profit |

| Defintion | Cash movement (in and out) | Total income after all the expenses |

| Purpose | Ensures liquidity to cover the daily expenses of your project | Measures the long-term profitability and financial health of your business |

| Impact | Affects the ability to pay for all direct and indirect costs, including bills, suppliers, and staff. | Showcases the profitability and potential growth of your business. |

Cash flow: Cash flow is the accounting of the movement of your cash in and out of your construction business. Depending on the type of your project or your company’s size, it is possible to have a positive cash flow without much profit, or vice versa.

Net profit: Net profit, on the other hand, refers to the balance left after all expenses. It is a key metric of any construction company’s profitability, showcasing a company’s efficient use of resources, making it a vital indicator of its long-term success.

Types of Cash Flow

Managing the finances in the construction industry can be tough, especially if you’re managing multiple projects at once. Therefore, analyzing and categorizing your company’s cash movement correctly is a must-have skill.

To simplify this process for you, we have outlined the three key cash flow categories, ensuring the strategic planning and financial control of your business.

Cash Flow from Operations (CFO)

This represents the money that comes from your company’s core business activities, which mainly includes the income from your projects and all the expenses associated with them.

Let’s assume that you are working on a construction renovation project, and you have reached the first milestone of your project. For the work you have already done, you have received $100.000 from your clients, but in the meantime, you have to pay the subcontractor $40.000 for the work they have already done.

In this scenario, the difference between the $100.000 you received from your clients and the $40.000 you paid to your subcontractors is your positive cash flow from operations.

Cash Flow from Investing (CFI)

This refers to money received or spent on investments. It typically includes cash outflow from purchasing equipment, technology infrastructure, or vehicles, as well as cash inflow from selling equipment that is no longer in use.

For instance, you might want to buy a $300.000 excavator to increase your earthwork capacity by 20%, which, as a long-term consequence, can lead to positive cash flow.

Cash Flow from Financing (CFF)

This is typically the cash received from construction loans, lines of credit, as well as the cash received that is used to cover debts or pay dividends.

The cash flow from financing showcases how a construction business funds its operations, beyond its day-to-day income. For instance, you might opt for a $1.4 million construction loan with draw schedules aligning it to your project schedules.

However, it is essential to take into account that maintaining a healthy balance between financing and operational costs is essential in construction, and the opposite case may lead to unexpected project delays and budget overruns.

How to Calculate Cash Flow in Construction?

To calculate your cash flow, you need to come up with a cash flow forecast. There are a few important things to keep in mind when creating your cash flow forecast.

#1 Make sure you have clearly defined payment terms for both your clients and suppliers. This will ensure that you receive your payment on time, plan your budget accordingly, and offer you legal protection.

#2 It is equally important to develop estimates for internal project costs. Estimating is an important part of the project, allowing you to predict how much money you will consume for your construction project over time.

Recommended reading:

#3 Be sure to include equipment cost, labor costs, material costs, and all the overhead costs associated with your project. To simplify this process for you, it is highly recommended to utilize an advanced construction estimating software for accurate project planning.

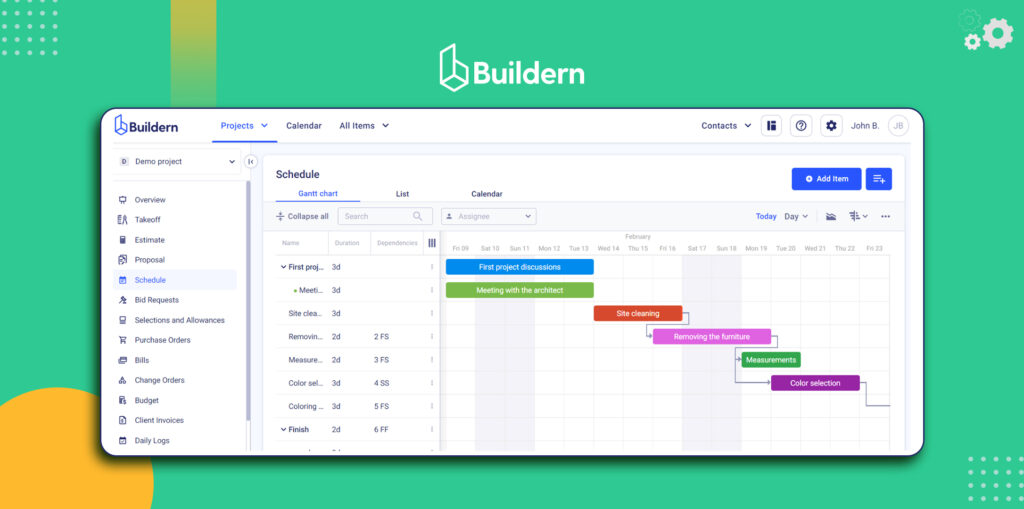

#4 Establishing a comprehensive project schedule plays a critical role in your cash flow forecasting success. For example, with a Gantt Chart feature, you can simplify your tasks, deadlines, and resources, making it a visually accessible timeline of your construction projects.

So, how do you actually calculate the cash flow once you’ve got your forecast ready?

Cash flow = cash inflows – cash outflows

Example: Let’s assume that the cash inflow of your construction project is $550,000 and the cash outflow is $510,000. In that case, your cash flow will be as follows:

$550,000 -$510,000 = $40,000

Benefits of Cash Flow Management in Construction

Cash flow management is extremely important and serves as the backbone of any business’s success. Let’s explore some of the advantages that cash flow offers businesses.

- Consistent Project Progress: Effective cash flow management in construction directly contributes to consistent project progress. Managing your cash properly will ensure timely material procurement, regular payment to subcontractors and aborers, and equipment availability, which ultimately leads to continuous project progress.

- Better Financial Planning: According to research, approximately 88% of small businesses face cash flow problems. Robust financial planning through effective cash flow management allows construction businesses to develop comprehensive budgets. With thorough financial planning, companies can also identify financial issues in advance, create contingency plans, and prevent budget overruns.

- Strong relationship with stakeholders: Effective cash flow management can foster a long-lasting relationship with project stakeholders. In the long run, this may lead to repeat business or valuable referrals.

- Operational efficiency: Properly managed cash flow can significantly improve the operational efficiency of your construction business. When all the financial resources are allocated properly and managed accordingly, it becomes easier to optimize material deliveries, preventing resource waste. This, as a consequence, may lead to a better operational efficiency.

Tips to Improve Cash Flow Management in Construction

Managing cash flow effectively can be really difficult, especially for an industry like construction. We have compiled the core tips and strategies that you should implement in your business to manage your cash flow effectively.

Use Real-Time Cash Flow Forecasting

Construction project forecasting is perhaps one of the best ways to manage your cash flow. By constantly evaluating your incoming and outgoing cash, you can gain visibility into your financial position.

Instead of reacting to missed payments or unexpected cost increases, contractors can take preventive measures early. They include adjusting payment schedules, revising spending plans, or reallocating resources across projects. Forecasting also reduces uncertainty, making it easier to cover labor costs, materials, and subcontractor costs without relying on emergency financing.

Beyond risk management, cash flow forecasting supports long-term planning. With a clear view of future cash availability, construction businesses can confidently plan, take on new projects, or invest in growth opportunities.

Automate Billing and Invoicing

One of the most common cash flow problems in the construction industry is slow or inconsistent billing. Projects are billed in phases, retainage is withheld until completion, and change orders often occur mid-stream.

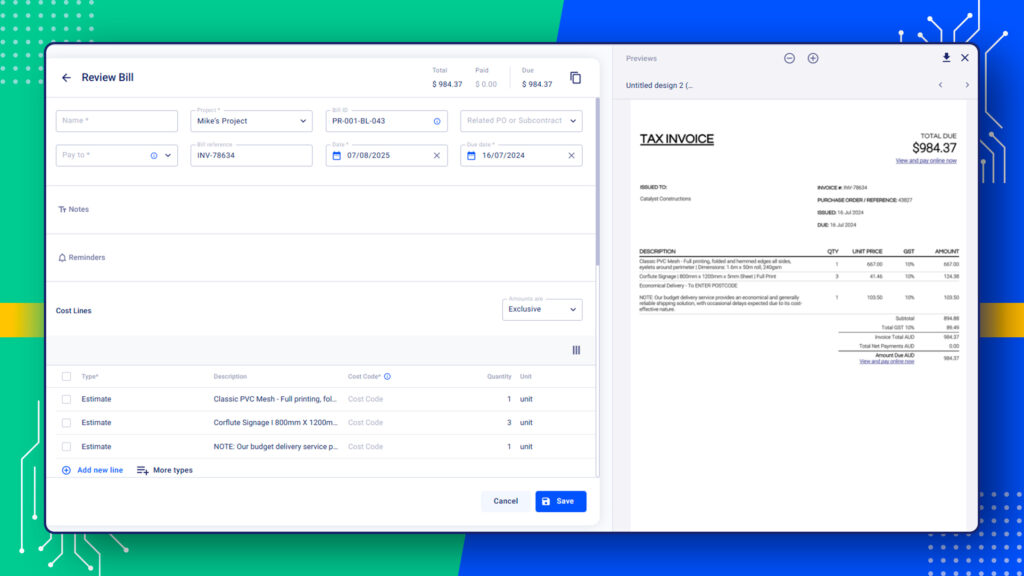

Relying on manual invoicing or spreadsheets makes it easy for these complexities to slip through the cracks, delaying payments and squeezing cash flow. Automating progress billing and invoicing helps eliminate manual issues and ensures that money owed is billed promptly and accurately.

Construction management software also includes AI billing capabilities that make this process even smoother. This feature can scan invoices, extract key details like vendor names, amounts, due dates, and line-item costs.

In addition, integrations with accounting systems mean that invoices and payment statuses stay synchronized across platforms, cutting down on double data entry and reconciliation work.

Track Job Costs Against Budgets

While budgets are created at the planning stage, actual costs evolve daily as labor hours are logged, materials are purchased, and subcontractor invoices are approved. Without consistent tracking, small overruns can quickly add up and put pressure on cash reserves.

Comparing real-time job costs to the original budget allows contractors to spot issues early. When costs begin to exceed expectations, teams can investigate the cause, adjust spending, revise forecasts, or address inefficiencies on site.

This level of visibility is especially important in construction, where margins are tight, and delays or scope changes are common.

Recommended reading:

Manage Change Orders Promptly

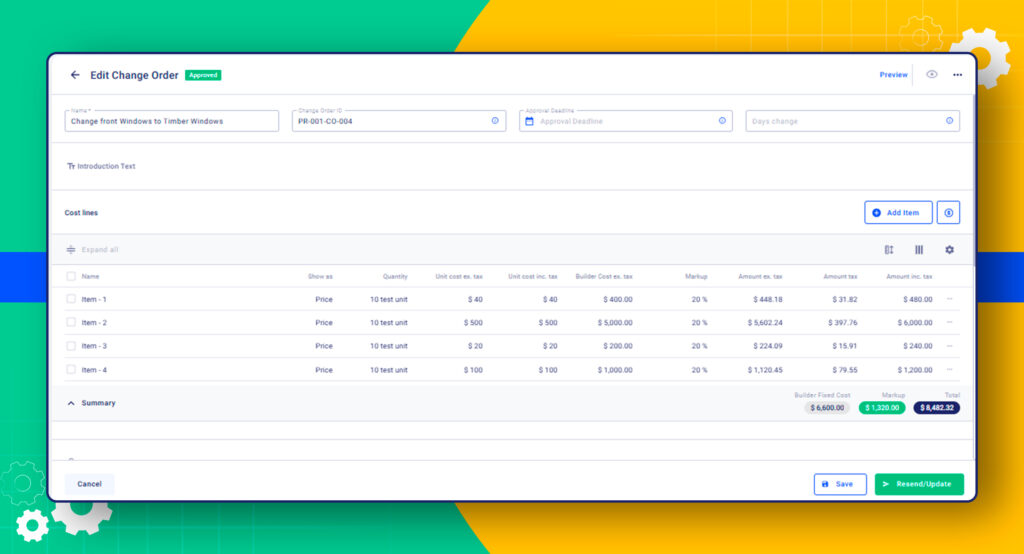

Change orders are a normal part of construction projects, but when they aren’t managed promptly, they can quickly disrupt cash flow and project budgets. Without a clear process, change orders may be forgotten or approved too late to reflect their true financial impact.

Handling change orders early helps contractors maintain control over both costs and cash flow. When changes are documented, reviewed, and approved on time, their impact on the project budget and schedule is clear from the start.

If a contractor uses construction management software, change order requests, approvals, and cost updates are centralized in one system.

Integrate Project and Accounting Data

Up-to-date financial information is essential for any construction project. If project management and accounting data are kept in separate systems, it’s easy for invoices, payments, and job costs to get out of sync.

For example, imagine a residential builder who purchases materials for a foundation, but the invoice isn’t recorded in the accounting system until weeks later. By the time the cost is entered, the project manager may think the job is under budget, while cash flow is already affected.

Integrating project and accounting data ensures that all financial information flows seamlessly between systems. Costs recorded on-site, such as labor hours, materials, and subcontractor invoices, automatically update the accounting ledger.

Final Thoughts

Effective cash flow management is the building block for construction projects. Given the complexity of the construction industry, costs, and project durations, a well-managed cash flow will ensure project delivery on time and within budget.

Implement the right cash flow management techniques and strategies. This will allow you to prevent the financial risks of your construction company and ensure the viability of your business.

What Is the Cash Flow of a Construction Project?

Cash flow is the amount of money moving in and out of a construction project. Since contractors pay for labor and materials upfront but get paid in milestones, cash flow is often negative at the start. It measures financial health, ensuring you can cover daily bills while waiting for client checks.

How to Improve Construction Cash Flow?

To improve construction cash flow, you should:

- forecast project expenses

- bill promptly with milestone-based invoices

- track job costs in real time

- manage change orders quickly

- integrate project and accounting data

What Are Signs of Poor Cash Flow in Construction?

Signs include delayed payments to suppliers or subcontractors, overdue invoices from clients, frequent cash shortages despite profitable projects, and unexpected project delays due to lack of funds. Reliance on credit for daily costs is also a major red flag that your project is out of cash.